Welcome to The Profit Zone 👋

Where thousands of millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on the web.

👉 What is Happening in the Stock Market Right Now?

👉 From Automated Investing to Cash-Back Rewards: The Best Apps Transforming Personal Finance in 2025 📱

👉 The Profit Zone is Getting a Facelift: Get In While You Still Can ✅

“The trick is not to learn to trust your gut feelings, but rather to discipline yourself to ignore them. Stand by your stocks as long as the fundamental story of the company hasn’t changed.”

What is Happening in the Stock Market Right Now?

After a brutal and confusing Thursday, with intraday swings and some bigger losses, U.S. stocks came through on Friday with a strong rebound:

Dow +493 pts (+1.08%) after being up as much as 800 earlier

S&P 500 +0.98%

Nasdaq +0.88%

What caused the chaos?

2 big questions dominate the market right now:

Is the AI bubble bursting?

Will the Fed cut rates in December?

Wednesday/Thursday seemed to deliver “yes” answers to both of the above:

Nvidia posted blowout earnings providing some relief that AI demand is still strong

September jobs report showed rising unemployment leading to markets betting on a December rate cut

Stocks soared on Thursday, but the rally completely collapsed by midday.

Why the reversal?

Traders are realizing the “good news” actually created new fears:

Nvidia’s numbers were so strong that investors worried nothing can top them

Hiring was actually much stronger than expected, unemployment rose only because more people re-entered the workforce, leading to the belief that maybe the labor market isn’t weak enough to force a Fed cut

This all led to Thursday became one of the most volatile days of the year.

Bottom line: Markets are back in “extreme fear” mode. Investors still don’t have clear answers on AI sustainability or December rate cuts, so elevated volatility is likely to remain, especially with thinner holiday trading and delayed economic data ahead.

7 Ways to Take Control of Your Legacy

Planning your estate might not sound like the most exciting thing on your to-do list, but trust us, it’s worth it. And with The Investor’s Guide to Estate Planning, preparing isn’t as daunting as it may seem.

Inside, you’ll find {straightforward advice} on tackling key documents to clearly spell out your wishes.

Plus, there’s help for having those all-important family conversations about your financial legacy to make sure everyone’s on the same page (and avoid negative future surprises).

Why leave things to chance when you can take control? Explore ways to start, review or refine your estate plan today with The Investor’s Guide to Estate Planning.

From automated investing to cash-back rewards, the best apps transforming personal finance in 2025

In 2025, fintech apps are now redefining passive income, turning your everyday habits into effortless wealth-building.

We can forget manual stock picking or tedious budgeting spreadsheets, because robo-advisors and neobanks (a digital-only financial company that provides banking services through mobile apps and websites) help automate your investing, rewards and money management.

Whether you just want to round up spare change or earn a high yield on your savings account, these tools are integrating seamlessly with traditional banks for transfers and direct deposits, allowing you to take full control of your money.

Let's dive into top picks, their features, fees, and real user wins to help you earn while you sleep.

Robo-Advisors: Set It and Forget It Investing

The future is here.

Robo-advisors use AI algorithms to build diversified ETF portfolios, rebalancing them automatically and can also help you optimize your portfolio for taxes, making it perfect for hands-off growth.

Here are a few examples you can use:

Acorns: This micro-investing app is a great choice for beginners because of its "Round-Ups" feature, helping you invest spare change from purchases. For example, buy a $4.50 coffee and it rounds to $5, investing $0.50. Other key features also include recurring investing, cash-back rewards from partnered brands and IRA matching up to 3% on contributions. Fees are as follows:

Bronze Tier ($3/month): Includes an investment account and banking features with a debit card.

Silver Tier ($6/month): Adds a retirement account (IRA) and an IRA match feature for qualifying contributions.

Gold Tier ($12/month): Includes all features from lower tiers, plus a children's account feature.

It can also link to your bank account for automatic transfers and supports FDIC-insured checking.

Betterment: A platform designed for more serious investors, this tool offers advanced tax-loss harvesting strategies (selling losses to offset gains) and goal-based planning for your future retirement or home purchases, as well as any other big purchases you can think of. Some attractive features include a high-yield savings account (4.65% for new customers (limited offer until Jan 15, 2026) and crypto portfolios. Fees are around $4/month for digital plans for accounts below $20,000 and 0.25% of assets under management for accounts above $20,000. It integrates well with external banks for ACH transfers and payroll direct deposits.

Neobanks: Streamlined Budgeting and Rewards

Neobanks are helping us ditch branches for app-based banking and offer high-interest savings, instant transfers and budgeting tools that help generate passive rewards.

Chime: A market leader in seamless budgeting. This tool provides no-fee checking accounts and overdraft up to $200 without fees for users who have enrolled in the SpotMe feature. Other features include automatic savings round-ups, up to 3.50% on savings accounts and cash-back on debit purchases, so you can make money on things you spend money on anyways. There are no monthly fees however you may get charged for out-of-network ATM withdrawals and deposits.

SoFi: SoFi blends banking and investing together, offering savings account interest rates up to 4.30% APY for eligible new customers who join the SoFi Plus program and have direct deposit by January 31, 2026. They also offer no account, service, or maintenance fees for its Checking and Savings accounts, though it does charge a fee for outgoing wire transfers. Other features include career coaching, loan refinancing and cash-back rewards.

Chime and SoFi are consistently recognized among the top neobanks for user growth.

Tips for Tech-Savvy Investors

Start small: Link apps to your primary bank for auto-transfers and aim for 10% of your monthly income, increasing as you get more comfortable saving and investing.

Diversify: Use Acorns platform for fun micro-investing, Betterments for tax strategies, and Chime for your daily banking.

Monitor passively: Enable notifications so you know when you get those juicy rewards. Other than that, these tools are practically hands off.

Security first: All of the above feature FDIC insurance up to $250K and two-factor authentication, so you can ensure your money is safe.

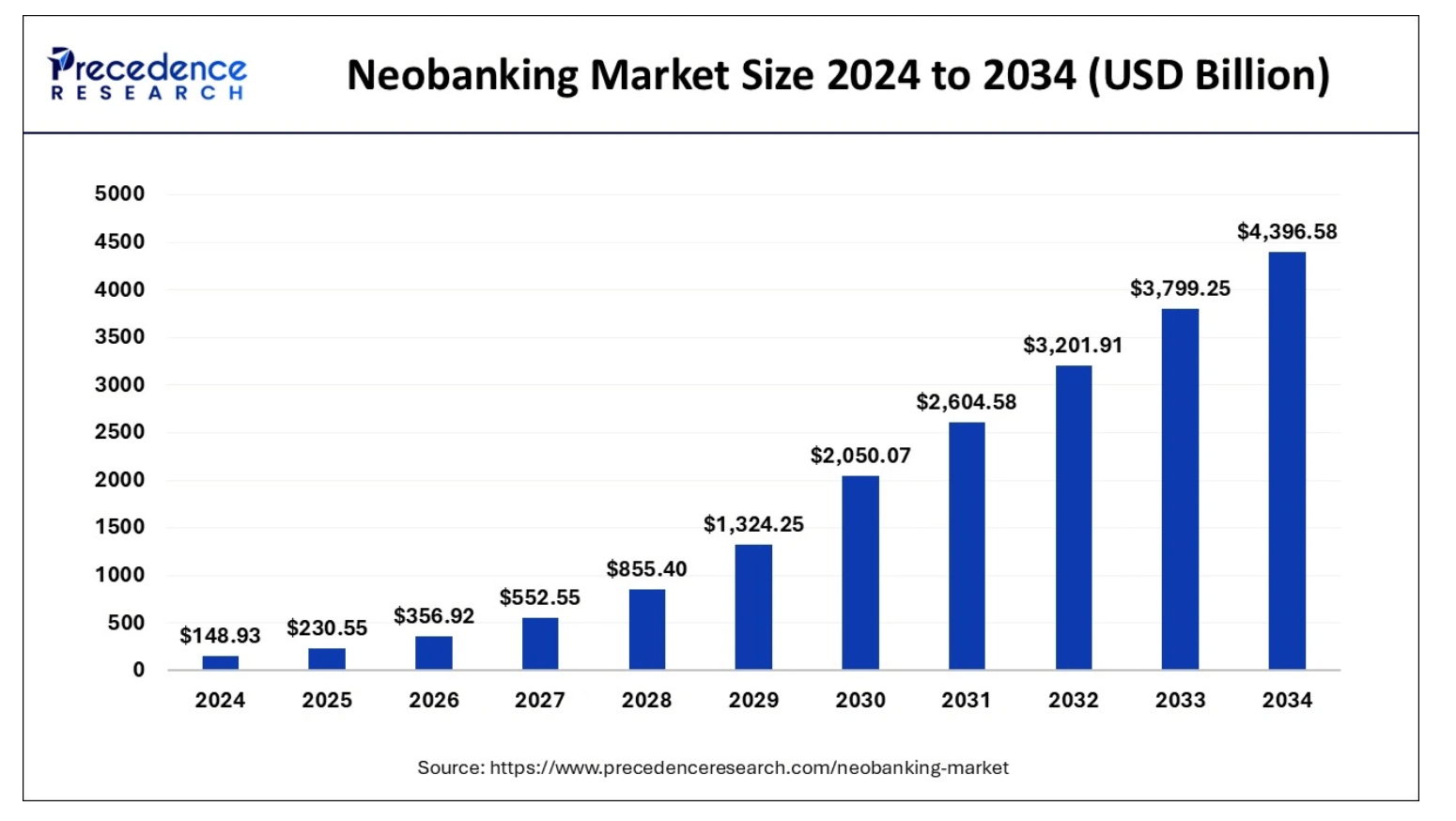

If you were wondering just how big this industry is, here are the stats.

The industry is expected to reach 4,396.58 billion by 2034.

It’s still so early.

Did you enjoy this newsletter?

The Profit Zone is Getting A Facelift

As you know, I don’t only send free newsletters every Monday morning (but they do go well with your morning coffee).

I also have a premium feature where my subscribers get access to my portfolio, my buys and sells in real time, earnings summaries and our Premium Portfolio, all within our Discord community of investors all on the same financial journey.

I’ve been working hard to provide you with the highest quality information and soon, the Profit Zone is going to get a facelift.

I’m talking updated to our newsletter, website and premium features.

I’ve been keeping the price low for this community for quite some time but as you may know, we have absolutely CRUSHED the S&P 500 YTD within the community.

My fundamental analysis gets posted and my subscribers buy the stocks.

All they have to do is wait and make money.

In fact, we’re still up 52% YTD after all the noise in the market recently.

Based on that and the content I share within the community, an increase in the cost of admission is long overdue.

I can’t tell you exactly when (I have to figure some stuff out before that happens) but I can tell you its coming.

If you’re interested in joining us and become the best possible investor you can be, click below to lock in your price at $20/month before it goes up.

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Dividend Domination Inc. is a publisher of financial information, not an investment advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

Any projections, market outlooks or estimates herein are forward-looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.