Top Card Offering 0% Interest until Nearly 2026

This credit card gives more cash back than any other card in the category & will match all the cash back you earned at the end of your first year.

Welcome to The Profit Zone 👋

Where thousands of millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on the web.

👉 The Trump Trade: How to Capitalize on Post-Election Hype 🔥

👉 Investing Secret: Turning Non-Dividend Paying Stocks Into Cash Flowing Assets 💵

👉 Snowball Analytics: The #1 Portfolio Tracker On The Market 📈

👉 Dividend Checklist: Get Our Dividend Checklist 100% Free 🔎

“If returns are going to be 7 or 8 percent and you're paying 1 percent for fees, that makes an enormous difference in how much money you're going to have in retirement."

Capitalizing On “The Trump Trade”

We’re in the post-election stock market honeymoon phase. Stocks are up, and indexes are hitting all-time highs.

The bull run we’re experiencing is being framed as Trump’s influence on the stock market, called the “Trump Trade”, but is this something new?

In previous election years, there has always been a “honeymoon” phase for stocks and it typically lasts until the new president is inaugurated in January.

In 2020, when Joe Biden won, the S&P 500 was up 14.3% from election day until his inauguration on January 20.

In 2016, after the first Trump victory, the S&P 500 was up 6.6% in the two and a half months between his election and inauguration.

In 2012, after pulling back the first ~10 days after Barack Obama was elected to a 2nd term, stocks rallied in the last 6 months of the year and didn’t stop until mid April of 2013, rising by 11.5% in just over 5 months.

What does this mean for you?

The market doesn’t care who wins, it’s just happy the election is over. Stocks (and certain sectors) will rise on the promises of what could be under the new administration.

The best time to buy stocks after an election is in the 2 and half months before the inauguration, a period in which stocks have averaged a 10.5% gain over the last two elections.

The Secret To Turning Non-Dividend Paying Stocks Into Cash flowing Assets

Did you know that there is a way to generate extra income on the dividend stocks you already own?

You can also turn non-dividend stocks into “dividend stocks” that pay you passive income.

Are you confused?

Let me explain…

There is an option strategy called Covered Calls which is used to generate income in the form of options premiums.

You can use this strategy if you expect a minor increase or decrease in the stock price.

If you believe that the stock price won’t change much in the short term, covered calls might be an effective way to squeeze out some more income from stocks you already own.

To execute this strategy, you must hold 100 shares on the underlying assets (1 contract) and then write (sell) a call option on that same asset.

If you’re wondering if this strategy works without holding 100 shares of the underlying asset, it does…

But that is called a Naked Call and I would advise against it as you would theoretically have unlimited loss potential if the underlying asset rises in price.

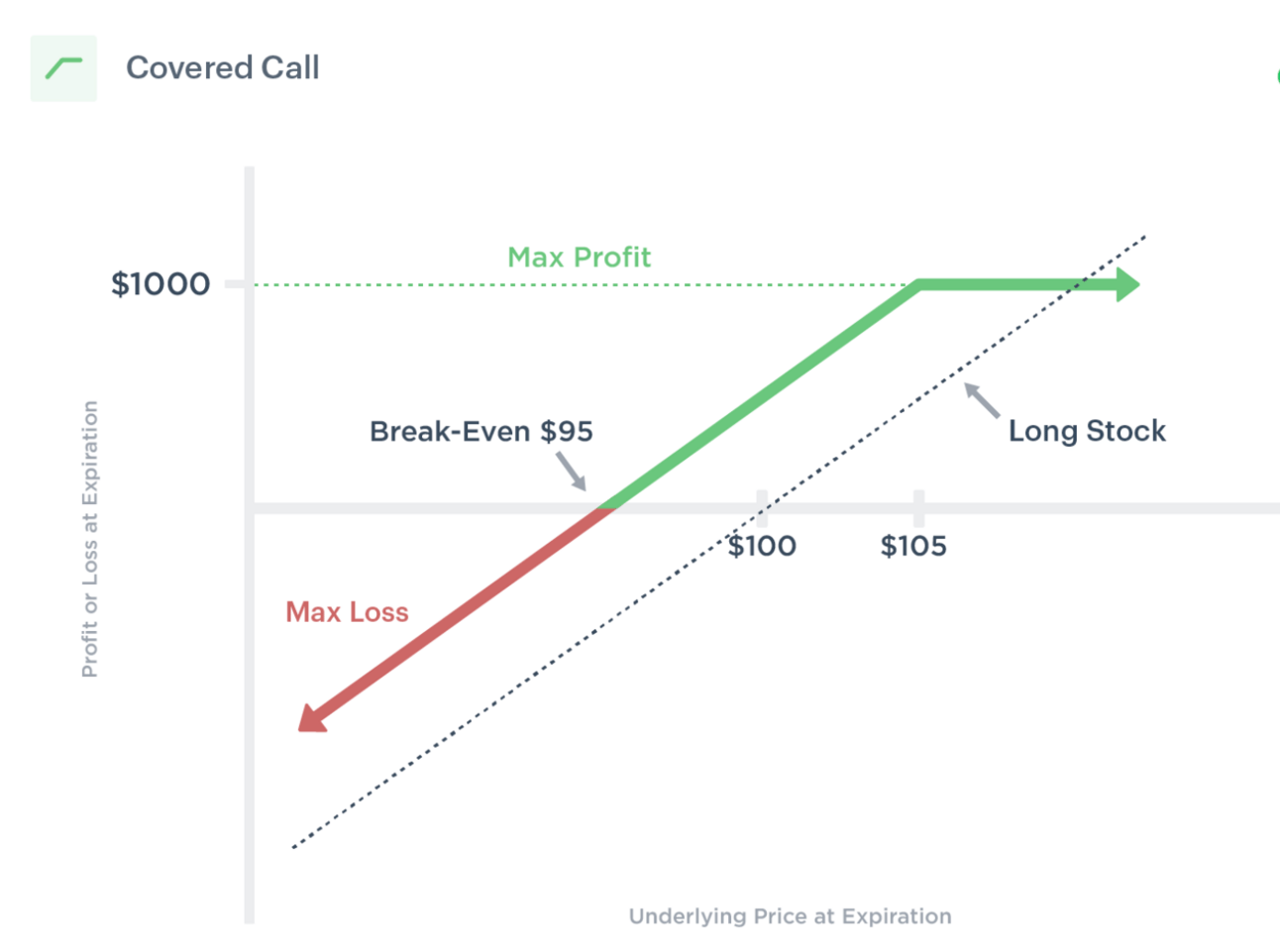

Below is a diagram showing how a covered call works.

The maximum profit you can earn on a covered call is equal to the premium received for writing the call and the upside of the stock between the current price and strike price chosen.

In the example above, the strike pice is $105.

Selling a covered call limits the profit you can earn but does not eliminate downside risk.

With being said, it does help to reduce the risk by the price of the premium received, which lowers your cost basis.

Example 🚨

Let’s say you buy 100 shares of Stock ABC at $100 and you sell a call option at a $105 strike price for $5 with 1 week expiry.

Your thought process: You think the stock will go up in price but not rise above $105 within 1 week.

Your cost basis is reduced by $5 (money that is now in your pocket) meaning your break even point of the long stock position is now $95.

Initial money spent: $10,000

Premium received: $5 x 100 shares (1 contract) = $500

Average cost: $10,000 - $500 = $9,500 ($95/share)

Scenario 1: Stock ABC trades BELOW the $105 strike price after 1 week 🏆

The option will expire worthless and you get to keep the premium of $500 for writing the call option. You still own the stock and have some extra cash in your pocket with a lower cost basis of $95. This is the OPTIMAL scenario.

Scenario 2: Stock ABC trades ABOVE the $105 strike price 💰

The option is exercised and the upside in the stock is capped at $105. You sell your shares at $105, keep the premium of $500 and the price appreciation of your shares from $100 to $105 ($5 x 100 = $500).

Total return is $1,000 ($500 premium + $500 in share appreciation).

Scenario 3: Stock ABC trades BELOW the $100 price you bought it for 📉

The option will expire worthless and you get to keep the premium of $500 for writing the call option. Your cost basis is now $95 (because of the $500 premium you collected) and if the stock is trading above $95, you’ve still made a profit. If the stock is trading below $95, you’re now in a loss.

Final Notes 🗒

Covered calls are a good way to squeeze some extra income out of stocks that are already paying you a dividend, or a way to turn non-dividend-paying stocks into income-generating assets.

The only thing you have to be extremely careful about is to avoid buying and selling options near earnings releases.

The reason is simple, stocks are often very volatile pre and post-earnings release, and it would be detrimental to your options strategy to experience a big swing in price due to market sentiment.

Another thing to note, once you sell the call option the premium is yours to keep, no matter what happens to your contract. That is money you can use to buy more shares in the same company or reinvest into an index fund.

Turning fast money into forever money is the name of the game.

Did you enjoy this newsletter?

2023 Dividend Income: $2,952

2024 Dividend Income: $4,019

And that’s without contributing a single dollar more for the rest of the year.

Here’s one thing I did to grow my dividend income by ~36% over the last 12 months ⬇

I started using AI to tell me if a stocks dividend was reliable or not.

Most of us don’t have time to spend hours looking through financial statements.

So instead, we can let AI do the heavy lifting.

Here’s Proctor and Gamble $PG, who received a dividend safety score of 63/100.

I use Snowball Analytics for all of my dividend stock research.

It’s the #1 platform on the market right now and they continue to release features that keep making it better.

Link your portfolio right to Snowball and all of your holdings will be updated in real time.

It’s a one stop shop for hedge fund level analytics about your portfolio.

Sign up here (or click below) and use code “dividenddomination” for a discount.

I put together a Dividend Checklist to help you analyze dividend stocks like a pro.

Everything you need can be found on this checklist, including common ratios to evaluate the quality of the company along with some questions to ask yourself before making an investment.

It’s yours 100% free when you answer “I want it!” in the poll below.

Having Trouble Analyzing Dividend Stocks? Try Our FREE Dividend Stock Checklist.

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Dividend Domination Inc. is a publisher of financial information, not an investment advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

Any projections, market outlooks or estimates herein are forward-looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.