You missed Amazon. You don't have to again.

Amazon, once a small online bookstore, grew into a global behemoth, transforming industries along the way. Now, imagine yourself at the forefront of the next revolution: AI. In The Motley Fool's latest report, uncover the parallels between Amazon's early trajectory and the current AI revolution. Experts predict one of these AI companies could surpass Amazon's success with market caps nine times larger. Yep, you read that right. Don't let history repeat itself without you. Sign up for Motley Fool Stock Advisor to access the exclusive report.

Welcome to The Profit Zone 👋

Where thousands of millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on the web.

👉 The Joe Biden Era Is Over: Here’s How Stocks Performed Over His Term 📈

👉 How To Figure Out What You Should Be Paying For Your Stock: Price Is What You Pay, Value Is What You Get 🤑

👉 Video Summary: A High Quality Video On How To Determine Intrinsic Value 💰

👉 Bonus Resources: Start Your Own Newsletter Today ✍

“Budgeting is telling your money where to go instead of wondering where it went.”

The Joe Biden Era is Over - Here’s How Stocks Performed Over His Term

U.S Stocks are closing out Joe Biden’s era on a high note as the president says his final goodbyes to the Whitehouse.

Biden is ringing in his time at the White House with the S&P 500 up over 55% since he took office on January 20th, 2021.

The Dow Jones Industrial Average rose by more than 39% over the same period and the Nasdaq Composite jumped nearly 46%, with the Russell 2000 falling very far behind advancing just over 5%.

It’s interesting to look at how these indexes performed during different presidential terms.

The Dow and the Nasdaq saw their worst returns since George W. Bush’s second term between 2005 and 2009, while the S&P 500 logged its smallest increase since Barack Obama’s second term between 2013 and 2017.

Biden’s term began in 2021, almost at the peak of the COVID-19 pandemic and the economy experiencing hardship.

Major stock indexes still posted double-digit returns by the end of that year, as the economy slowly began its recovery from 2020.

But in 2022, Wall Street suffered its worst year since the 2008-09 financial crisis, during Russia’s invasion of Ukraine, while the U.S. combated soaring inflation and even higher interest rates.

Then in 2023 and 2024, tech fuelled growth to historic levels, with artificial intelligence leading the way.

The S&P 500 saw double digit gains by the end of 2024 and is now kicking off it’s 3rd year in a bull market.

David Russell, the global head of market strategy at TradeStation, said there was an “explosive surge” in certain sectors of the market that benefitted from the world reopening after the pandemic.

Also, Biden’s landmark Inflation Reduction Act in 2022 helped fuel industrial activities that ultimately lead to higher interest rates and the bear market of 2022.

He also commented on AI, citing that this was a “completely different” tailwind for the market, because it had nothing to do with Biden or his administration. The boom of AI had been something that was cooking up for years before establishing its presence in the market in the early part of 2023.

The market has high hopes for stocks during President Trumps upcoming term.

Investors have been betting that the former President’s return to the White House could further strengthen the economy by providing tax relief, cutting financial regulations and hiking tariffs.

Only time will tell, but I think we’re in for a wild ride over the next 4 years.

How To Figure Out What You Should Be Paying For Your Stocks

The stock market is an interesting place.

Everyone knows the price, but very few know to calculate the instrinsic value of a company.

That’s what made Warren Buffett so good at investing.

He knew the price, but his ability to determine the value is what allowed him to compound his money for so many years ultimately making him one of the greatest investors to have ever lived.

Everything has a price tag on it.

When someone asks you “how much did that cost?” we can answer them quickly, because we know how much we paid.

But if someone were to ask you “what is that worth?”, it’s not so much of an easy question anymore.

Enter the stock market…

The stock market lets you know what other investors are willing to pay (right now) for a stock.

If I buy stock ABC for $10 and next month it’s trading at $15, the market is willing to pay $15.

Since every investor is faced with the challenge of trying to figure out if the stock is overpriced, underpriced, or priced at fair value, it’s imperative that you know how to find the intrinsic value so you can make better and more informed investment decisions.

It’s logical to assume that most long-term investors are indirectly value investors.

And if you disagree with that statement, you should probably reevaluate your investing strategy.

Your goal is to find companies that are trading below what they’re worth so the value of your investment can increase over time as the true value gets priced in.

That’s fundamental analysis at a very base level.

And it’s a skill every investor should learn.

What is Intrinsic Value?

Intrinsic value is a measure of what an asset is worth, not what you paid.

For example, if you bought a house for $500,000 but 3 other similar houses recently sold for $600,000 after you purchased yours, then it’s now worth $600,000.

Using market comparables, we can get a good a better idea of what we paid vs. what we got.

But how does this work in the stock market?

Because no 2 stocks are the same, it’s hard to use market comparables to estimate the value.

When it comes to the stock market, intrinsic value is based on an asset’s financial performance, compared to similar assets in its category.

The calculation you’re about to see below has a lot more truth and substance to it and is much more reliable than your friend Justin telling you “trust me bro, this stock is going to the moon”.

We’ve all heard that one before…

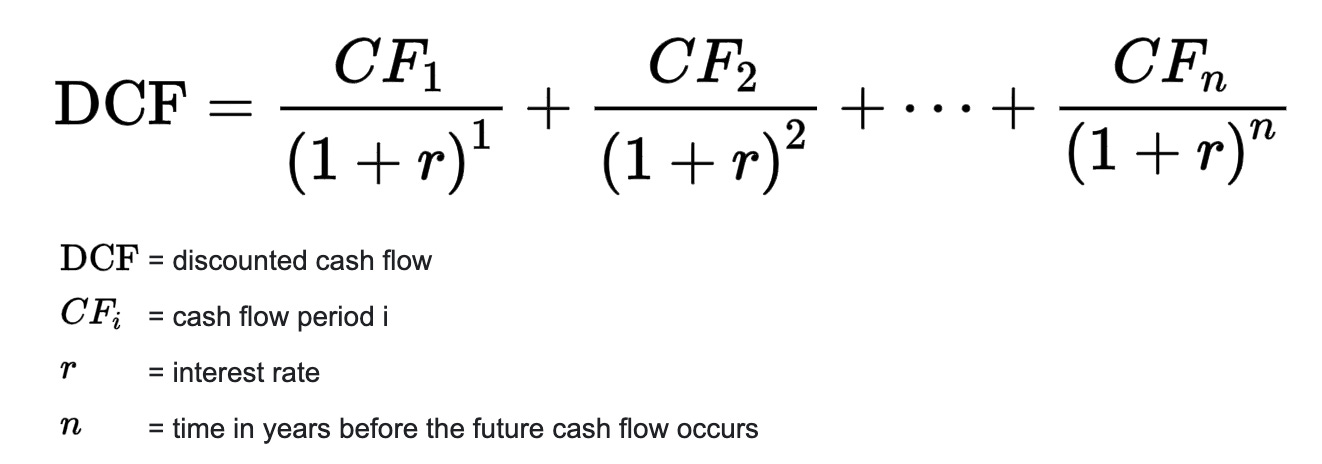

The main metric used for analyzing a company’s financial performance is called the Discounted Cash Flow (DCF). You’ll see me referencing this acronym (DCF) many times down below, so make sure you’re familiar with it.

DCF is a valuation method used to determine the intrinsic value of an asset based on its return of future cash flows.

Wall Street uses this. Financial advisors use this. And you should be using this as well.

Lets dive into it.

How to Calculate The Intrinsic Value of a Stock

To use the DCF model, you need 3 things:

Projected/estimated future cash flows of the company

Discount rate

Terminal value

I’ll explain each of the 3.

Here’s the formula for reference. I’d suggest writing this down somewhere.

If you’re scared of a little bit of math, then you can go back to listening to your friend Justin about stock picks.

If you’re not scared of a little bit of math, you’ll be miles ahead of 99% of investors.

#1 - Projected/estimated future cash flows of the company (DCF)

The best way to estimate future cash flows is to take the cash flows from the past 12 months and assume a certain growth rate to project those cash flows into the future.

As you know, past performance is no guarantee of future returns, but when we’re doing calculations like these, we have to rely on how the stock has performed recently to project the future.

There are 2 kinds of cash flows you can use when doing DCF.

Free cash flow to firm (FCFF)

Free cash flow to equity (FCFE).

FCFF is the cash flow that is generated by the entire business, FCFE is the cash flow allocated to shareholders only.

For the sake of simplicity and my personal preference, we will be using FCFF to get a broader idea of the company’s cash flows.

You can find this number through a quick google search.

Here is Apple’s FCFF since 2019, including their Cash Generated By Operating Activities.

In September 2024, Apple generated $108.807 billion in FCFF.

#2 - Discount rate (r)

The discount rate is the interest rate used in DCF to determine the present value of future cash flows.

Future cash flows are impacted heavily by the discount rate.

The higher the “r” is in the equation, the lower the present value of future cash flows (and vice versa).

According to Warren Buffet, an appropriate discount rate to use is the risk-free rate or the yield on the 10-year or 30-year Treasury bond.

As of January 17th, the 10-Year Treasury Bond Yield is 4.61%.

This is our discount rate “r”.

#3 - Terminal value (CFn)

It’s important to pick a time horizon for how far in the future you’re going to be projecting the cash flow of a company.

DCF models average around 5-10 years but remember, the further you project the more difficult and inaccurate projections become.

The terminal value is just a multiple of the cash flows in the final year. If you want to get more in-depth and calculate it yourself, here is the formula.

[FCF x (1 + g)] / (d – g)

Where:

FCF = free cash flow for the last forecast period

g = terminal growth rate (the constant rate at which the company is expected to grow year over year)

d = discount rate (or “r” from above”)

Using the above calculations, you can get a better idea of what Apple should be trading at today Vs. it’s stock price.

If you only plan on holding the stock for 5 years, run the model on a 5 year projection.

If you plan on holding for 10 years, do the same thing.

The world is your oyster, my friend.

If absolutely none of that made sense to you…

Below is a quick 10-minute video that will explain how to find the intrinsic value of a company using nothing but Excel and Yahoo Finance.

The method is slightly different but the principles remain the same.

This is one of the best and simplest videos I’ve found on determining intrinsic value.

Give it a watch here. It’s worth your time.

Did you enjoy this newsletter?

BEEHIIV - The #1 Email Provider On The Market 🐝

Are you ready to elevate your newsletter?

Or maybe you haven’t started one and want to build an email list that turns into a cash-flowing asset.

Newsletters are vital for online businesses going into 2025.

And if you don’t have one, you’re going to get left behind.

Beehiiv offers a suite of tools to help you create, grow, and monetize your content seamlessly.

Why beehiiv?

Intuitive Design Tools: Create stunning newsletters without any coding skills.

Integrated Website Builder: Launch a professional website alongside your newsletter.

Growth Mechanisms: Utilize referral programs and recommendation networks to expand your reach.

Monetization Avenues: Access an ad network and offer paid subscriptions to generate income.

Comprehensive Analytics: Gain valuable insights into your audience with advanced analytics.

Bonus 🚨

If you sign up using the link below and create a Beehiiv account, send me a DM on X or email ([email protected]) with the email you used to sign up and I will give you the following 100% FREE:

🔎 Help with creating a launch strategy

📈 Tips and tricks for growing your subscriber list

💰️ Ways to monetize your newsletter so you can start turning it into a cash-generating asset

All of the above comes at no additional cost to you when you use the link here to create a Beehiiv account.

I look forward to helping you start and build your newsletter.

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Dividend Domination Inc. is a publisher of financial information, not an investment advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

Any projections, market outlooks or estimates herein are forward-looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.