Top Card Offering 0% Interest until Nearly 2026

This credit card gives more cash back than any other card in the category & will match all the cash back you earned at the end of your first year.

Welcome to The Profit Zone 👋

Where thousands of millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on the web.

👉 Wall Street: They Aren’t Worried About A Market Crash, And Neither Should You 🚫

👉 Tax Loss Harvesting: Using Your Losses To Decrease Your Taxes (Legally) 🔻

👉 5 Day Email Series: Learn How To Analyze Dividend Stocks Like A Pro (Free) 💰

“Waiting helps you as an investor and a lot of people just can’t stand to wait. If you didn’t get the deferred gratification gene, you’ve got to work very hard to overcome that.”

Wall Street isn’t worried about a stock market crash and you shouldn’t be either

The market has been rising at an astronomical rate recently, but Wall Street isn’t worried about it all coming crashing down.

Why?

Because of the SKEW index of the last 15 years (see below), which measures perceived volatility in the stock market.

The majority of investors have become even more bullish than they were before.

How does it work?

The SKEW index measures the divergence between the consensus expectation of the majority of traders and the view of a “super-bearish” minority. As the spread between these two groups widens, the SKEW index rises meaning there is less worry in the market.

Bull markets and a rising SKEW index have a positive correlation. Over the past 15 years, the correlation coefficient is 56.3% between the S&P 500’s SPX TTM return and the SKEW index.

This is good data for investors and one that puts us somewhat at ease… for now.

Do you hate taxes?

So do I.

Which is why I’m going to show you how to pay less of them. Legally.

Some of the wealthiest people in the world pay the least amount of taxes because of it.

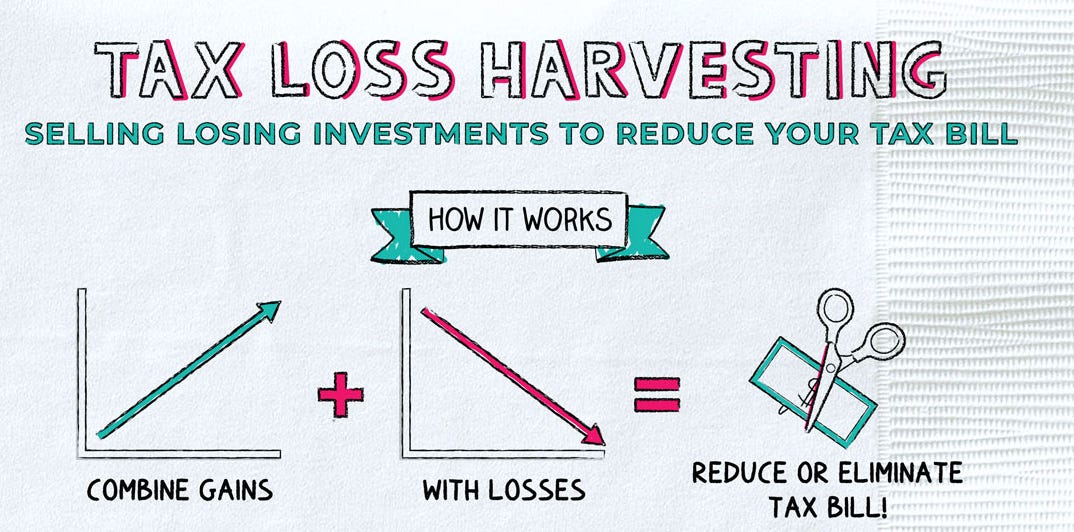

It’s called tax loss harvesting.

“By utilizing tax loss harvesting, you are in essence making lemonade out of lemons”.

Let’s make some lemonade shall we?

What is Tax Loss Harvesting?

Tax-loss harvesting happens when you sell an investment that has dropped below the price you bought it, also known as a “capital loss”.

It’s a strategy often used to limit the taxes an investor would pay on short-term capital gains, which are typically taxed at a higher rate than long-term capital gains.

Bear markets offer great opportunities to use this strategy.

Also, if tax loss harvesting is used properly, you will find yourself keeping more of your money as the market recovers.

There are different tax rules depending on where you live, so I won’t be diving too much into the numbers specifically.

But in any case, this is an important concept to learn because it might just save you a few dollars.

Tax loss harvesting won’t put money in your pocket (although some would argue it does) but it will lessen the impact of your losses.

Note: Tax loss harvesting can only be done in a taxable account.

Example:

Say you bought $5,000 worth of Apple stock in your taxable account.

6 months later the value of your investment has fallen to $4,000.

If you wanted to use tax-loss harvesting in this scenario, you would sell the Apple stock for a total loss of $1,000 ($5,000 - $4,000) buy a DIFFERENT stock, and claim the $1,000 loss against the other stock’s capital gains (in the event it appreciates).

Tax loss harvesting is most effective when you sell out of a position at a loss to enter another similar position that helps maintain your overall investment strategy.

There is something called a “superficial loss” that you need to be aware of as an investor using tax loss harvesting.

This rule states that when claiming a capital loss on the sale of an asset, an investor cannot buy the SAME investment within 30 days of the sale.

There’s also something called a “wash sale” which you also need to be aware of.

A “wash sale” occurs when an investor does not follow the superficial loss rule.

Here’s an example:

Let’s say you own 100 shares of Stock ABC that you paid $10,000 for.

You decide to sell all of your shares on September 1 for $6,000, which means you incurred a total loss of $4,000.

That loss is claimable.

But if you decide you want to repurchase the shares anytime between September 2 (the day after) and October 1 (30 days after) then the sale is considered a “wash sale” and you cannot use the capital losses to offset future capital gains.

This rule also applies to investors who buy the same shares 30 days before the sale. For example, if on August 2 or after that date you bought shares equal to the amount you sold on September 1 ($6,000), then that would also be considered a “wash sale”.

The above rule works on a 1:1 ratio. If you repurchased 20 shares, then it would wash out 20 shares of the taxable loss.

Fun Fact 🚨

Some Robo-Advisors can implement tax loss harvesting for you.

You don’t even need to think or do any calculations.

The Robo-advisor will automatically provide tax loss harvesting to minimize the amount of tax you pay on future capital gains.

Note: not all brokerages offer this feature. Please check with the one you currently use if this is available.

Did you enjoy this newsletter?

Having trouble analyzing dividend stocks?

I’ve got you covered.

I put together a 5-day email series teaching you everything you need to know about analyzing dividend stocks like a Wall Street Analyst.

What ratios you should be looking at

How to figure out if a stock will keep growing its dividend

How to make sure you don’t experience dividend cuts

How to find the needles in the haystack

When you finish this email series, you’ll have all the tools you need to start picking the winners.

Click “Yes please, I’m ready to level up” on the poll below to get the first email sent right to your inbox.

Enjoy!

Gain Access To Our 5 Day Email Series

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Dividend Domination Inc. is a publisher of financial information, not an investment advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

Any projections, market outlooks or estimates herein are forward-looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.