Welcome to The Profit Zone 👋

Where thousands of millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on the web.

👉 Wall Street Ends Volatile November on a High Note 📈

👉 The Quiet Bull Market Almost Nobody Noticed 🐂

👉 When to Take Profits Before the Crowd Wakes Up 💤

“There’s no shame in losing money on a stock. Everybody does it. What is shameful is to hold on to a stock, or worse, to buy more of it when the fundamentals are deteriorating.”

Keeping You In The Loop

Wall Street ends volatile November on a high note.

U.S. stocks closed higher for a 5th straight day in a shortened post-Thanksgiving session on Friday, allowing the S&P 500 to squeeze out a small monthly gain and avoid its first negative month since April.

The market recovered from a mid-month slump driven by profit-taking in overhyped AI leaders.

A late-week rally was fuelled by growing confidence that the Fed will deliver another rate cut at its December 10th meeting.

Other highlights:

Bitcoin surged past $92,000

Most mega-cap tech names rose

Retail stocks mixed ahead of Black Friday data

Treasury yields edged up, with the 10-year at 4.01%.

Missed OpenAI? The Clock Is Ticking on RAD Intel’s Round

Ground floor opportunity on predictive AI for ROI-based content.

RAD Intel is already trusted by a who’s-who of Fortune 1000 brands and leading global agencies with recurring seven-figure partnerships in place.

$50M+ raised. 10,000+ investors. Valuation up 4,900% in four years*.

Backed by Adobe and insiders from Google. Invest now.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

The Quiet Bull Market Almost Nobody Noticed

While financial media obsessed over big tech giants and the S&P 500’s headline-grabbing gains, a more quiet story is unfolding in the stock market.

Small-cap stocks have been putting together a strong rally in the latter half of 2025, flying under the radar during broader market volatility.

This quiet bull run is offering opportunities for investors looking to diversify beyond the usual suspects.

Lets dive into why this trend matters and how you can position yourself accordingly.

Small-cap stocks are up 38% from October lows – here’s proof

Small-cap stocks, tracked by the iShares Russell 2000 ETF $IWM ( ▲ 0.0% ) are up ~45% from their 52 week low back in April 2025, yet nobody is talking about this.

This rally reflects a more positive sentiment following policy shifts and economic indicators that are favouring domestic-focused companies.

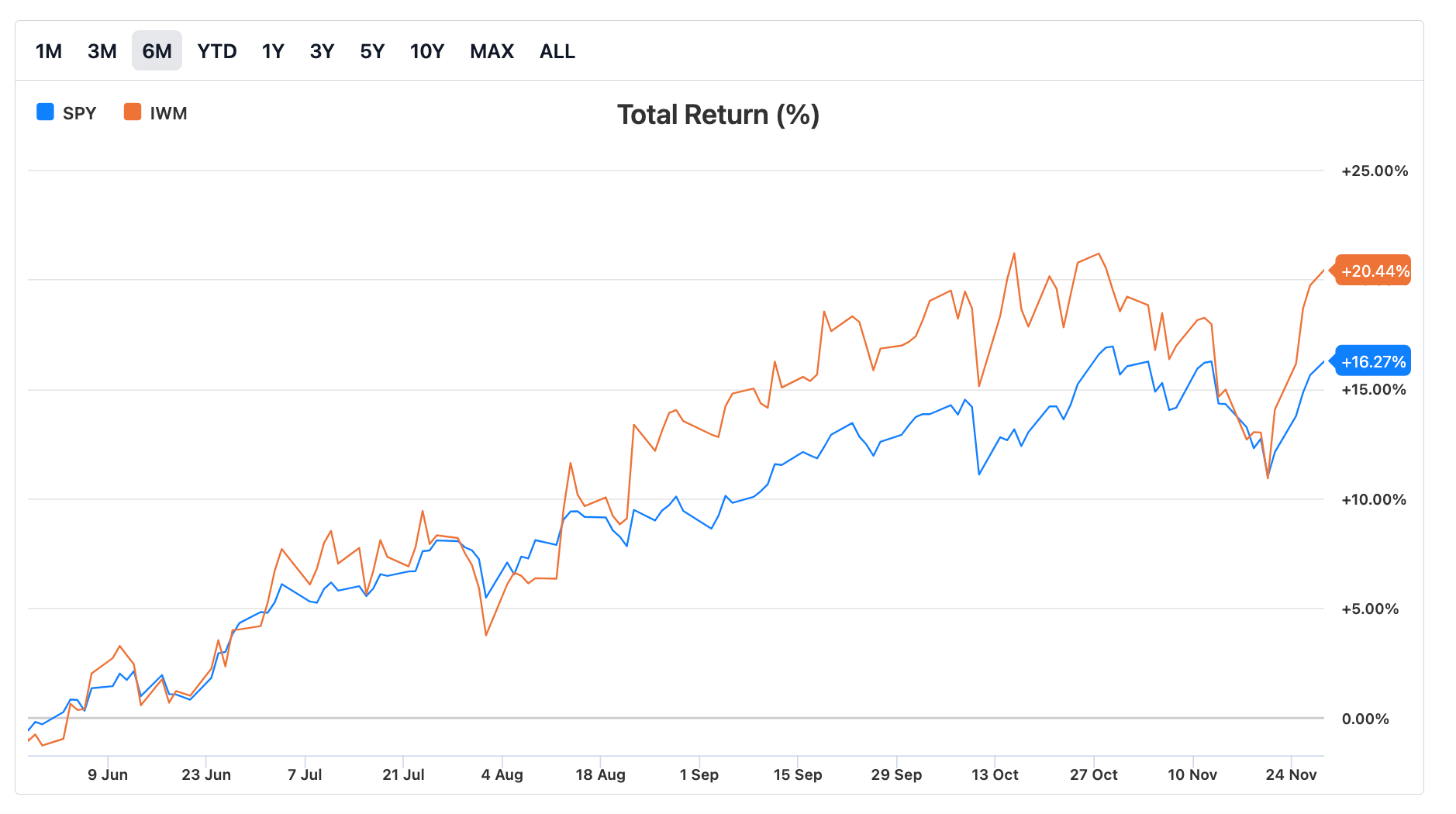

Below is a chart comparing the returns of the $SPY ( ▲ 0.72% ) vs. $IWM ( ▲ 0.0% ) over the last 6 months. Notice the steep trajectory of the Russell 2000 in November compared to the SPY’s steadier increase, especially in November.

Why the “Magnificent 7” distraction is costing you money

The Magnificent 7 tech stocks have stolen the show and captivated investors, but there may be better opportunities for you to build wealth elsewhere.

Over the last 6 months, the Invesco S&P 500 Equal Weight ETF $RSP ( ▲ 0.47% ) has returned 10%, while the Invesco QQQ Trust $QQQ ( ▲ 0.89% ), which leans of the heavy side of tech behemoths but isn’t equally weighted, has returned 19%.

The underperformance in equal-weighted indexes shows how over-reliance on a few mega-caps can leave your portfolio in the dust when broader market dynamics start to shift.

By chasing Mag 7 hype, you are risking missing out on sectors less tied to tech valuations.

When to take profits before the crowd wakes up

History suggests that January could bring even stronger gains for small-cap stocks due to the “January effect”, which is the hypothesis that stock prices tend to rise more in January than in other months, particularly affecting small-cap stocks.

This pattern is often attributed to investors selling losing stocks in December for tax-loss harvesting and then repurchasing them or other stocks in the new year.

Data shows small-caps averaging 3-4% returns in January, versus 1% for large-caps.

This quiet bull run in small-caps is a reminder to look beyond the headlines.

By incorporating these insights into your strategy, you can capture upside while managing risk.

Did you enjoy this newsletter?

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Dividend Domination Inc. is a publisher of financial information, not an investment advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

Any projections, market outlooks or estimates herein are forward-looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.