Hands Down Some Of The Best 0% Interest Credit Cards

Pay no interest until nearly 2027 with some of the best hand-picked credit cards this year. They are perfect for anyone looking to pay down their debt, and not add to it!

Click here to see what all of the hype is about.

Welcome to The Profit Zone 👋

Where thousands of millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on the web.

👉 Peter Lynch: 20 Golden Rules of Investing 📈

👉 Tweet of the Week: 6 Rules for Long-Term Investors 💸

👉 Game Changer: This One Tool Changed The Way I Invest My Money 💰

“Thousands of experts study overbought indicators, head-and-shoulder patterns, put-call ratios, the Fed’s policy on money supply…and they can’t predict markets with any useful consistency, any more than the gizzard squeezers could tell the Roman emperors when the Huns would attack.”

Peter Lynch - 20 Golden Rules

Peter Lynch is one of the most successful and well-known investors on the face of the Earth.

He is most famously known as being the former manager of the Magellan Fund at the brokerage Fidelity.

In 1977, Peter Lynch took over the fund at age 33 and ran it for 13 years, where he earned an annualized return of 29.2%, more than twice what the S&P 500 earned during that time.

His success allowed him to retire at the age of 46.

Here is a collection of his most important investing rules, based on his books One Up on Wall Street and Beating the Street.

Peter Lynch's 20 Golden Rules of Investing:

Invest in What You Know

Look for investment opportunities in industries or companies you understand. If you don’t know how the business makes money, you shouldn’t buy it.

Do Your Homework

Research and understand the company's fundamentals, products, and competitive advantages before investing. Never blindly invest in a company because a friend told you it’s a good idea. Make sure you understand the full picture before investing your hard-earned money.

Know Why You Own a Stock

Be clear on your reasons for investing and what you expect to achieve. If you can’t explain to a 10-year-old why you’re investing in a company, you shouldn’t be investing in it.

Avoid Hot Tips

Don't invest based on rumours, tips, or trends that you haven't researched yourself. The majority of investors want to get rich overnight and with that desire comes blindly following “hot tips” that may fit in the box of your investing strategy.

Be Patient

Successful investing takes time. The stock market rewards the patient and consistent investor. Once you learn how to play the game, investing becomes easy.

Focus on Companies, Not Markets

Ignore short-term market fluctuations and concentrate on finding solid businesses. A high quality company will prevail even when market conditions are against them.

Don’t Try to Time the Market

Predicting market movements is nearly impossible. Remember: Time IN the market beats TIMING the market. If someone says they can time the market, they’re lying to you.

Understand the Story

Know the company’s growth story, management, and future prospects. This relates to “investing in what you know”. If you don’t understand how the company makes money, who their customers are and what plan they have to expand the business, then that company shouldn’t be in your portfolio.

Look for "Tenbaggers"

A "tenbagger" is a stock that grows to be worth 10 times its initial purchase price. You only need 2 or 3 of these to build massive amounts of wealth. These are typically smaller cap companies with large runways for growth. Be careful as investing in small cap companies comes with higher risks and price volatility.

Diversify Wisely

Own enough stocks to spread risk but not so many that you can't follow them all. If you’re investing in individual stocks, it’s your responsibility to keep up with market news, earnings and valuations. Diversifying is great, but over-diversification exists too.

I wrote a post on over-diversification, A.K.A “diworsification”. You can read it below:

Buy What You Believe In

Invest in companies whose products or services you use and appreciate. Look around you. What do you use on a daily basis? What could you not live without? Chances are there are millions of others who feel the same way. These are the companies that will keep growing no matter what the markets are doing because demand will always be there.

Look for Growth at a Reasonable Price (GARP)

Invest in companies with solid growth prospects but avoid overpaying for them. I’m sure you’ve heard that the U.S. markets are extremely overvalued right now. It’s important to understand the fundamentals of the company so that you can determine a fair price.

Check the Balance Sheet

Strong financials and low debt are signs of a healthy company. Here’s a great video on how to learn how to read balance sheets.

Beware of Overhyped Stocks

Stocks with excessive media attention or unrealistic expectations often underperform in the long run. By the time you’ve heard of a company, it’s probably too late to invest in it. Don’t chase the hype and stay in your lane.

Keep a Long-Term Perspective

Stocks are for long-term growth, not short-term speculation. Keep your eye on the light at the end of the tunnel. The stock market rewards the long term investor.

Use Common Sense

If something about a company doesn't make sense, stay away from it. Investing isn’t just black and white. Sometimes you have to ask yourself “Does this investment make sense?”.

Or does cutting the tree like this make sense? Surely not…

Learn from Mistakes

Every investor makes mistakes. Use them as learning opportunities to improve. I’ve made countless mistakes that have cost me thousands of dollars. The great part is that I made these mistakes with small money, so they were less expensive. If you can’t manage $1,000, you won’t be able to manage $100,000. Make your mistakes early on and take those lessons with you throughout the rest of your investing journey.

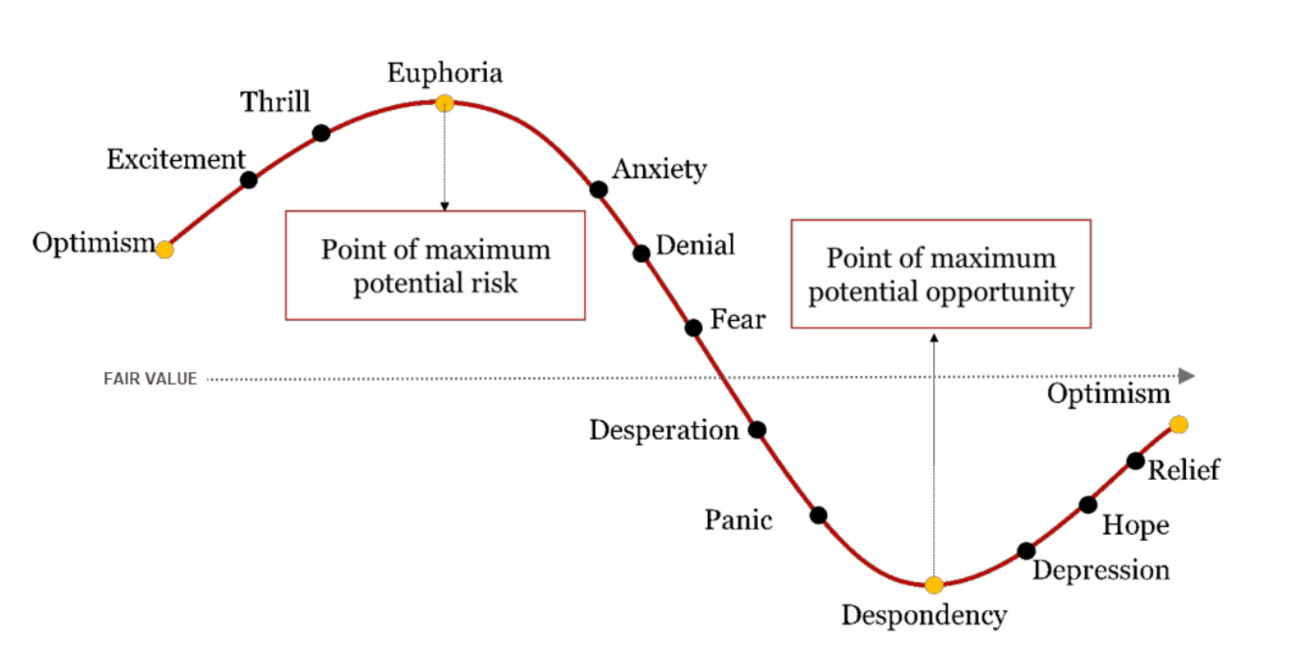

Don’t Panic Sell

Hold through market downturns if the company’s fundamentals remain strong. Too many investors panic and sell the second the market starts pulling back. There’s always a reason to sell, but if the fundamentals remain and you still believe in the long term growth of the company, don’t sell.

Avoid Over-diversification

Owning too many stocks can dilute returns and make it harder to track performance. You can read more about this here.

Stay Within Your Circle of Competence

Stick to industries or businesses you understand well. When it comes to investing, venturing off into the unknown is often a bad strategy.

Did you enjoy this newsletter?

This Tool Changed The Way I Invest My Money

Gone are the days of using Excel to track your portfolio.

Look how ugly this is…

Information overload. And it’s giving me a headache the more I look at it.

This used to be me…

I was tracking all of my dividend income and holdings on an Excel spreadsheet and it was a nightmare.

Then I found Snowball Analytics the #1 portfolio tracker on the market.

Snowball Analytics lays out all of your holdings, allocations, dividend income and more in easy to read graphs that don’t hurt your eyes.

They even have a built-in Artificial Intelligence tool that will tell you if a dividend is reliable or not based on a score of 1-100 by scraping the company fundamentals.

Not only that, but the stock screener is one of the best tools I’ve found.

Sort by:

Dividend growth streak

Dividend growth rate

Revenue growth

Free cash flow growth

Dividend yield

And more

Snowball Analytics gives you hedge fund level analytics at the tip of your fingers.

Create an account here and use code “dividenddomination” for 10% OFF your plan.

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Dividend Domination Inc. is a publisher of financial information, not an investment advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

Any projections, market outlooks or estimates herein are forward-looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.