Welcome to The Profit Zone 👋

Where 12,700+ millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on the web.

We’re teaching you what schools forgot in 5 minutes or less.

Happy Monday!

Let’s start the week off strong.

The agenda for today:

👉 JP Morgan shares fall on dissapointing 2024 guidance

👉 Average and Median retirement savings: how do you stack up?

👉 How to figure out how much you need in retirement

“Superior investors make more money in good times than they give back in bad times.”

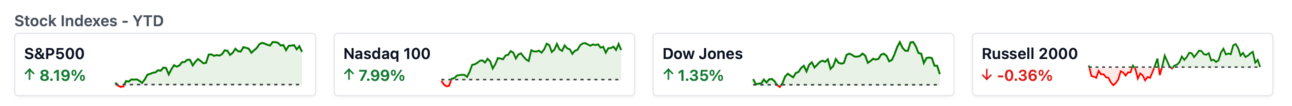

Markets YTD

Headlines Making Noise: Keeping You Informed and Empowered 📝💡

How Much Money Do You Need for Retirement?

With the cost of living rising every single year, lets talk about the big question every one has been asking…

How much do you really need in retirement?

Before we can tackle that question, let’s have a look at the average and median retirement savings based on a 2022 survey done by the Federal Reserve.

How do you stack up?

As of 2022, the median retirement savings is only $87,000…

Does that scare you?

It should.

Let’s break it down by age now.

This is even scarier…

During peak retirement ages (55-65) the median retirement account value sits around $180,000 - $200,000.

This is a total sum of all retirement accounts held by an individual.

Do you think this is enough to live on?

I surely don't.

Here are some factors that will determine how much you should aim to retire with:

When you plan to retire

The amount of time you have to compound your money will have a large impact on how much you end up with in retirement.

The longer you can postpone retirement, the lower your savings (per year) can be.

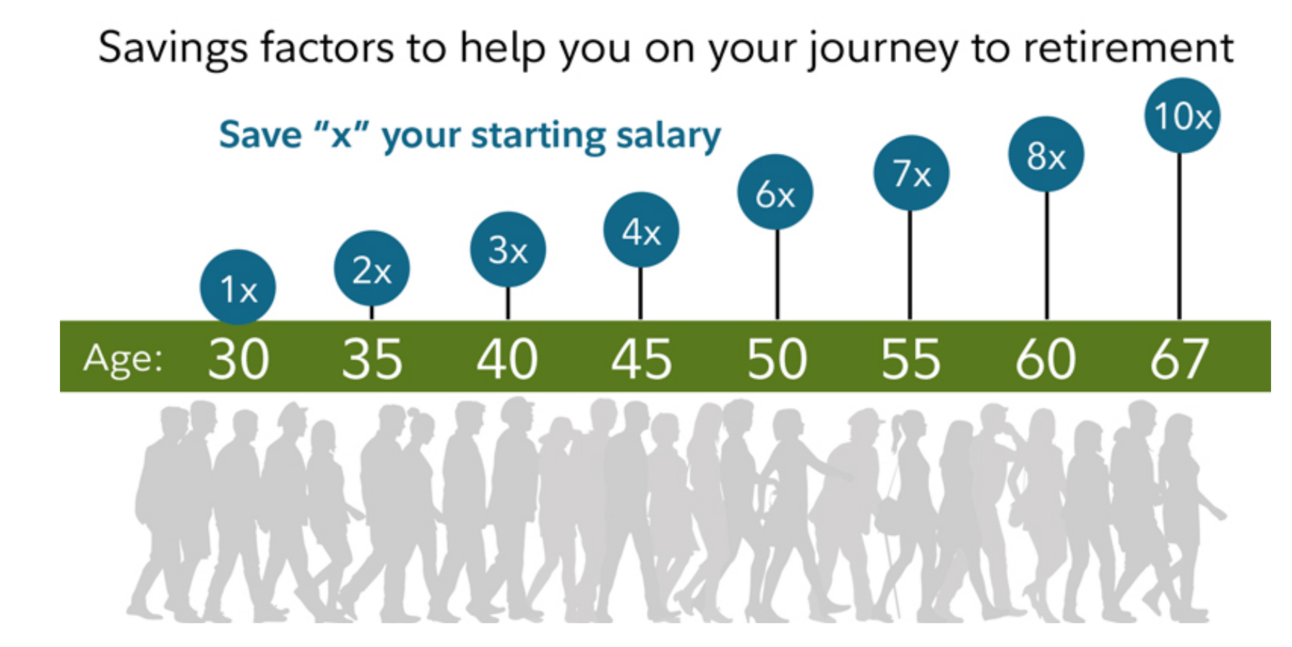

A study done by Fidelity found that you should aim to hit certain milestones of “retirement savings” by specific ages.

By age 30, you should have 1x your starting salary saved for retirement.

By age 35, you should have 2x your starting salary saved for retirement.

By age 40, you should have 3x your starting salary saved for retirement.

And so on.

How do you stack up?

How do you want to live in retirement?

The lifestyle you want to live in retirement will play a large role in how much you need.

In other words, do you expect your living expenses to fall in retirement, or rise?

Will you have more dependents? Or less?

If you expect your living expenses to fall drastically in retirement, you may only need to save 9x of your starting salary to live comfortably.

However, if you want to spend your retirement travelling and seeing new parts of the world, you may find that you need to save 12x of your starting salary to make that happen.

The 4% Rule

The 4% rule is a popular rule of thumb for retirement which suggests that retirees can safely withdraw up to 4% of their savings during the year they retire then adjust for inflation every year thereafter.

This is a great rule of thumb because of its simplicity, however there are some downsides that can have an impact on how much you can actually withdraw.

Here are a few factors that can impact the 4% rule:

Medical Expenses: As we get older, many of us will encounter larger and more frequent medical expenses that are impossible to predict.

Life expectancy: This goes without saying, but the longer you live, the more money you’ll need to have in retirement. Of course, nobody can predict exactly how long they’ll live but the average life expectancy in the US right now is 73.5 years for males and 79.3 years for females. Predict yours accordingly.

Market fluctuations: The economy will fluctuate and so will your investments. In a booming economy, withdrawing 4% may be just fine, however when the market starts to fall, that number may decrease depending on the value of your portfolio.

Personal tax rate: This will be determined by where you live, your annual income and what types of investment accounts you have, as well as any taxable deductions you can make.

The Bottom Line:

While the 4% rule is a good benchmark to use, it’s not one size fits all and can vary depending on your circumstances.

Let’s look at an example based on my own statistics:

This scenario assumes the following:

I plan to retire at 50 years old

I plan to live until 80 years old

My current pre-tax income is $85,000/year

My income increases at a rate of 5%/year

I need $70,000/year in retirement to live comfortably

My investments grow at an average rate of 10%/year

Inflation is 3%/year

I earn $15,000/year in other income (dividend income, rental income, pension etc.) which is a conservative number right now

I plan to contribute $12,000/year ($1,000/month) to my investment accounts

After inputting all of this data, the retirement calculator states that I will need $1.37M to retire by age 50.

To some, this seems like a lot. To others, it will seem like it’s not nearly enough.

Luckily, if I continue investing at the rate I am today, I will end up with ~$2.3 million at the age of 50.

Using the 4% rule, I can safely withdraw $92,000/year which is enough to live on just from my investments and not including my pension, social security, dividends, rental income and other various forms of income I’ll have by that age.

Retirement is not an age, but a dollar amount.

If I were to contribute more to my investments every year, that 50 year old retirement milestone may become 45 years old.

Everyone’s circumstances are different. And its not one size fits all.

Work backwards to figure out how much you need in retirement and set monthly goals to keep you on track.

If you want to check out the retirement calculator I used to make these predictions, click here.

See you in the next one!

Miss last weeks newsletters? Read them below:

The Free Newsletter:

The Premium Newsletter:

Sponsor The Profit Zone

Want to get more eyes on your products?

Advertise to 12,700+ investors hungry for financial content.

Click below to book with us.

Upgrade to Premium

Premium subscribers get access to content free subscribers don’t get to see.

This includes:

Stock deep dives

My watchlists

What I’m buying and why

My portfolio breakdown

And more.

Consider joining us for less than you’ll spend on lunch today.

Did you enjoy this newsletter?

My Website - a one-stop shop for all things dividend investing.

Financial Domination - learn how to set up an effective budget, figure out your investor profile, use stock screeners and rebalance your portfolio without paying someone to do it for you.

The Complete Investors Accelerator Pack - everything you need to build a dividend portfolio that grows on itself. Learn more about dividend investing, how to analyze dividend stocks, what to do with your dividends and how to build a stream of passive income through the stock market.

Beehiiv - sign up for Beehiiv and start your own newsletter today.

TweetHunter - let the software do the tweeting for you. The only scheduler you’ll ever need. This tool makes me money in my sleep. Give it a try for free.