Welcome to The Profit Zone 👋

Where 12,700+ millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on the web.

We’re teaching you what schools forgot in 5 minutes or less.

Happy Monday!

Let’s start the week off strong.

The agenda for today:

👉 My investing strategy is simple…

👉 SBF got 25 years and has to repay $11 Billion

👉 5 things you should avoid at all costs when investing

“If you are not willing to own a stock for 10 years, do not even think about owning it for 10 minutes.”

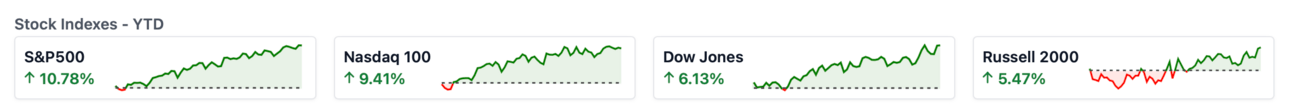

Markets YTD

Headlines Making Noise: Keeping You Informed and Empowered 📝💡

Sponsored

BraVoCycles Newsletter

Having trouble analyzing the market?

Don’t understand market cycles and how to capitalize on them?

Learn from an expert in market cycle analysis and gain insights into the stock market with BraVoCycles Newsletter.

20,000 investors are getting stock market guidance 4x a week.

Gain a financial edge sent right to your inbox.

Keep More of Your Money

5 Things You Should Avoid At All Costs When Investing

Buckle up!

Today we’re shining a spotlight on the 5 mistakes that trip up even the savviest investors.

As someone who has made these mistakes, you’ll want to avoid them at all costs.

1. Clinging To A Sinking Ship

When it comes to investing, holding onto losers is like trying to bail out a leaky boat with a teaspoon.

Unlike what you see in the movies, don't be the captain of a sinking ship.

Cut your losses, jump ship, and set sail for smoother waters.

There are plenty more fish in the sea.

How do you know when you need to jump ship?

There has been a fundamental change in the business

New management that’s not cut out to lead the squad

A material change that goes against your initial investing thesis

Just because the stock price fell, doesn’t mean it’s a bad investment.

In fact, it may be time to buy more at a discount. Just make sure you know WHY the stock fell before making that decision.

2. Falling Head Over Heels for a Stock

Love is in the air...

Or is it just the scent of your favorite stock?

Beware of falling madly, deeply, and irrationally in love with a company.

Remember, investing is a business transaction, not your favorite rom-com on Netflix.

Keep your heart in check, and let your brain do the talking.

Falling in love with a stock will make you blind to what’s actually going on beneath the surface.

3. Overtrading

The stock market is not a casino. If you want to gamble, take your money and go to Vegas.

You must resist the urge to play the slots and roulette with your hard-earned cash.

Instead of chasing every “opportunity” that you feel warrants your investment, sit back, relax, and enjoy the show.

Plan to hold for 10+ years and let compounding do the heavy lifting for you.

Remember, slow and steady wins the race...

4. The Dangers of Overconfidence

Confidence is key, but overconfidence is like trying to juggle flaming torches while riding a unicycle on a tightrope.

You might look impressive for a moment, but sooner or later, you're gonna crash and burn.

Stay humble and stay curious.

And never be afraid to admit you were wrong.

The most successful investors have been wrong a hundred times.

The difference is that they don’t see it as a loss, but rather a learning opportunity.

5. Riding the Hype Train

All aboard the hype train!

Next stop: Disappointment City.

Don't get swept away by the latest craze or shiny new toy in the market.

Before you jump on board, ask yourself:

“Is this the real deal or am I just trying to make a quick dollar?”

Don’t forget, trends come and go, but fundamentals are forever.

Final Notes:

Investing isn’t about how much money you make. It’s about how much you can keep.

The best investors are able to take past mistakes, learn from them, and make sure they never happen again.

Learning from the mistakes of others is the first step in leveling up as an investor.

Miss last week’s FREE newsletter? Read it below:

Miss last week’s PREMIUM newsletter? Read it below:

See you in the next one!

Alex (The Dividend Dominator)

Founder and CEO of Dividend Domination Inc.

Follow me on Twitter, Instagram and LinkedIn

Sponsor The Profit Zone

Want to get more eyes on your products?

Advertise to 12,700+ investors hungry for financial content.

Click below to book with us.

Did you enjoy this newsletter?

My Website - a one-stop shop for all things dividend investing.

Financial Domination - learn how to set up an effective budget, figure out your investor profile, use stock screeners and rebalance your portfolio without paying someone to do it for you.

The Complete Investors Accelerator Pack - everything you need to build a dividend portfolio that grows on itself. Learn more about dividend investing, how to analyze dividend stocks, what to do with your dividends and how to build a stream of passive income through the stock market.

Beehiiv - sign up for Beehiiv and start your own newsletter today.

TweetHunter - let the software do the tweeting for you. The only scheduler you’ll ever need. This tool makes me money in my sleep. Give it a try for free.