News you’re not getting—until now.

Join 4M+ professionals who start their day with Morning Brew—the free newsletter that makes business news quick, clear, and actually enjoyable.

Each morning, it breaks down the biggest stories in business, tech, and finance with a touch of wit to keep things smart and interesting.

Welcome to The Profit Zone 👋

Where thousands of millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on the web.

👉 Stocks Rose on Friday: Stronger-Than-Expected Payrolls Report 📓

👉 The Financial Impact of Lifestyle Creep and How to Reverse It: Turning Your Creep Expenses into Wealth-Building Opportunities 🤑

👉 Reversing Lifestyle Creep: Proven Tactics For Taking Control of Your Money 💰

👉 Join The Profit Zone Premium: Supercharge Your Investment Strategy and Stay Ahead of the Market (Beating the S&P 500 by 36% YTD) 📈

“There is no point in being confident and having a small position.”

Stocks rose on Friday following a stronger-than-expected payrolls report, which helped to alleviate fears of an imminent economic slowdown.

The Dow Jones Industrial Average rose 1.05%, while the S&P 500 gained 1.03% and the Nasdaq Composite climbed 1.20%.

The Bureau of Labor Statistics reported a 139,000 increase in May payrolls, higher than the 125,000 forecast. Unemployment rate remained steady at 4.2%.

Uncertainty continues regarding tariff impacts on inflation, with effects expected to emerge in summer data. However, President Trump’s announcement of upcoming U.S.-China trade talks fuelled some optimism for investors.

The Financial Impact of Lifestyle Creep and How to Reverse It

Lifestyle creep, the quiet increase in spending as your income grows. Posing a significant threat to your long-term financial stability.

I get it, everyone wants to upgrade their lifestyles when they earn more money.

The big house. The nicer car. The new phone. The fancy dinners. The designer shirts.

But you don’t just pay the price for the item. There’s a hidden cost attached to this as well.

Let me explain.

The phenomenon of “lifestyle creep” isn’t just about spending more. It’s about how small, incremental increases in your expenses can compound over time, taking money away from your savings, investments and even repayments on outstanding debt.

According to the 2023 Consumer Expenditure Survey by the U.S. Bureau of Labour Statistics, the average household spending reached $77,280, a 5.9% increase from 2022.

Key drivers included:

Housing (up 4.7%)

Transportation (up 7.1%)

Eating out (8.1%)

So the average household spending increased by 5.1% more than the average wage increase.

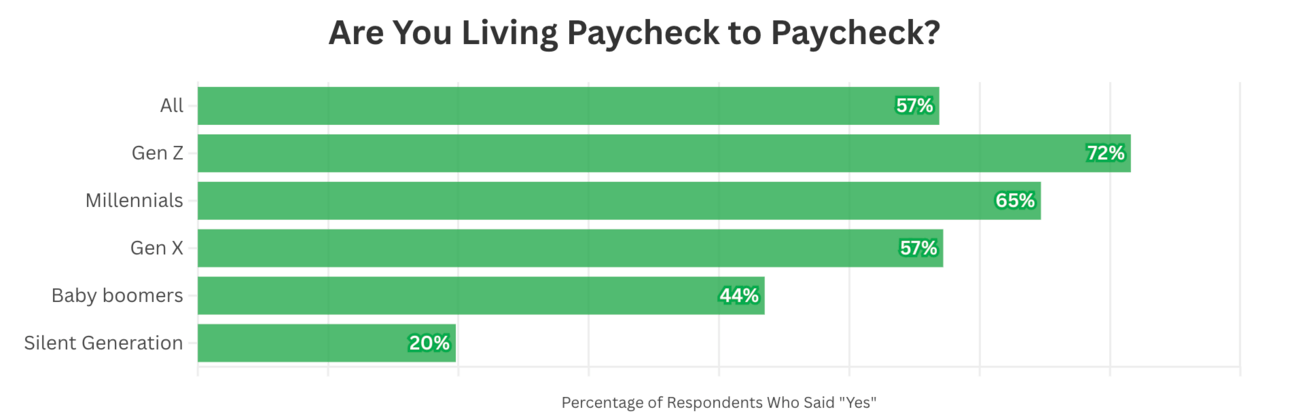

This is why tons of Americans are living paycheck to paycheck. To be specific, 57% are living in this doom cycle.

Lets consider the math:

If you upgrade from a reliable $20,000 car to a $40,000 new model, that adds $20,000 in costs, usually financed with a loan if you’re the average car buyer.

Lets say you have a great credit score. The interest rate on a new car loan will be in the range of 5%. Over a 5 year term, you’re paying ~$5,000 in interest expenses, not to mention the insurance and potential maintenance costs.

Now lets look at dining out, something people love to spend money on. The average american spends $166/month eating out. Let’s call it $165 for simplicity.

Over the course of a year, that amounts to $1,980.

We could get into what that would compound to at a 10% annual return over 30 years, but I’ll spare you for now.

Now credit cards.

A tool (for some), the devil (for most). I say this because credit cards can be powerful, but only if you pay off your debt on time.

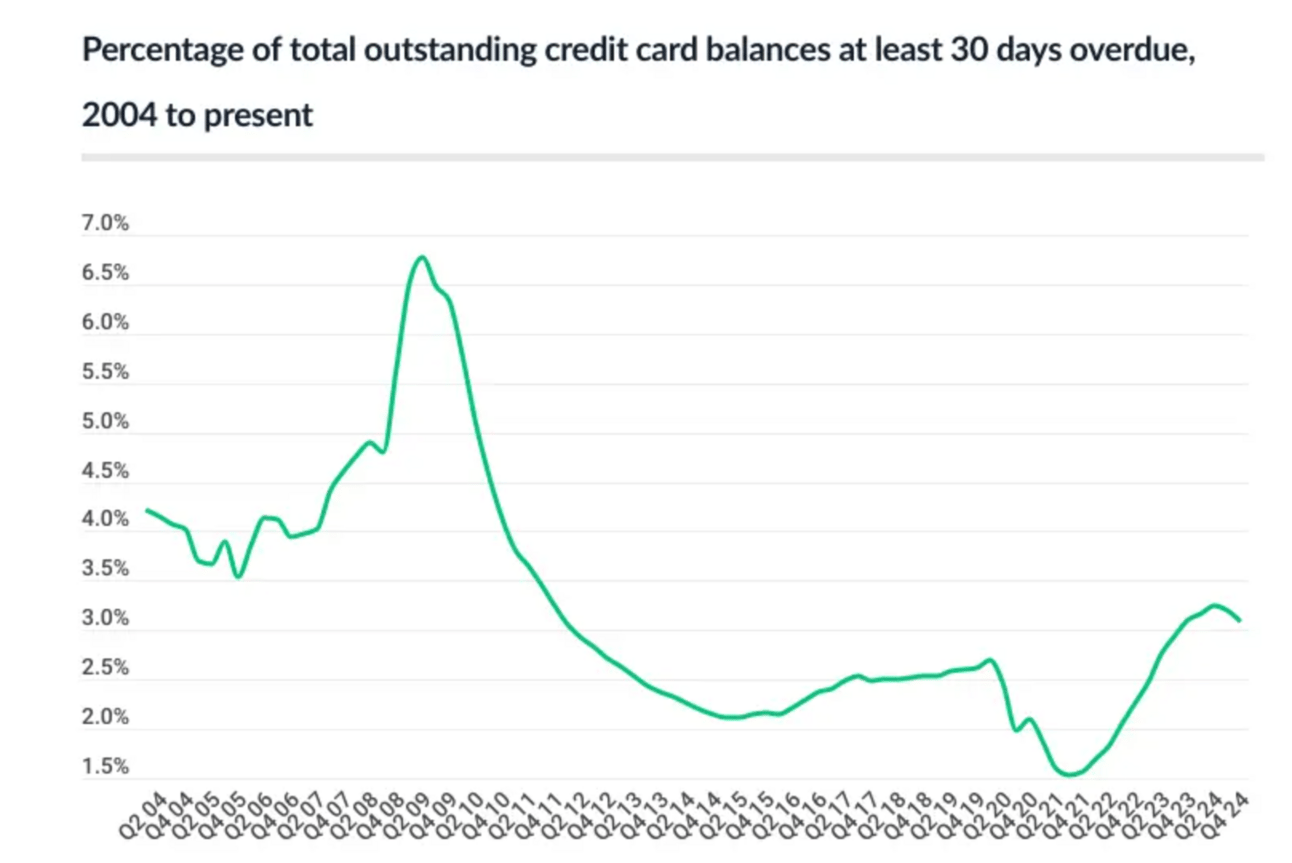

Below highlights the percentage of outstanding credit card balances at least 30 days overdue. This number has gotten significantly better since the 2007-09 recession, but it’s on the rise once again touching 3.05%.

That’s a large number (in $) when you consider that Americans' total credit card balances now stand at a record-high $1.21 trillion.

In fact, that’s about $36,905,000,000 of outstanding credit card debt held by Americans.

The problem with credit cards is that it makes you think you can afford to buy things you wouldn’t otherwise buy with cash. Credit cards made people forget common sense.

But if you use them properly and never let an outstanding balance get overdue, and only buy things you know you can pay for, the points can be extremely rewarding.

This cycle of increased spending traps households in a hamster wheel they can’t get off from.

What Creates Lifestyle Creep?

Lifestyle creep is driven by psychological and social factors.

As income rises, people feel entitled to “treat themselves” and keep up with their peers, also known as “keeping up with the Joneses”.

But I’m sorry to tell you, the Joneses are broke.

Social media helps to amplify this. A feed of curated lifestyles that normalize luxury spending.

That’s a rough stat.

Another rough stat.

But if you’re part of this group, don’t worry because there’s a way out.

How to Reverse Lifestyle Creep

Reversing lifestyle creep requires intentional strategies that require discipline, creativity, and a shift in mindset.

Below are 5 unconventional hacks to combat it and redirect funds towards your wealth-building goals:

Gamify Your Savings Journey: Transform saving into a challenge. Launch a “no-spend” month, avoiding non-essential purchases like dining out or new gadgets. Track progress using online apps, with some gamifying budgeting with progress bars or virtual rewards. Celebrate milestones, for example $500 saved, with low-cost treats, like a homemade movie night.

Redirect “Creep” Expenses to Income-Generating Assets: Find one “creep” expense, such as a $50/month premium coffee subscription, and use those funds to invest in assets instead. You can even automate these transfers to ensure your consistency.

Find Your Definition of “Enough”: Define what “enough” means for you. For me, it means a comfortable home, a way to get around from point A to point B, and the ability to have meaningful experiences. Write down what your “enough” is and review the list before making any major purchases to avoid impulsive upgrades. For example, if your “enough” car is a reliable sedan, skip out on buying the $60,000 SUV just because your friend Johnny has one.

Monetize Underused Assets: Try turning “creep” expenses into income sources. If you’ve already upgraded to a larger home and maybe you have a spare room, rent it out on Airbnb. If you’ve splurged on a 2nd car, use it for ride sharing on weekends. Redirect these earnings to savings or repayments on your outstanding debts.

Your Next Steps

Start by auditing your last 3 months of expenses to spot “creep”: those small, recurring increases in dining, subscriptions, or travel.

Then pick one of the above hacks to implement.

For example, cancel one unnecessary recurring subscription and invest the savings in an index fund.

Make sure to monitor your progress monthly, adjusting when needed.

The stakes are higher than you think. A lifestyle that remains unchecked can delay your retirement by years and every year you don’t address it, you dig yourself a deeper hole.

Your future self will thank you for choosing financial freedom over financial upgrades.

Until next time!

Did you enjoy this newsletter?

Join The Profit Zone Premium to supercharge your investment strategy and stay ahead of the market.

Our premium newsletter delivers exclusive insights and tools to help you build wealth on autopilot.

Gain access to:

Market-Beating Performance: Our 2025 stock picks are outperforming the S&P 500 by 36% year-to-date 📈

Real-Time Trade Alerts: Get instant access to my buy and sell recommendations as they happen 🚨

Deep-Dive Stock Analysis: Receive concise one-pager reports on undervalued stocks with high potential 📔 Below is a one pager on Hims & Hers we did months before the stock popped.

Direct Direct Access to Expertise: Ask me questions anytime to guide your investment decisions ❓

Income Opportunities: Earn extra income through exclusive affiliate marketing opportunities 💰

Don’t miss out. The price will 2x again after the next 25 members.

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Dividend Domination Inc. is a publisher of financial information, not an investment advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

Any projections, market outlooks or estimates herein are forward-looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.