Here’s Why Over 4 Million Professionals Read Morning Brew

Business news explained in plain English

Straight facts, zero fluff, & plenty of puns

100% free

Welcome to The Profit Zone 👋

Where thousands of millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on the web.

👉 Wall Street Slashes Stock Market Forecasts Amid Tariff Fears: S&P 500 Forecast for 2025 📉

👉 Want More Exposure on Your Business: The Profit Zone Has You Covered 🫰

👉 Two Safe Bets for Your Long-Term Gains: Meet the Balance Sheet Champs 🏆

👉 Snowball Analytics: Your Gateway to Higher Returns and More Wealth 📈

“Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.”

Wall Street slashes stock market forecasts amid Trump tariff fears

Wall Street banks, including JPMorgan $JPM ( ▼ 0.12% ) and Bank of America $BAC ( ▼ 1.29% ), have significantly lowered their S&P 500 forecasts for 2025, now expecting a modest 2% gain in 2025.

This downgrade is largely due to fears of new tariffs proposed by President Donald Trump, which could disrupt global trade, increase inflation, and pressure corporate earnings.

The Banks cite potential economic challenges, such as higher costs for consumers and reduced growth prospects, as key factors behind the cautious outlook.

This pessimistic outlook reflects a recalibration of expectations as Wall Street tries to understand the uncertainty of policy changes and their ripple effects on the global economy.

2 Safe Bets for Your Long-Term Gains: Meet the Balance Sheet Champs

Welcome to another edition of The Profit Zone, your one-stop shop for building long term wealth.

Today we’re spotlighting 2 companies with bulletproof balance sheets that are built to last.

We’ll unpack their financial strength, calculate their Altman Z-Scores for bankruptcy risk, and compare them to competitors.

Let’s dive in!

Boost Your Brand with The Profit Zone!

Your ad could be here!

The Profit Zone newsletter offers prime marketing placements to showcase your product or service.

Connect with our engaged audience of wealth-builders.

Limited spots available —contact us today to secure yours!

Email: [email protected] or send us a DM on X.

Why Balance Sheets Matter

A strong balance sheet signals a company can handle downturns, fund growth, and reward investors.

In todays issue of The Profit Zone, we prioritize low debt, large cash reserves, and steady profits.

The Altman Z-Score, which blends 5 financial ratios, measures this stability.

A score below 1.8 signals the company is likely headed for bankruptcy, while companies with scores above 3 are not likely to go bankrupt

1. Monolithic Power Systems $MPWR ( ▲ 1.98% )

What They Do:

Monolithic Power Systems designs power-efficient circuits for smartphones, laptops, and data centres. Becoming increasingly vital in a tech-driven world.

Why They’re Strong:

Monolithic has very minimal debt, a rare occurrence in tech.

Their Q4 2024 balance sheet shows $1.565 billion in total current assets, mainly comprised of cash, cash and equivalents and short term investments, versus $471 million in liabilities.

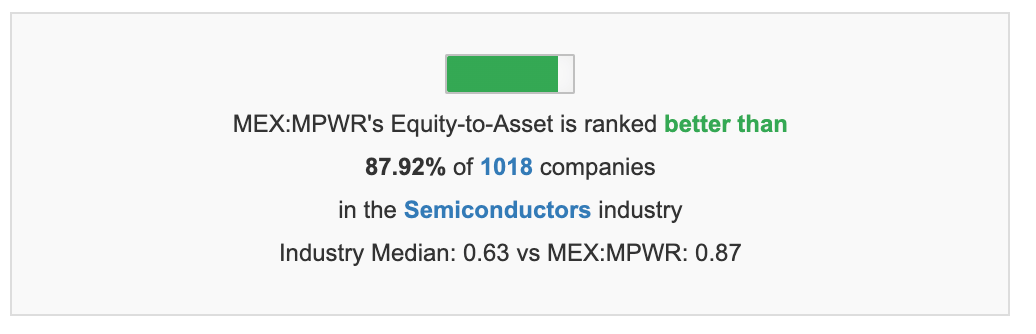

Their equity-to-asset ratio (0.87) tops ~88% of semiconductor peers.

With 22.3% annual revenue growth over 3 years, forecasted to grow at 17.7% over the next 3 years and a 33.97% net profit margin, they’re printing profits.

Altman Z-Score:

During the past 13 years, Monolithic Power Systems's highest Altman Z-Score was 50.04. The lowest was 21.66. And the median was 28.02.

The current Altman Z-Score is 35 which is considered very strong.

Sustainability:

Being practically debt-free, Monolithic has the ability to fund R&D and acquisitions as they wish.

Their energy-efficient chips ride the green tech wave, ensuring demand, and their high margins keep them nimble in markets like these.

Vs. Competitors:

Texas Instruments $TXN ( ▼ 2.96% ) (debt-to-equity: 0.76) and Analog Devices $ADI ( ▲ 0.27% ) (0.19) carry much higher levels of debt, unlike Monolithic’s.

Their Z-Scores, Texas Instruments of 7.77 and Analog Devices of 4.83 lag behind Monolithic’s, showing less flexibility in a cyclical sector.

2. Intuitive Surgical $ISRG ( ▲ 0.39% )

What They Do:

Intuitive Surgical’s da Vinci system powers robotic-assisted surgeries, thriving amid aging populations and healthcare tech growth.

Why They’re Strong:

Intuitive’s Q4 2024 balance sheet shows $11.545 billion in current assets, comprised mainly of $8.832 billion in cash and short term investments, against $2.214 billion in liabilities, with no long-term debt.

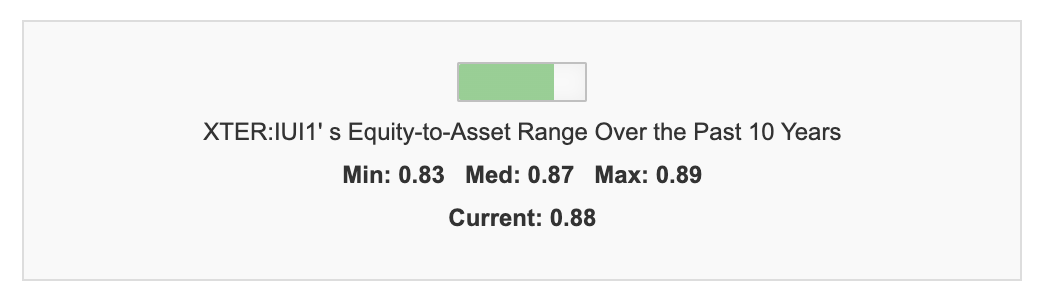

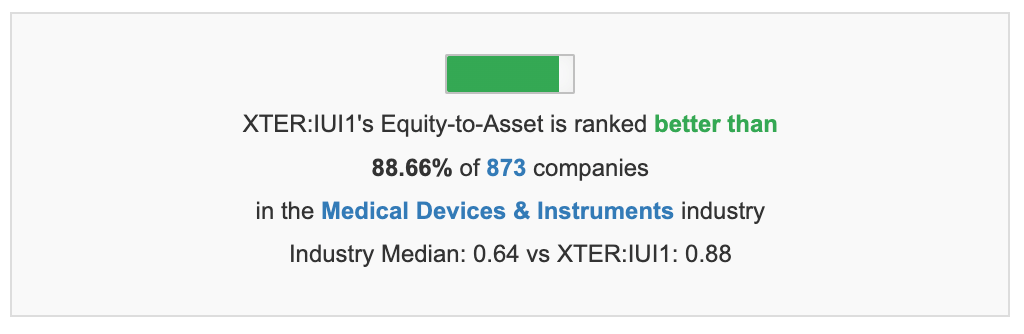

Their equity-to-asset ratio (0.88) beats ~89% of medical device peers.

With 13.5% annual revenue growth over 3 years, forecasted to grow at 14.9% over the next 3 years and a 27.27% net profit margin, they’re also printing money.

Altman Z-Score:

During the past 13 years, Intuitive Surgical's highest Altman Z-Score was 52.22. The lowest was 22.52. And the median was 30.93.

The current Altman Z-Score is 49.7 which is considered very strong, even stronger than that of Monolithic Power Systems.

Sustainability:

Being cash rich and virtually debt free, Intuitive invests in AI and robotics.

Their market-leading system and recurring consumable revenue lock in cash flow, especially for the long term.

The rise in demand for healthcare, especially among baby boomers, keeps them relevant in this market.

Vs. Competitors:

Medtronic $MDT ( ▼ 1.89% ) (debt-to-equity: 0.48) and Stryker $SYK ( ▼ 0.88% ) (0.59) trail Intuitive’s by a long shot.

Their Z-Scores, Medtronic’s of 2.82 and Stryker’s of 5.22 show higher leverage, limiting their agility compared to Intuitive Surgical.

Why They Excel

Monolithic Power and Intuitive Surgical share very low levels of debt, massive amounts of cash, and high recurring profits.

Their Z-Scores scream financial health.

Their competitors’ levels of debt and lower Z-Scores highlight their weaker flexibility in this market.

The tech and healthcare markets ensure long-term growth, with both companies holding a unique edge: chip innovation and surgical dominance.

Closing Thoughts

Smart investing means backing companies that can endure market turbulence.

These 2 companies laugh off recessions with balance sheets built for growth and stability.

For everyday investors, they’re a solid foundation for lasting wealth.

If you want to learn more about how we value stocks, what companies we’re looking at and my buys and sells in real time, join The Profit Zone Premium for less than what you’ll spend on dinner tonight.

Gain access to more than what you get here every Monday morning.

Did you enjoy this newsletter?

Elevate your investing game with Snowball Analytics, the tool designed to empower you with professional-grade insights and real-time control. Here’s why you need it:

Real-Time Portfolio Sync: Link your portfolio and see your buys and sells update instantly, keeping you in the driver’s seat.

Wall Street-Grade Analytics: Access in-depth portfolio insights previously reserved for elite investors, helping you spot trends and optimize returns.

Find the Dip Feature: Get smart alerts when your stocks dip, giving you the edge to buy low and maximize profits.

Ready to transform how you invest?

Sign up today using the link below and use code "dividenddominator" for 10% OFF your plan.

Start building the wealth you deserve:

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Dividend Domination Inc. is a publisher of financial information, not an investment advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

Any projections, market outlooks or estimates herein are forward-looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.