Welcome to The Profit Zone 👋

Where 12,700+ millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on the web.

The S&P 500 has historically returned 10% per year since 1957.

But more than 90% of active fund managers fail to beat the index every year.

These expert traders are an exception.

Beating the S&P 500 by 94% in 2024 on an annualized basis.

They’ve beaten the market 3 years in a row, and not by a small margin…

Read about it below and change the way you invest your money.

Follow them on 𝕏 here.

Download their free app here and get quality stock picks at your finger tips.

Happy Monday!

Let’s start the week off strong.

The agenda for today:

👉 The 3 Biggest Risk To Your Financial Success

👉 How I fought back against these risks

👉 Time IN the market > timing the market

“In many ways, the stock market is like the weather, in that if you do not like the current conditions, all you have to do is wait.”

Headlines Making Noise: Keeping You Informed and Empowered 📝💡

The 3 Biggest Risks to Your Financial Success

There are plenty of risks to your financial success.

But many of them are things you can’t control.

For example:

How the market will perform over the next decade

The inflation rate

A companies earnings

Regulations imposed by the government

For the sake of this newsletter, we’re not going to be concerning ourselves with what we can’t control.

That’s the equivalent of being mad about the weather and letting it ruin your day.

You have no control over the weather. Don’t let it ruin your day.

But enough about sunshine and rainbows…

Let’s cover the 3 biggest risks to your financial control… that you CAN control.

1) Ignorance

When you’re ignorant, you fall behind the pack.

It can lead to making poor financial decisions that are too risky for your own tolerance.

If you’re ignorant about money, you might not have a budget in place or an emergency fund to plan for unexpected life events.

You may take on too much debt without understanding interest rates or repayment terms. Burying you in a hole of debt that is impossible to climb out of.

But one of the worst things that can happen when you’re ignorant about money is the missed opportunities.

Without understanding how to effectively grow and manage your money, opportunities will pass you by and you’ll have no idea they were right in front of you.

How I fought back against my ignorance:

I subscribed to finance newsletters to stay up to date with market news.

I started reading finance books to learn more about investing and portfolio management.

I googled “best high interest savings accounts” and used that information for how to best save my money at the highest possible rate.

I followed highly intelligent finance individuals on Twitter and Instagram and started reading their content.

I watched YouTube videos on how to read a cash flow statement.

I started listening to finance newsletters that talk about money and investing.

There are so many ways to learn and become less ignorant, you just have to take the first step.

2) Greed

Get rich quick schemes are a great way to go broke fast.

Write that down somewhere.

It’s common for the average investor to only look at the rate of return on an investment, without ever analyzing the risk.

Everyone wants to 10x their money overnight, but not everyone understands the risks that come with chasing that goal.

Risky investments are attractive because they promise higher returns. But sooner or later you’re bound to get caught up in a bad situation.

Greed can also lead to excessive borrowing and using leverage to amplify potential gains. This is also called trading on Margin. Another word for “getting a loan to invest”.

Never do this.

Leverage can magnify profits in a good market, but it can destroy you in a bad market.

How I fought back against my greed:

I stopped trying to get rich quick and started focusing on getting rich for sure.

I realized that by the time everyone is talking about a stock, it’s probably too late to get in.

I figured out that wealth building is a slow process and requires patience.

I decided that high-risk investments weren’t for me because they made me too emotional and lose sleep at night.

I stopped trying to be like everyone else and focused on my own strategy. Anything that didn’t fit that strategy was thrown to the side.

3) Time Horizon

There are a ton of reasons why people don’t start investing early.

But if you are reading this newsletter and haven’t started investing yet, what are you waiting for?

The longer your time horizon, the better off you’ll be.

There’s a saying that goes:

“The best time to invest was when you were born, the second best time to invest is today”.

The longer your money stays invested, the less chances you have of losing money.

Also, the longer your time horizon, the less short term news and market price fluctuations affect you.

How I increased my time horizon:

The answer is you can’t.

You can’t go back in time to when you were 18 and invest more money.

If you’re lucky enough to still be relatively young, you can play catch up and still create a solid financial future for yourself.

The longer you wait, the more you’ll have to invest every month to reach your goals.

Start today. Whether it’s with $5, $10, $50, or $100. Get in the habit of investing your money and increase your contributions over time.

Building good habits early on will ensure a lifetime of wealth.

See you in the next one!

Miss last weeks newsletter? Read it below:

Stop waiting on the sidelines to get in at the perfect time.

The more you try to time the market, the more you will miss out on wealth building opportunities.

Time in the market > Timing the market

Give compound interest a reason to work in your favour.

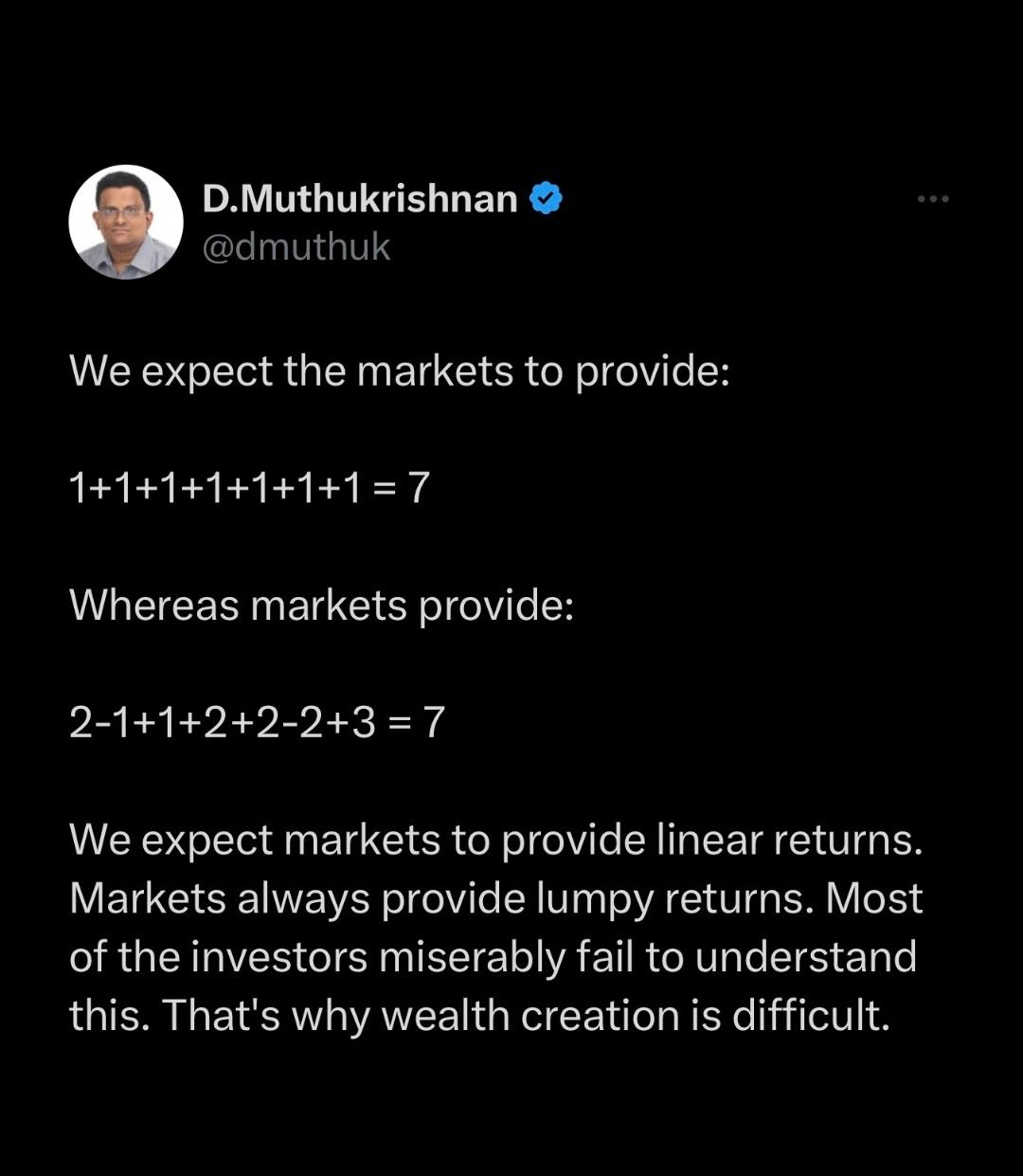

I really liked this tweet and thought it was worth sharing.

Sponsor The Profit Zone

Want to get more eyes on your products?

Advertise to 12,700+ investors hungry for financial content.

Click below to book with us.

Did you enjoy this newsletter?

My Website - a one-stop shop for all things dividend investing.

Financial Domination - learn how to set up an effective budget, figure out your investor profile, use stock screeners and rebalance your portfolio without paying someone to do it for you.

The Complete Investors Accelerator Pack - everything you need to build a dividend portfolio that grows on itself. Learn more about dividend investing, how to analyze dividend stocks, what to do with your dividends and how to build a stream of passive income through the stock market.

Beehiiv - sign up for Beehiiv and start your own newsletter today.

TweetHunter - let the software do the tweeting for you. The only scheduler you’ll ever need. This tool makes me money in my sleep. Give it a try for free.