Welcome to The Profit Zone 👋

Where thousands of millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on the web.

👉 Are Stocks Too Expensive? The Data Says No ⤵

👉 Top 2 Defense Stocks to Watch: Middle East Tensions Are Rising 🪖

👉 Join The Profit Zone Premium: Start Beating The S&P 500 in 2025 💰

“Successful investing is anticipating the anticipations of others.”

Are Stocks Too Expensive? The Data Says No ⤵

At the time of writing this, the S&P 500 is nearing record highs, creating some discussion about its current valuation, which exceeds both 5 and 10 year averages, leading many investors to label stocks as “expensive”.

But as we know, high valuations don’t always predict an immediate market correction, as they can continue to rise based on market sentiment and economic conditions.

Data suggests that inflated P/E ratios can remain for extended periods of time, but is still dependent on corporate earnings and monetary policy.

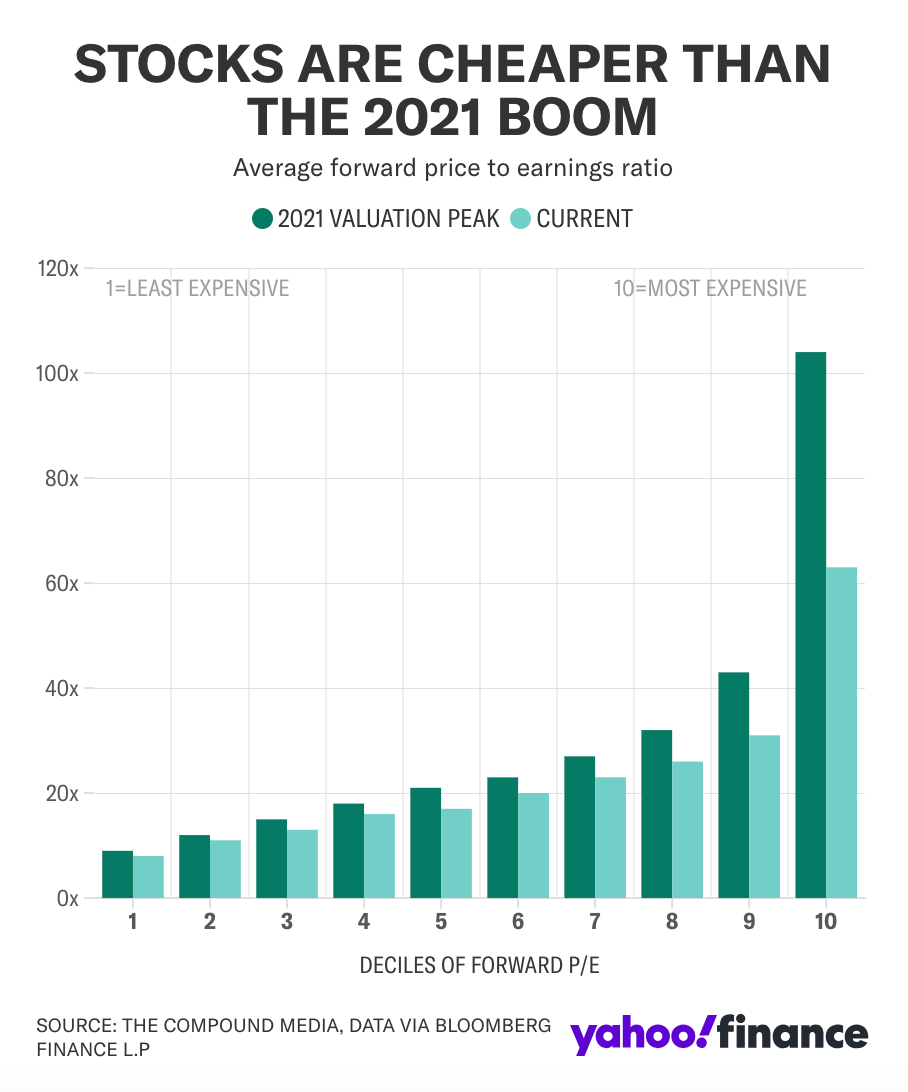

As per the image below, the current market is less “expensive” than the 2021 stock boom.

In fact, the most expensive stocks today trade at an average P/E of 63x, compared to 104x in 2021.

P/E ratios are more of a reflection of investor confidence rather than a market indicator. While high valuations can raise some concerns, they are not a guarantee of downturns.

Tackle your credit card debt by paying 0% interest until nearly 2027

Reduce interest: 0% intro APR helps lower debt costs.

Stay debt-free: Designed for managing debt, not adding.

Top picks: Expert-selected cards for debt reduction.

Top 2 Defense Stocks to Watch as Middle East Tensions Escalate

The defense sector is set for significant future growth driven by geopolitical tensions, rising defense budgets, and technological advancements in AI, cybersecurity, and advanced materials.

Geopolitical Tensions: Conflicts like Russia-Ukraine/Israel-Iran and global power rivalries are boosting defense budgets.

Technological Innovation: Advances in AI for decision-making and battlefield operations, alongside growing cybersecurity needs are driving the industries growth.

Supply Chain Progress: Defense contractors are improving supply chain efficiency, which leads to enhanced profitability.

Government Support: Increased funding, R&D initiatives, and partnerships create a favourable environment for defense companies.

Lets dive into 2 companies that could see growth in the coming months.

Northrop Grumman Corp $NOC ( ▲ 1.03% )

Northrop Grumman is a leading global aerospace and defense technology company. It’s a provider of systems and technologies for aerospace, defense, and space exploration. The company is renowned for developing advanced aircraft like the B-2 stealth bomber, as well as space systems and defense electronics. Northrop investors were blindsided by a $477 million pre-tax charge on the company's B-21 bomber program in the first quarter of 2025, but the charge was mostly due to adjustments that allow Northrop to ramp up production more rapidly.

Pros:

Innovation Focus: Investments in next-generation technologies like the B-21 bomber and space defense position it for future growth.

Global Demand: Strong international interest in missile and missile defense systems due to rising global threats.

Stable Cash Flows: Long-term contracts and a focus on high-margin segments support financial stability.

Cons:

High Development Costs: Significant R&D spending on programs like the B-21 could put pressure on short-term margins.

Geopolitical Dependence: Performance is tied to sustained global tensions, which may not persist if conflicts de-escalate.

First quarter 2025 net earnings totalled $481 million ($3.32 per diluted share) as compared with $944 million, or $6.32 per diluted share, in the first quarter of 2024.

The stock is up 4% YTD (as of June 25th).

Lockheed Martin Corp. $LMT ( ▼ 0.91% )

Lockheed Martin is a leading global defense, security, and intelligence firm, and is a key supplier to NASA and other non-defense government agencies. The company produces missile and targeting systems, mission systems for ships, submarines, and aircraft, and manufactures Black Hawk and Seahawk helicopters.

Pros:

Stable Revenue: Long-term government contracts provide predictable cash flows.

Dividend Reliability: Offers a consistent dividend with a yield of approximately 2.9%, appealing to income-focused investors.

Technological Leadership: Investments in AI, space defense, and cybersecurity align with U.S. modernization priorities and societal demands.

Cons:

Political Risk: Heavy reliance on U.S. government spending makes it vulnerable to budget cuts or policy shifts.

Geopolitical Sensitivity: Potential de-escalation of global conflicts could reduce demand for defense products.

Q1 2025 sales of $18.0 billion, compared to $17.2 billion in the first quarter of 2024. Net earnings in the first quarter of 2025 were $1.7 billion ($7.28 per share) compared to $1.5 billion ($6.39 per share) in Q1 2024.

The stock is down 5% YTD (as of June 25th)

Did you enjoy this newsletter?

Join The Profit Zone Premium Today: Take Your Portfolio To The Next Level

Are you ready to level up as an investor?

A subscription to The Profit Zone Premium gives you exclusive access to proven strategies, real-time insights, and a thriving community to help you achieve your financial goals.

With a track record of success and personalized support, now is the time to join our community of investors all on the same path towards reaching their financial goals.

Why Choose The Profit Zone Premium?

46% YTD Portfolio Returns: Gain exclusive access to our carefully curated 5-stock portfolio, which has delivered an impressive 46% return year-to-date in 2025, outperforming the market by a wide margin.

The Profit Academy Community: Join our vibrant Profit Academy, where I share my real-time buy and sell decisions, along with in-depth stock deep dives, giving you a front-row seat to my investment strategies and watchlists.

Direct Access to Expert Guidance: Ask me any investing or personal finance questions directly and get personalized answers to help you navigate the markets and achieve your financial goals with confidence.

What You Get with Your Subscription

As a Premium member, you’ll receive 2 newsletters per month packed with actionable insights, updates on our 5 stock portfolio and performance as well as access to our Discord Community The Profit Academy.

Every newsletter lands directly in your inbox, ensuring you never miss a beat.

Not feeling it? Cancel anytime with no commitment—just a few clicks, and you’re done.

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Dividend Domination Inc. is a publisher of financial information, not an investment advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

Any projections, market outlooks or estimates herein are forward-looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.