Welcome to The Profit Zone 👋

Where thousands of millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on the web.

👉 Netflix Buys Warner Bros in a Massive Deal 💰

👉 The 60/40 Portfolio: Resurrected and Thriving in 2025 🔥

👉 The Current State of the Bond Market 📈

“The time component of compounding is why 99% of Warren Buffett’s net worth came after his 50th birthday, and 97% came after he turned 65.”

Netflix Buys Warner Bros in a Massive Deal

Netflix has agreed to acquire Warner Bros. in a massive $82.7 billion deal.

The streaming giant, led by co-CEOs Ted Sarandos and Greg Peters, secured $59 billion in financing to fund the acquisition, which includes a $5.8 billion breakup fee if the deal falls through.

Warner Bros. shareholders will receive $23.25 in cash and $4.50 in Netflix stock per share, while Warner Bros. networks (CNN, TNT, HGTV, and Discovery+) will spin off in Q3 2026, with CFO Gunnar Wiedenfels as its new CEO.

Netflix promised to preserve Warner Bros.’ operations, including its film releases, while expanding studio capabilities and generating $2-3 billion in annual cost savings.

The merger is intended to enhance user choices, optimize plans and create more value for talent by combining Netflix’s global reach with Warner Bros.’ iconic franchises like DC Comics, Harry Potter and Lord of the Rings.

The deal faces regulatory hurdles, with theater owners seeing it as a threat with concerns over industry impacts.

I believe this is a strategic and intelligent move by Netflix to command the market and add to its product offerings.

Hands Down Some Of The Best 0% Intro APR Credit Cards

Balance Transfer cards can help you pay off high-interest debt faster. The FinanceBuzz editors reviewed dozens of cards with 0% intro APR offers for balance transfers and found the perfect cards.

Take a look at this article to find out how you can pay no interest on balance transfers until 2027 with these top cards.

The 60/40 Portfolio: Resurrected and Thriving in 2025

In the whirlwind of 2025’s stock market, a year that has been marked by AI hype, surges in crypto (though not recently) and election drama, the humble 60/40 portfolio has staged quite the comeback.

This portfolio is a classic allocation of 60% stocks / 40% bonds, which was dismissed as “outdated” not too long ago, but is now outperforming a ton of hedge funds.

Why you ask?

Because Bonds are yielding over 4% again, providing investors like you a reliable stream of income, while stocks continue to trade at nosebleed valuations. This portfolio split has now become a smart hedge against volatility.

The Current State of the Bond Market

Let’s start with the bond market.

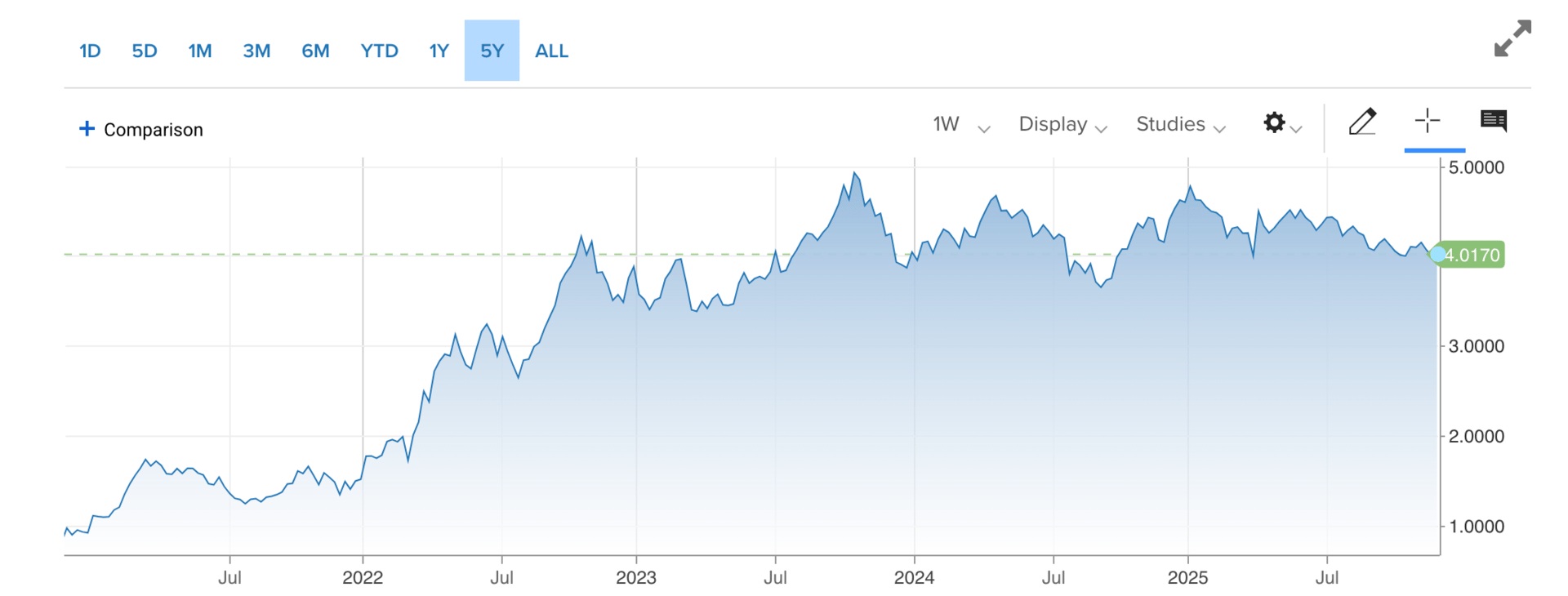

The 10-year U.S. Treasury yield sits around 4% today, up from sub 1% in the pandemic era.

This growth in the 10-year Treasury stems from the Fed’s rate cuts during a period of slowing job markets, yet persistent inflation in the economy has maintained yield attractiveness.

For you, it means fixed income isn’t just a safety net, its now an income generator. And that flip is enough to attract new capital into the market.

When paired with stocks, which are significantly overvalued as of right now, it provides for more balance within your portfolio.

When equities become pricey (as they are now) bonds start to shine by cushioning drawdowns.

The proof is in the performance.

BlackRock’s 60/40 Target Allocation Fund has delivered returns of 15.36% YTD (as at Nov 29), outpacing the return of many large cap stock funds.

For hedge funds, the average return YTD sits around 14% YTD (as at Nov 29).

While some hedge funds perform better than others, many lagged the 60/40 split.

Although the returns appear close, hedge funds come with their own set of fees due to the active management of the fund, eroding your returns over time.

The 60/40 split boasts expense ratios of less than 0.1%, allowing you to keep more of your money in your pockets.

The lesson here?

In an expensive stock market with yielding bonds, simplicity wins.

The 60/40 isn't flashy, but its low-correlation magic (stocks for growth, bonds for stability) is quietly beating hedge fund pros.

As we enter the uncertainties of 2026, consider reallocating your portfolio. It may save your retirement (if you’re nearing that stage of life).

Did you enjoy this newsletter?

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Dividend Domination Inc. is a publisher of financial information, not an investment advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

Any projections, market outlooks or estimates herein are forward-looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.