Welcome to The Profit Zone 👋

Where thousands of millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on the web.

Why Your Emergency Fund Is Probably Costing You Thousands 🫰

How to Fix It Without Losing Sleep 😴

Alternative Ways To Earn Interest On Your Money 📈

“The game of investing is a process of discovering who you are, what you’re interested in, what you’re good at, what you love to do, then magnifying that until you gain a sizable edge over all the other people.”

The Stock Investor’s Edge

The hardest part of investing is not finding information. It is about knowing what actually matters, and finding it before the move happens.

The Stock Investor’s Edge helps you cut through the noise with deep research, specific stock buys and options ideas, and real-time market updates you can act on.

If you want to stop reacting and start making calmer, more confident decisions, this community is built for you.

Why Your Emergency Fund Is Probably Costing You Thousands (And How to Fix It Without Losing Sleep)

Hey wealth builder, let’s talk about that pile of cash you’re hoarding for a rainy day.

You know, the emergency fund everyone talks about?

That thing that will save you when sh*t hits the fan?

It’s supposed to be your financial airbag: 3-6 months of living expenses stashed away in case life throws you a curveball. Curveballs can come in all shapes and sizes: job loss, car wreck or that surprise vet bill for your dog.

For the average Joe earning $60k/year, that can mean having $15-$30k sitting on the sidelines.

But here’s the real kicker: that money may be rotting in a big-bank savings account earnings pennies (think 0.01% APY). At that point, you’re basically paying to store your own money, while the banks lend it out to others at rates you can’t even imagine.

In 2026’s rate environment, where inflation hovers around 2.5%, that’s not just laziness, its a silent wealth killer pulling money away from you without you even noticing.

Mike The Real Estate Agent

Take Mike, a real estate agent from New York I chatted with on X in late 2025.

Back in 2022, during the Fed’s crazy rate hike frenzy, he lost his job when the housing market started to cool.

Mike had a $25k emergency fund that was held with Wells Fargo savings account at an 0.04% APY.

Over the next 5 months while he was hustling for a new gig, that cash earned him a whopping $4 in interest.

Meanwhile, what he didn’t see was inflation, which chewed away about 1% of the total $25,000 sitting in the account ($250).

Mike could have switched accounts earlier, but he didn’t and that cost him hundreds of dollars in opportunity cost.

Fast forward to today, traditional savings account rates are still laughable, with the national average at 0.64% APY.

Big banks love it because they pay you next to nothing and can loan out your money for 7%+ for mortgages. It’s highway robbery in a suit and tie.

The Math Hurts: Here’s Why

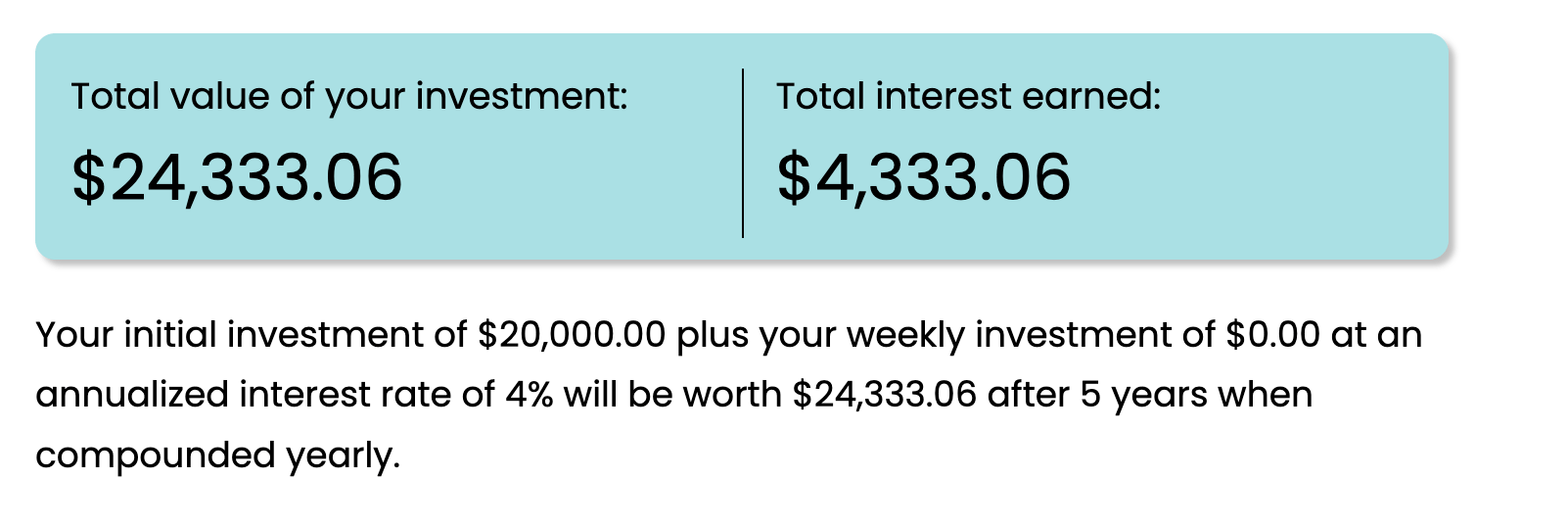

Let’s say you have $20k sitting in that 0.5% savings account you haven’t bothered to change.

Over 5 years with annual compounding (without any new contributions), you’ll earn about $505 in interest.

If you switched over to a competitive high-yield savings account (HYSA) at a 4% APY, the lower range of APY’s, you’re looking at 4,333 in interest.

That’s a $3,828 difference over a period of 5 years, that you may have missed out on because you didn’t shop around.

And that’s being conservative, some HYSA’s are offering rates as high as 4.50% right now and could push that interest higher.

These are FDIC-insured up to $250k, fully liquid, and accessible cash within a few clicks of a button.

The excuses have run out.

You can’t say “it’s too complicated” because these accounts take minutes to open.

If you want to see the best rates for 2026 right now, click here.

Alternative Ways To Earn Interest On Your Money

HYSA’s aren’t the only options here.

Money Market Funds (MMFs) can also provide you a safe-haven for stashing your cash away, with rates as high (if not higher) than HYSA’s.

They’re great for liquidity purposes, and are baked by treasuries or agencies, although yields can fluctuate with short-term rates.

Current 3-month T-bill rates are around 3.62% and 6-month at 3.61%.

The trap?

Don’t confused “safe” with “invested”.

Remember 2020? Many investors who parked their emergency funds in stocks panic-sold when the market took a turn for the worst, turning just a simple market dip into a disaster.

The Bottom Line

Shift your mindset. Your safety net isn't a dead weight, it should work overtime for you.

In 2026, with rates holding steady post-2025 cuts, letting it earn 4%+ means compounding your money without risking any sleep. And that’s what we love to do.

Audit your own fund today: Compare rates on Bankrate or NerdWallet, transfer your money, and watch it grow.

You're not just saving, you're building an empire.

The Profit Zone Premium

I’m always searching for the best HYSA rates on the market, because I hate when my money loses to inflation.

When I find new offers, I let my premium subscribers know first.

This is only scratching the surface of what I provide inside The Profit Zone Premium.

Last year, our 2025 Stock Picks returned a total of 64.24%, crushing the S&P 500, and we’re doing it all over again this year, but better.

If you want access to our 2026 Stock Picks, you can find the post and upgrade below.

|

Did you enjoy this newsletter?

Until next week,

The Profit Zone