Welcome to The Profit Zone 👋

Where thousands of millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on the web.

Nvidia Signs a Deal With Groq ✍

From Tariffs to Earnings Growth: What Investors Need to Watch Going Into 2026 👀

Recapping 2025: AI Reigns Supreme Amid Commodity Booms 💥

Forecasting 2026: Muted Gains in a Resilient Economy 🔇

Key Risks: Inflation, Tariffs, and Beyond ❌

Barbell Strategies: Blending Growth and Defense 🏋

“Owning stocks is like having children – don’t get involved with more than you can handle.”

Nvidia 🤝 Groq

Nvidia has agreed to a non-exclusive license for AI chip startup Groq's technology, which specializes in AI inference, also known as the process where trained models respond to user requests.

They will hire key executives including Groq's founder Jonathan Ross and President Sunny Madra.

Groq is valued at $6.9 billion after a recent funding round and will continue operating independently with Simon Edwards as its new CEO.

CNBC reports that Nvidia might acquire Groq for about $20 billion in cash, though neither company has confirmed this.

The deal is a licensing and talent acquisition arrangement similar to recent Big Tech moves by Microsoft, Meta, and Amazon.

This highlights Nvidia's efforts to increase its position in the competitive AI inference market, where it faces rivals like AMD and Cerebras.

Strong move by Nvidia.

From Tariffs to Earnings Growth: What Investors Need to Watch Going Into 2026

As we close out 2025, the stock market has had yet another rollercoaster year, marked by AI’s relentless dominance and explosive commodity rallies, more specifically gold.

With the S&P 500 set to end the year around 6,800 - 6,900, up about 17% YTD, investors are eyeing 2026 with some cautious optimism.

Despite this optimism, there are risks like increased inflation and policies that could impact the market as a whole.

In todays newsletter, we’ll recap the years trends, have a look at what’s in store for 2026 and share some actionable strategies, including a barbell approach which you can use to balance growth as well as some defence.

Let’s get into it.

But first, a word from our sponsor.

Business news worth its weight in gold

You know what’s rarer than gold? Business news that’s actually enjoyable.

That’s what Morning Brew delivers every day — stories as valuable as your time. Each edition breaks down the most relevant business, finance, and world headlines into sharp, engaging insights you’ll actually understand — and feel confident talking about.

It’s quick. It’s witty. And unlike most news, it’ll never bore you to tears. Start your mornings smarter and join over 4 million people reading Morning Brew for free.

Recapping 2025: AI Reigns Supreme Amid Commodity Booms

2025 was the year that AI solidified its stranglehold on Wall Street, with Nvidia’s market cap rising to a massive $5 trillion, helping fuel the sector as a whole.

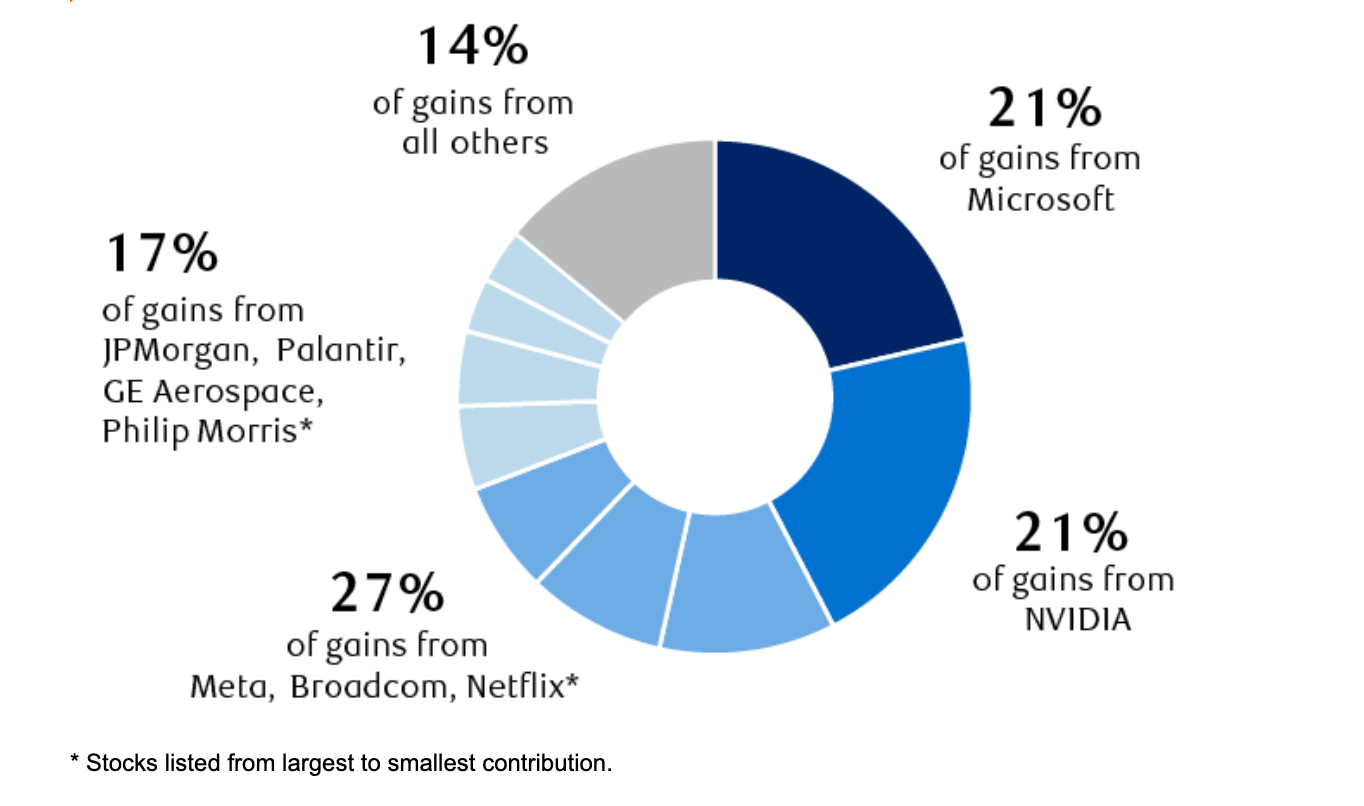

The “Mag 7” stocks, including some of the heavyweights like Nvidia and Broadcom, accounted for a large portion of the S&P 500 gains.

In fact, over 85% of the stock markets first half of the year returns came from only 9 stocks.

Isn’t that concerning?

AI wasn’t the only star of 2025, as commodities stole the spotlight too, with gold climbing ~70% YTD to new record highs, and silver more than doubling to over $69/ounce representing am ~140% gain for the year.

Commodities rose due to Federal Reserve rate cuts, geopolitical tensions and strong demand for AI infrastructure, more specifically data centres which require tons of power and metals to function properly.

Overall, it was a year where innovation met uncertainty, rewarding those who bet on tech and hedges (like commodities).

Forecasting 2026: Muted Gains in a Resilient Economy

Now the fun part…

Looking ahead to 2026, experts are forecasting a continued bull market momentum, but at a slower pace than what we experienced this year.

Here are some S&P 500 price forecasts for the end of 2026.

8,000: Among the most bullish forecasts, with Deutsche Bank expecting the S&P 500 to hit 8,000 by the end of 2026. The bank believes that earnings growth will persist and expects double-digit returns yet again for the index.

7,800: Morgan Stanley and Wells Fargo are projecting 7,800 for the S&P 500 by the end of 2026, as they also believe that there is more earnings growth to come.

7,500: Both HSBC and J.P. Morgan project that the S&P 500 will rise to 7,500, which would be the slowest growth for the index over the past 4 years. JPMorgan does see it potentially rising to 8,000, but that's if interest rates continue to come down.

These forecasts would represent the ultimate soft landing for the U.S. economy, with AI investments potentially adding $5-8 trillion in capex through 2030.

Key Risks: Inflation, Tariffs, and Beyond

Of course there are no forecasts without potential risks.

As we enter 2026, inflation continues to remain a wildcard, with year-over-year rates potentially rising as high as 3.3% and a consensus landing around 2.5%.

Many economists are predicting moderate inflation, but not always for ideal reasons (lower demand from higher rates).

Policy shifts under the Trump administration are fuelling these concerns, as tariffs have already escalated in 2025, adding ~$1,100 - $1,400 per household in effective taxes.

Reciprocal hikes on imports from China, Europe, and even pharmaceuticals (potentially to 200%) could also raise inflation, curb growth, and spark trade wars.

Barbell Strategies: Blending Growth and Defense

To make sure you stay afloat, I recommend a barbell-like portfolio.

In simple terms, this strategy goes heavy on high-growth AI plays on one end and defensive/risk-free assets on the other, skipping any and all assets with moderate risk.

How you choose to allocate the percentage to each side is completely up to you.

For growth, I would concentrate into market AI leaders. Think the Nvidia’s, Meta’s, and Palantir’s of the world.

I would also include ETF’s tracking semiconductors with a sprinkle of cyclicals that benefit from infrastructure spending.

On the defensive side, I would prioritize dividend aristocrats for cash flow, mainly in healthcare and financials. Think Johnson & Johnson, Pfizer and JPMorgan’s of the world.

You may even want to explore bonds for a hedge against volatility for this side of the barbell. Alternatives like gold ETFs can also help with the defensive side of your barbell strategy.

My ideal portfolio would look like this:

40% to AI/tech growth

40% to dividends/bonds/ETFs

20% to commodities

With adjustments made based on market headlines as the year passes.

For deeper dives into these picks and real-time alerts, now's the perfect time to upgrade to The Profit Zone Premium. With exclusive reports, deep dives and my watchlists, it's your edge in uncertain times. Prices are rising in the new year. Sign up here to lock in current rates.

Final Thoughts: Invest with Conviction

2026 will be filled with opportunities in an earnings-driven market, but having discipline is key.

Avoid chasing the highs we saw in 2025 and instead, use a barbell strategy to keep more of your money in the chance that things go south.

This isn’t to scare you… it’s to keep you aware of the potential risks.

Stay diversified, monitor Fed moves, and remember: markets reward the prepared.

Main Engine – Core Membership

Profit Zone Premium

My exact 5-stock portfolio (+57% YTD), real-time alerts, weekly earnings breakdowns, and our private Discord where serious investors compare notes in real time.

Education – Skill Compounder

Financial Domination

An 8-year compressed playbook that teaches you budgeting, choosing the right

brokerage, building a personal investing strategy, creating a watchlist,

understanding your investor profile, avoiding costly mistakes, and structuring

a portfolio that actually works for you.

If you’re a beginner or intermediate investor, this is the shortcut to taking

full control of your financial life.

Tools – Command Center

Snowball Analytics

Connect every brokerage, forecast dividends, and see your net-worth trajectory on one clean dashboard – the same one I check every morning.

Did you enjoy this newsletter?

Until next week,

The Profit Zone