Welcome to The Profit Zone 👋

Where 12,700+ millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on the web.

Happy Monday!

Let’s start the week off strong.

The agenda for today:

👉 A letter to my younger self

👉 5 things I wish I knew when I started investing

👉 Cathie Woods sees a problem in the stock market

👉 The question of the day: A, B or C? Keep reading to find out

“The important question for the investor is not whether conditions are good or bad (if, in fact, they can be measured on such a scale), but whether they are changing for the better or for the worse relative to expectations”

Get value stock insights free.

PayPal, Disney, and Nike recently dropped 50-80%.

Are they undervalued?

Can they recover?

Read Value Investor Daily to find out.

We read hundreds of value stock ideas daily and send you the best.

5 Things I Wish I Knew When I First Started Dividend Investing

I’ve been dividend investing since I was 18 years old and have been able to grow my passive income to ~$10.15/day (~$15/day including my Money Market Fund).

This didn’t happen by mistake.

It took years of consistency and sacrifice to get to this point.

With that being said, I’m not satisfied with where I’m at and will be continuing to increase my contributions to get to my goals faster.

But enough about me.

Part of the reason why I started this newsletter was as a way to give back to my audience.

It’s like a letter to my younger self. What I wish I had when I first started investing.

Because like many investors, my first few years of investing were filled with trial and error.

Making mistakes left, right and centre and losing money in the process.

My goal is to share those with you so that (hopefully) you don’t make the same ones I did.

In today’s newsletter, we’re covering 5 things I wish I knew when I first started dividend investing.

1) Look For Sustainability

The most successful investors find a way to preserve the money they have.

It’s not about how much you make, but how much you can keep.

Why?

Because the more money you have invested, the more you will make. Which is why the accumulation phase is so vital to your success as an investor.

We truly never get out of the accumulation phase as long term investors, always striving for more shares of our favourite stocks, however setting up that foundation early on, especially with stocks that can sustain their dividends long term is the key to unleashing the compound effect.

How do you find stocks that can sustain their dividend?

Look for a strong payout ratio in the 35-55% range.

Look for significant and growing free cash flow.

Look for healthy profit margins.

Look for a history of dividend payments.

Look for a healthy current ratio (1 and above).

Look for a wide moat.

I wrote a detailed guide on how to analyze dividend stocks from start to finish and what I look for. You can get a copy here.

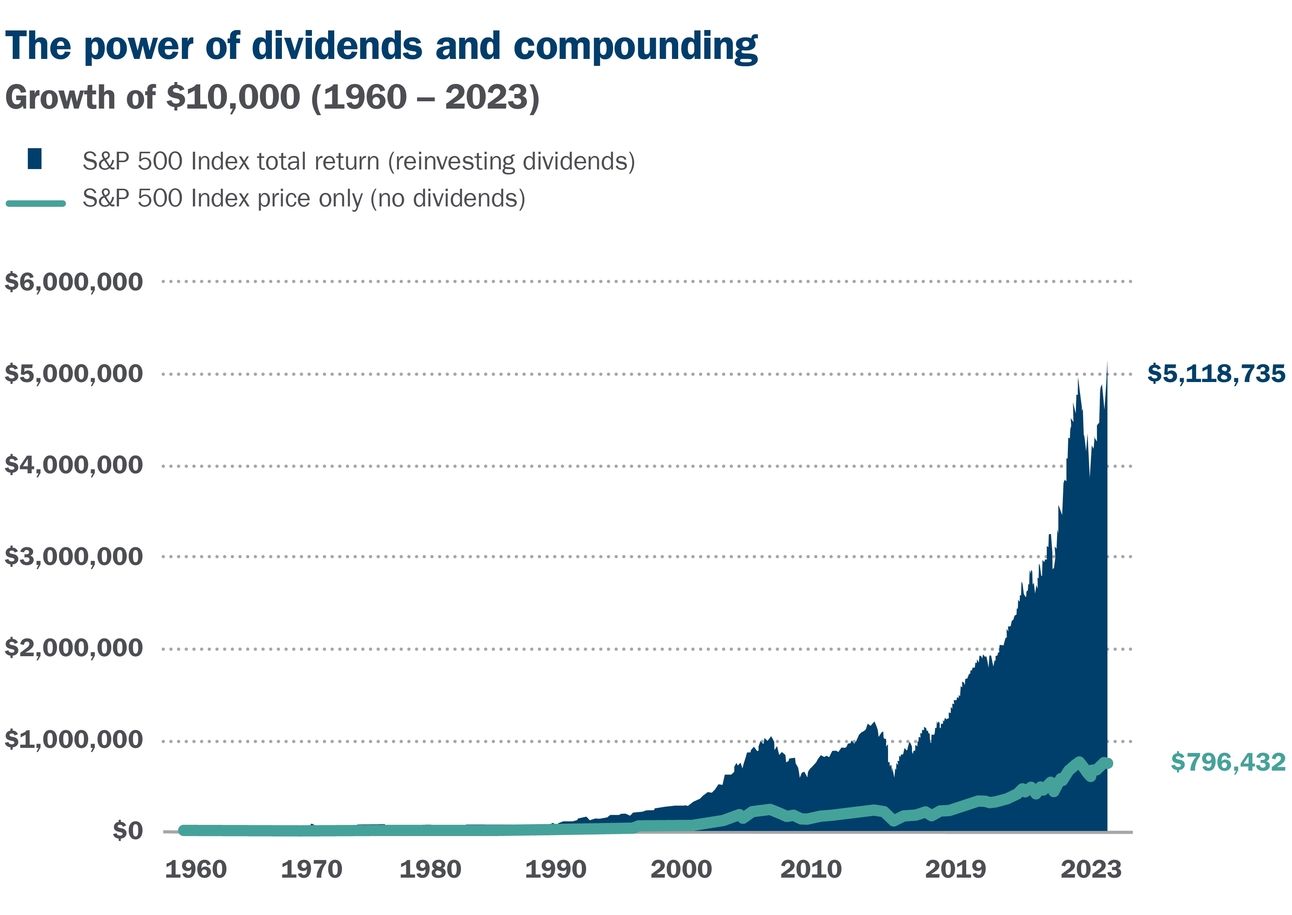

2) Reinvest EVERYTHING

Earning a dividend is great, but if you spend the money that you’re earning you’re defeating the purpose of dividend investing.

Yes, the goal is to one day live off your dividend income. But how do you expect to get there if the money you’re making isn’t making you money.

If you choose to pull out the dividend, you’re foregoing the compound effect.

The more you reinvest, the more exponential growth you will see.

3) Don’t Chase High Yielding Junk

Buying the highest yielding stocks can be tempting, but it’s not a great strategy (unless you’re an income investor).

I’ve battled with this myself. Seeing a stock with a dividend yield of 10%+ is attractive because it’s natural to want the biggest bang for your buck.

It seems like easy money. Just buy the stock and earn more than the average and outpace inflation at a higher rate.

But in the long run, this could prove to be costly. As high yielding stocks are often susceptible to dividend cuts and eliminations.

The problem becomes that the company is paying out too much of their earnings in the form of a dividend and neglecting a large part of what investors want to see: growth of the business.

A healthy balance needs to be found between earning passive income and allowing for internal reinvestment to fuel growth.

4) Growth Should Be Your Main Focus

Dividends are great, but dividend growth is better.

A dividend hike is like getting a raise for doing no extra work.

You sit back, buy shares, get paid more, get to reinvest more and earn more as a result.

It’s the raise you didn’t get from your boss, but got from your assets.

Doing basic fundamental analysis will tell you if the company has room to grow its dividend.

Use the criteria mentioned in point #1 as a baseline.

5) Stay In It For The Long Haul

If your goal is to build your wealth with dividend investing, you must have a long time horizon. No if, and’s or but’s.

The point of dividend investing isn’t to get rich overnight, it’s to get rich for sure.

When I first started implementing this strategy, I was frustrated because it’s slow. But once you see the compound effect start to take action, you realize that patience is the key to building a stream of income that will one day replace your salary.

The strategy forces you to become a long term investor and hold onto your shares.

Which are great habits when it comes to building wealth.

Remember:

The quickest way to go broke is to try and get rich fast.

See you in the next one!

Headlines Making Noise: Keeping You Informed and Empowered 📝💡

Miss last weeks FREE newsletter? Read it below:

Miss last weeks PAID newsletter? Read it below:

Sponsor The Profit Zone

Want to get more eyes on your products?

Advertise to 12,700+ investors hungry for financial content.

Click below to book with us.

Did you enjoy this newsletter?

My Website - a one-stop shop for all things dividend investing.

Financial Domination - learn how to set up an effective budget, figure out your investor profile, use stock screeners and rebalance your portfolio without paying someone to do it for you.

The Complete Investors Accelerator Pack - everything you need to build a dividend portfolio that grows on itself. Learn more about dividend investing, how to analyze dividend stocks, what to do with your dividends and how to build a stream of passive income through the stock market.

Beehiiv - sign up for Beehiiv and start your own newsletter today.

TweetHunter - let the software do the tweeting for you. The only scheduler you’ll ever need. This tool makes me money in my sleep. Give it a try for free.