Welcome to The Profit Zone 👋

Where thousands of millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on the web.

👉 YieldMax MSTY: High-Yield Income Opportunity 💵

👉 Risk and Opportunities: What You Should Know 🤔

👉 How I Use High Yielding Funds To My Advantage: The Cycle of Wealth 🔄

“The stock market is the story of cycles and of the human behavior that is responsible for overreactions in both directions.”

Stop Drowning in Market News. Focus On Making Money.

Every day: 847 financial headlines, 2,300 Reddit stock mentions, 156 Twitter trading threads, 12 IPO updates, 94 crypto developments.

Your problem isn't lack of information; you have too much.

While you're scanning headlines wondering what matters, profitable trades slip by. The signal gets buried in noise.

What if someone did the heavy lifting for you?

Stocks & Income reads everything:

Twitter traders

Reddit buzz

IPO announcements

Crypto insider takes

Crowdfunding opportunities

Market news

Then we send you only what can actually move your portfolio.

No fluff. No useless news. Just actionable stock insights in 5 minutes.

We track every source so you don't have to. You get the 3-5 opportunities worth your time, delivered daily.

Stop wasting time on useless “investing news” and start thinking critically about real opportunities in the stock market.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

YieldMax MSTY: High-Yield Income Opportunity

In today’s newsletter, we’re going to be doing a deep dive on a standout offering from YieldMax ETFs:

YieldMax MSTR Option Income Strategy ETF $MSTY ( ▼ 0.1% )

This fund has attracted significant attention for its yielding potential and innovative income-generating strategy.

We’ll be covering its performance, objective, expense ratio and how it’s able to deliver monthly income for its shareholders.

YieldMax MSTR Option Income Strategy ETF (MSTY)

Fund Objectives

MSTY is an actively managed ETF with the goal of generating monthly income while maintaining capped exposure to the share price of MicroStrategy Inc. $MSTR ( ▲ 0.29% ).

The fund does not invest directly in MSTR but rather uses options to achieve its objectives.

It’s secondary focus is to provide capped participation in the gains of MSTR. The reason it’s “capped” is due to the options strategy of the fund, which limits the participation in the upside potential of the stock.

Combining income with growth, this makes MSTY an attractive option for investors who are seeking income without the volatility of directly owning MSTR stock.

Income Generation Strategy

MSTY generates income by selling covered call options on MSTR stock. This strategy produces high yields for investors by harvesting these premiums and distributing them back to shareholders.

In a nutshell, MSTY sells the right for someone else to buy MSTR stock at a specific price (the strike price) in the future. Something to be aware of is that the funds distributions include return of capital, which can erode the net asset value (NAV) over time if MSTR underperforms.

Expense Ratio

MSTY has a gross expense ratio of 0.99%, which is considered competitive for an ETF with such an innovative strategy. Though higher than passive ETFs, the distributions of the fund can outweigh the cost.

This fee covers the costs of managing the options portfolio. Like any actively managed fund, the expense ratio will be higher. It’s important to note that while the expense ratio is modest, it can impact your returns over a long period of time.

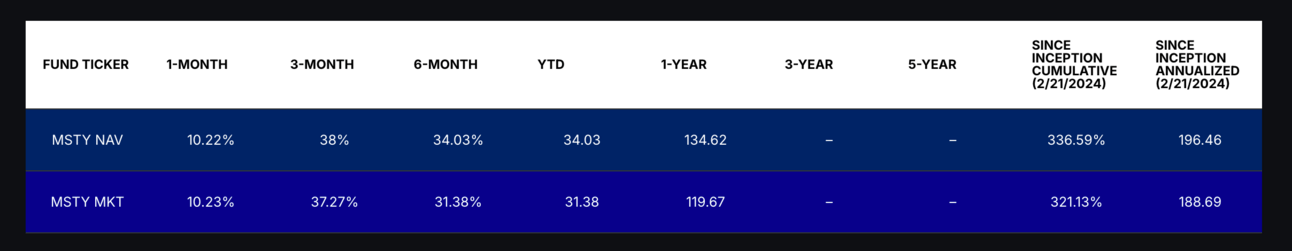

Since inception, the total return of MSTY is 336.59% (196.46% annualized) including all dividends paid.

Monthly Distributions Dating Back to January 17th, 2025

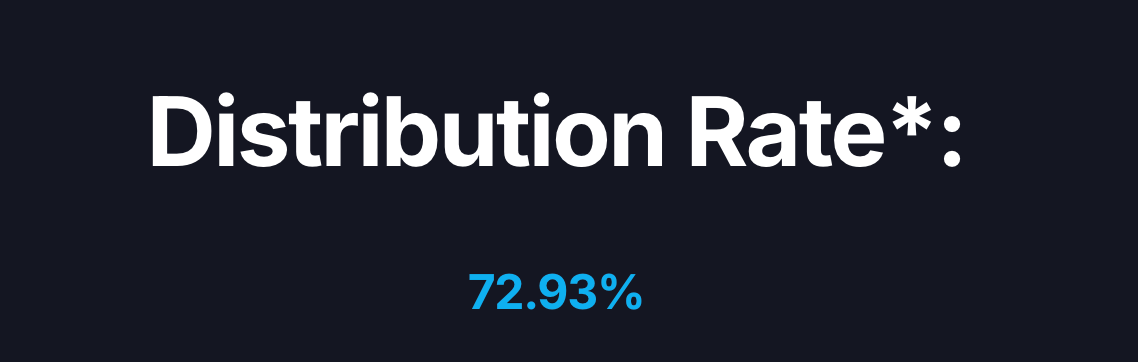

The Current Distribution Rate

The distribution rate is the annual rate that an investor receives using the most recently declared distribution from the ETF, including option income. It is calculated by multiplying the ETFs Distribution per share by 12 and dividing that amount by the ETFs most recent net asset value.

Risks and Considerations

MSTY poses risks due to its single-issuer focus and option based strategy. The fund is not diversified and therefore its performance is heavily ted to MSTR, which can lead to higher volatility than your traditional ETF.

Your upside potential is capped due to the covered call strategy and you’re exposed to downside risk should the underlying stock decline.

Additionally, distributions are not guaranteed, and the inclusion of return of capital can erode NAV over time.

How I’m Currently Using MSTY

MSTY has become a cash flow position for me, to use in other high upside stocks. Yes, the net asset value erosion plays a large part in this position, however the distributions received outpaces the erosion of the share price to date, and therefore I’ve experienced a positive return.

That isn’t to say that this will continue nor am I making a prediction that it will. However the underlying stock MSTR is tied to the price action of Bitcoin, an asset I’m extremely bullish on long term.

My Strategy with MSTY:

I currently own 406 shares at an average price of $23.68.

Every month, I get paid between $400-$600, depending on the price action of MSTR.

That money gets directly deposited into my cash position (in USD) and I then turn around and do 1 of 3 things:

Reinvest the money back into MSTY to then generate more dividend income the following month

Reinvest the money into other higher growth stocks. You’ll get access to the full list of stocks I’m currently buying when you upgrade to premium here.

Take the money out and use it towards living expenses. I’ve only done this one time and it was because I was in a pinch. But I HIGHLY recommend reinvesting the dividend back into the market.

These types of funds are great tools if you already have a solid base of assets that you want to build.

For reference, and based on the last MSTY distribution, if you had $250,000 invested in MSTY, you would have received a juicy $14,000 pay day in July.

Of course this amount will vary month to month, but you can see how this could be powerful for income investors.

See you in the next one!

Did you enjoy this newsletter?

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Dividend Domination Inc. is a publisher of financial information, not an investment advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

Any projections, market outlooks or estimates herein are forward-looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.