Smarter Investing Starts with Smarter News

Cut through the hype and get the market insights that matter. The Daily Upside delivers clear, actionable financial analysis trusted by over 1 million investors—free, every morning. Whether you’re buying your first ETF or managing a diversified portfolio, this is the edge your inbox has been missing.

Welcome to The Profit Zone 👋

Where thousands of millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on the web.

👉 Market Sentiment: What Does This Mean For Investors? ❓

👉 Want to Retire With Millions? Here’s The Blueprint 📓

👉 Game Changer: This One Tool Changed The Way I Invest My Money 💰

“The idea that a bell rings to signal when to get into or out of the stock market is simply not credible. After nearly fifty years in this business, I don’t know anybody who has done it successfully and consistently. I don’t even know anybody who knows anybody who has.”

There’s always uncertainty when it comes to investing in the stock market.

But there are some important indicators investors can look at to determine what direction the stock market might be moving.

Last week on Wednesday, the latest update from the Michigan Consumer Sentiment Index came out.

And it gave investors some insight into the market and how consumers are thinking about their money.

The index is made up of the survey results of 500 households, a small sample of the population. But it still gives us a good visualization of the market.

As you can see above, positive market sentiment is rising.

Essentially, when investors are feeling positive about the market, their spending goes up.

When they aren’t, their spending goes down.

Easy to understand right?

Based on the results, we can gain an understanding of what might occur in the near future, but as always, these should not be relied upon to make investment decisions, but simply used as guidance.

A weak outlook can cause share prices to fall, which can create buying opportunities in a couple of different ways.

If a decline in spending is likely to be temporary, long-term investors might consider buying shares in companies that will be able to endure short-term challenges before they emerge even stronger.

Alternatively, if a stock falls because the market overestimates how willing consumers are to cut back on its products, it might be undervalued. This could generate an opportunity for investors to consider.

The other reason the reading is significant is it can help predict when companies in a cyclical downturn are likely to turn around.

Your blueprint to retiring with $1 million+

Retiring a millionaire takes patience and consistency.

Most people have the earning power to get there, but they don’t have the habits.

In today’s post, I’m going to highlight some habits and behaviours you need to ensure you join the millionaire club.

Have enough patience to stay in the game

Everyone always talks about patience, but why is it so important?

I’ll give you the answer.

Patience is important because nothing that is worth doing happens overnight.

Patience is worth it because like a snowball rolling down a hill, it doesn’t start growing to be very large until it picks up speed, which may take a while.

Patience is worth it because the economy goes through business cycles and you might be investing during a recessionary period, but a valley turns into a peak every single time.

Commit to a goal

With patience comes commitment.

Before you start investing (or if you’ve started and haven’t done so already) you must paint a clear picture of your investing goals.

What do you want to get out of your money?

What does the light at the end of the tunnel look like?

Here’s a personal example:

My goal from dividend investing has always been to build a portfolio that generates $10,000/month passively. That would mean I’d be making $120,000/year in passive income which would allow me to be 100% financially free and most likely never have to work another day in my life.

’m committed to that goal and I know that every action or sacrifice I make today is helping me move one step closer to achieving it.

If you don’t have a goal to chase, you’re travelling aimlessly with no destination and by doing that, you’ll find it hard to reach financial freedom.

Put the blinders on

You have so much power when you don’t care what everyone else is doing.

From the time I started investing and researching money online, I’ve seen hundreds of people screaming from the rooftops that their strategy is the best one and all of the others don’t work.

It’s important to realize that although their strategy has made them money, it does not mean it’s the right fit for you.

Remember, investing strategies are like diets, they’re not “one size fits all”.

Once you find something that works for you and your lifestyle, put the blinders on and forget about what everyone else is doing.

Of course, you can still learn lessons from others and implement little tips and tricks here and there, but don’t veer off track from what works.

For myself, this is a healthy balance of growth stocks, dividend stocks, index fund ETFs and a small portion of crypto I call my speculative “I don’t care if it goes to $0” money.

Have a long-term mindset

A long-term mindset can benefit you in so many areas of life, not just investing.

Think about all the people who are working out to get big but never take time to stretch.

Eventually, their bodies are going to break down or they’re going to get injured and it’s because they didn’t take the necessary steps to remain sustainable over the long term.

The same goes for investing. Every decision you make should benefit you financially in the long run. If you keep a long-term mindset, you’ll be ahead of so many people when everything is set and done.

People are too worried about today to be thinking 15+ years down the road.

Don’t be like other people.

See the value in small amounts

One of the biggest mindset shifts I had to force myself to go through was seeing the value in small amounts.

In the early stages of investing, especially dividend investing, it can be hard to convince yourself it will be worth your time.

As your portfolio grows as well as your dividend income, you start realizing the power of small amounts because they eventually grow into something significant.

I never looked at a $5 dividend as just $5.

I always looked at it in terms of how many shares I could buy when I reinvested the money and what it would turn into a year from now.

Being able to see the value in $5 is a skill not many people have, which is a shame, but it’s a skill that takes some time to acquire.

It’s hard to explain in words why $5 is more valuable than just $5, but once you experience it you’ll know exactly what I’m talking about.

Remember: never unnecessarily disrupt the compounding effect.

Telling non-believers to respectfully f*ck off

There will be tons of people who won’t be able to see your vision.

They’ll try to impose their limitations on you but it’s your job to respectfully tell them to f*ck off.

Just because they can’t comprehend your goals doesn’t mean they’re not reachable.

Stick to the process.

The power of compounding

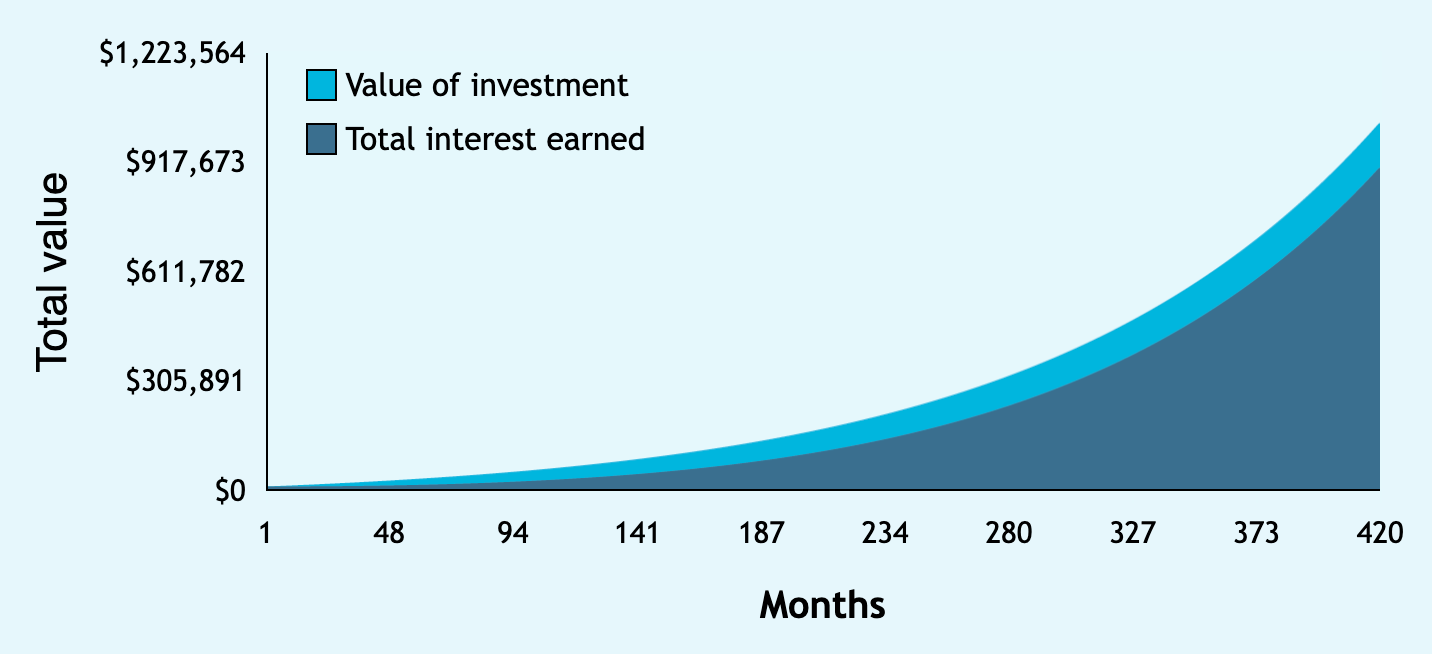

Here’s an example of how much you could retire with if you stayed consistent with your contributions and gave your investments time to grow.

In the below example we’re assuming the following:

Starting with an initial investment of $0

Contributing $300/month

Averaging 10%/year return

35-year time horizon

You’re currently 20 years old

Total value of your investment: $1,019,637.30

Total interest earned: $893,637.30

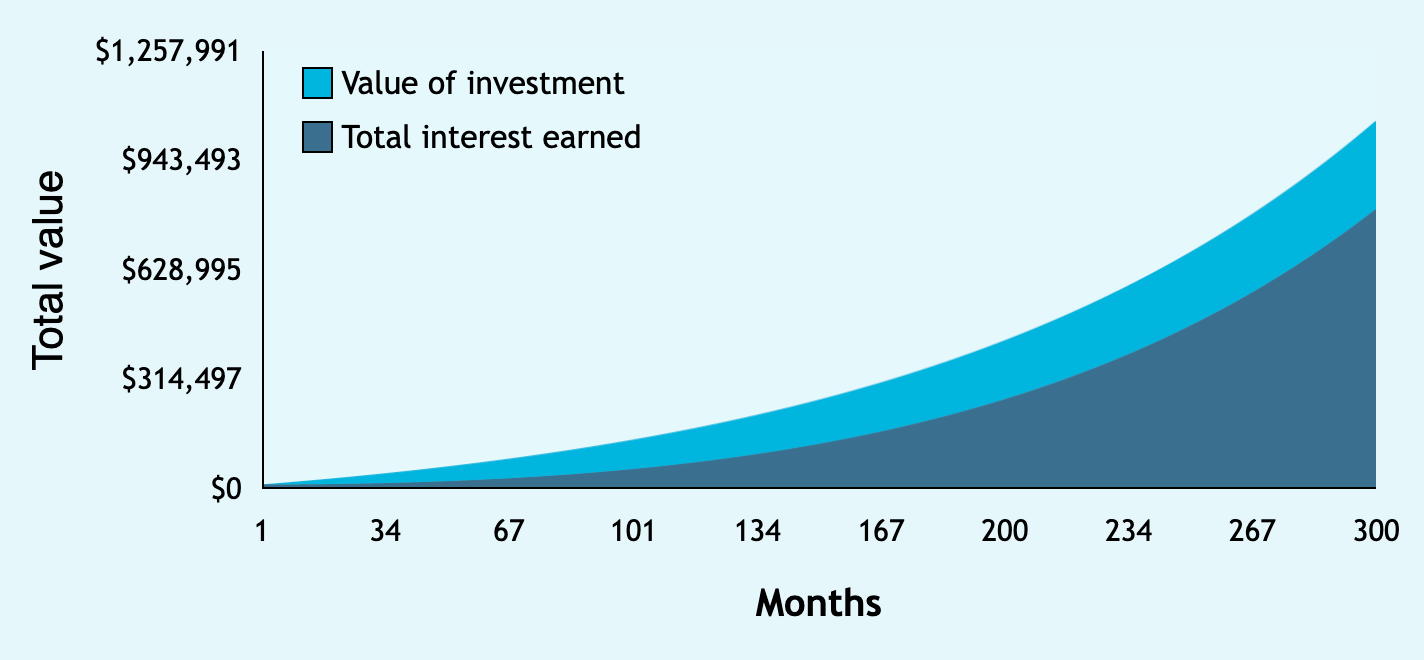

Now let’s say you don’t want to retire at 55 years old because it’s just too old for your liking.

Let’s say your target age is 45 years old instead (keep in mind we’re 20 in this example).

And let’s say you started a side hustle that earns you $500/month, which you invest 100% of the money. Plus $350 of your monthly income from your 9-5.

In the below example we’re assuming the following:

Starting with an initial investment of $0

Contributing $850/month

Averaging 10%/year return

25-year time horizon

You’re currently 20 years old

Total value of your investment: $1,048,326.16

Total interest earned: $793,326.16

The point of showing you these examples is not to just give you motivation but to show you exactly what you need to commit to in order to reach your goals.

The truth is, your situation isn’t going to be the same as mine.

You might not be in your 20’s and have as much time to compound your money.

You might be just starting your financial journey at 40, struggling to make ends meet but also trying to invest as much as you can so you don’t have to work until you’re 60.

You might already have $1M+ and laugh at these numbers.

Everyone is in a different stage of their lives. But it all boils down to this.

If you want to retire earlier, you have to invest more. And there are 2 ways to do that:

Increase your income

Decrease your expenses

There is no other way to get more money in your pocket.

Number 2 is simple. Track your spending for a month in a log or an app and at the end of that month see where you’re spending the majority of your money.

I’m sure you can find $100-200 of savings every month if you really try WITHOUT affecting your lifestyle.

Negotiate your phone bill, insurance, unsubscribe to services you don’t use, walk more, make your coffee at home, make your lunch at home or cut out high-spending nights like eating out.

Number 1 is a bit harder to do.

Increasing your income is something a lot of people chase all of their lives. The way we’re taught is to work harder so you can get a promotion.

It’s a shame that people still believe this is the only way to make more money.

If you’re having trouble with ideas, I’ll give you a couple that I’m currently doing and are proven to work:

Affiliate marketing - become an affiliate for a product, course or service you’ve used and had results from. Whenever you make a sale through your affiliate link you’ll earn a commission. Click here for the course that I used to learn.

Blogging - blogging is a great way to earn extra income every month if you monetize it. You can do so by promoting other brands or offering paid content to your subscribers.

Uber Eats - I have friends bringing in an extra $1,000/week doing Uber Eats. This is something you can do after work for a couple of hours a day and even on weekends when you feel like it. The best part is that if you live somewhere warm, you can invest in an electric scooter or bike and save money on gas while you make money delivering food.

Tutor English - if you read this entire post without any issues, you’re more than qualified to teach English online. There are people across the globe paying people like you and me to teach them English, and you can do it all from home!

Doing just 1 or 2 of the above can have you earning $500+ per month in no time.

It’s amazing how many ways there are to make extra cash you can invest, you just have to be willing to do it.

Did you enjoy this newsletter?

This Tool Changed The Way I Invest My Money

Gone are the days of using Excel to track your portfolio.

Look how ugly this is…

Information overload. And it’s giving me a headache the more I look at it.

This used to be me…

I was tracking all of my dividend income and holdings on an Excel spreadsheet and it was a nightmare.

Then I found Snowball Analytics the #1 portfolio tracker on the market.

Snowball Analytics lays out all of your holdings, allocations, dividend income and more in easy to read graphs that don’t hurt your eyes.

They even have a built-in Artificial Intelligence tool that will tell you if a dividend is reliable or not based on a score of 1-100 by scraping the company fundamentals.

Not only that, but the stock screener is one of the best tools I’ve found.

Sort by:

Dividend growth streak

Dividend growth rate

Revenue growth

Free cash flow growth

Dividend yield

And more

Snowball Analytics gives you hedge fund level analytics at the tip of your fingers.

Create an account here and use code “dividenddomination” for 10% OFF your plan.

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Dividend Domination Inc. is a publisher of financial information, not an investment advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

Any projections, market outlooks or estimates herein are forward-looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.