Welcome to The Profit Zone 👋

Where 12,700+ millionaires, CEO’s and high-performing entrepreneurs reading the #1 financial newsletter on the web.

The Sweet and Bitter Truths About Share Buybacks

Imagine having a box full of your favourite chocolates.

You’d want to maximize each piece’s value and make it memorable, wouldn’t you?

So you decide to take some pieces out of the box and eat them.

As you start to eat the chocolates, there are fewer chocolates remaining in the box making each piece more rewarding than the last one as you claw your way through.

Companies do something similar.

But they have shares instead of chocolates.

When a company buys back its own shares, it takes them out of the market.

But why would companies do something like this?

For 2 main reasons:

The 1st reason is to make their shares more valuable for the shareholders who already own them.

Similar to having fewer chocolates in the box, which makes each chocolate more special.

The 2nd reason is to prevent other people from gaining too much control over their company.

Similar to if you and your friend have all of the chocolate, but you don’t want your 3rd friend to have more chocolate than you.

It’s not all sunshine and rainbows when it comes to share buybacks.

Here are the pros and the cons:

The 3 sweetest flavours of share buybacks that will lead to impressive gains and lasting wealth:

Sweetening your experience as a shareholder.

Just like biting into delectable chocolate, share buybacks enhance the experience for shareholders.

When a company buys back its own shares, it reduces the number of outstanding shares available in the market.

This reduction increases the ownership stake of existing shareholders, giving them a larger piece of the cake.

As shareholders own a larger percentage, they will enjoy a greater share of the company's future profits and potential growth.

This is a good thing.

Savouring the sweetness of the company’s value.

Sometimes the market undervalues a company's shares.

In cases like these, companies may choose to engage in share buybacks.

This way, companies show their confidence that the market has underrated the sweetness of their value.

Investors see this as a positive sign, leading to an increase in the share price.

Delighting in improved financial ratios.

Imagine a box of chocolates with beautifully arranged layers.

Similarly, a company's financial ratios reflect its health and attractiveness to investors.

Share buybacks can be like cleaning up and refining those ratios.

When a company repurchases its shares, it reduces the number of shares available in the market.

As a result, the earnings per share (EPS) on the remaining shares increases, jacking up the attractiveness for potential investors.

Improved financial ratios make the company more appealing to investors as they check its value and potential for growth.

But when it comes to share buybacks, and just like a box of chocolates, there are a few that will leave a disgusting taste in your mouth.

You can avoid those unpleasing pieces of chocolate, but you have to know which ones they are.

Get the best stock ideas

Our AI tool scours the internet every day for the best stock ideas that we share with you each morning in our free, daily email.

We find stock ideas from:

Billion-dollar hedge funds

Professional analysts

Millionaire investors

and more…

We’ve already found stock ideas like:

Carvana ($CVNA) - +822% in 4 months

Myomo ($MYO) - +507% in 3 month

ImmunityBio ($IBRX) - +313% in 1 month

and a ton more…

Subscribe to our free, daily email to start getting the best stock ideas sent to your inbox each morning.

The 3 bitter flavours of share buybacks that kill your delightful experience while silently eroding your financial success:

Personal gain over company growth.

The executives delight in the tasty chocolates, leaving you (as a shareholder) with a disappointing taste in your mouth.

Sometimes buybacks focus on the self-interest of executives, benefiting their wealth. This slows (or even kills) long-term growth for the company.

The sourness of inequality leaves you feeling let down, while executives take advantage of your investments.

They’re basically stealing your hard-earned money.

This is not a good thing.

Poor timing, like stale chocolates.

Have you ever bitten into chocolate, only to discover it's stale and has a hardened core?

That’s an awful experience.

Which mirrors the consequences of poorly timed share buybacks.

Just like stale chocolate, a mistimed buyback fails to please your cravings, leaving you unsatisfied with your investment.

Sometimes, companies buy back their stock during market downturns.

Or when their stock becomes overvalued.

By doing so, they harm your shareholder value and miss out on growth opportunities.

It's like biting into that stale chocolate and realizing you should have thrown the box out.

Excessive leverage – the overly sweet chocolate.

Imagine picking up a chocolate that looks enticingly sweet.

But as you take a bite, it overwhelms your taste buds with an excessive amount of sweetness.

Similarly, excessive leveraging from share buybacks negatively impacts the company's financial stability.

It's like indulging in that overly sweet chocolate only to find out that your stomach didn’t agree with it…

Right to the toilet you go.

Sometimes companies are overly focused on buybacks, pushing their leverage to the max. This destroys their ability to invest in future growth, innovation, and much-needed capital expenditures.

Just like the sickening sweetness of that chocolate, too much focus on buybacks can create short-term gratification which will compromise the long-term stability and growth of the company.

While share buybacks can benefit you as an investor by increasing the value of your shares.

Share buybacks also cost opportunity, if funds aren't available for growing the company long-term.

Also, concerns about transparency and manipulation may impact your trust as an investor.

Now, if you want to invest without feeling like you’re gambling…

And without the fear of losing all your hard-earned money…

Where I’m releasing my top stocks to buy every month, showing you the valuation metrics and comparing them against popular benchmarks so you can ensure you're making the right investments.

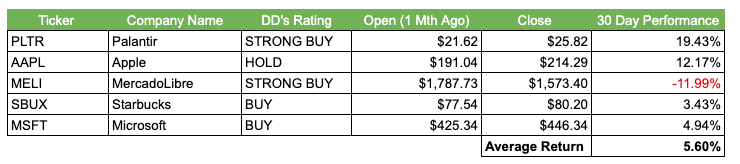

Here are my picks going into July 2024.

In the premium post, I reveal all of their valuation metrics and the reasoning behind why I think these companies will continue to see massive growth.

Or you can keep wasting time and money by playing around with risky investments…

Your friend,

Starting A Newsletter Is One Of The Most Rewarding Things You Can Do

I started my newsletter back in the summer of 2021.

Since then, I’ve been able to accumulate 12,500+ subscribers hungry for financial content.

It gives me another way to share my experience and knowledge with people like YOU.

During my time writing newsletters, I’ve been able to meet some very intelligent people and collaborate with other creators.

If you have a business of your own, this is an opportunity you should be taking advantage of.

Nobody can ever take your email list from you. It’s yours to keep forever.

And as more businesses realize the power of email and connecting with their audiences, you’re going to get left in the dust if you don’t have one of your own.

I’ve used plenty of email providers and Beehiiv is the best. Hands down and second to none.

So here’s my offer to you.

If you sign up to Beehiiv using this link, I will share every secret I have with you about starting and building a newsletter.

Think of it like this…

You’re getting the BEST email provider on the market.

PLUS you’re getting tips and tricks from someone who has been doing it for over 3 years.

I’ve seen almost everything there is to see when it comes to newsletters, and there’s no doubt in my mind that my experience can help you grow something from the ground up.

3 years from now, you could be doing this full-time from wherever you want in the world.

Just imagine the possibilities.

And there’s proof in the pudding.

It’s common for a successful newsletter with a large and engaged subscriber base to be sold for a multiple of 5-10x its annual revenue.

So if you build something that generates $20,000/year (which isn’t hard to do with Beehiiv), you could sell it for $100,000 - $200,000.

Then take that knowledge and do it over again.

If you want to start today and take advantage of this offer, click here.

Once you sign up, send me an email ([email protected]) or a message on X (@TheAlphaThought) and we’ll schedule a time for me to give you all of my deepest darkest newsletter secrets I can’t possibly share with everyone.

Talk soon!

📌 Disclaimer: the link above is an affiliate link. My content is supported by readers like you. If you buy after clicking a link, I get a commission at no extra cost to you. 😊

Did you enjoy this newsletter?

Financial Domination - learn how to set up an effective budget, figure out your investor profile, use stock screeners and rebalance your portfolio without paying someone to do it for you.

The Complete Investors Accelerator Pack - everything you need to build a dividend portfolio that grows on itself. Learn more about dividend investing, how to analyze dividend stocks, what to do with your dividends and how to build a stream of passive income through the stock market.

Beehiiv - sign up for Beehiiv and start your own newsletter today.

TweetHunter - let the software do the tweeting for you. The only scheduler you’ll ever need. This tool makes me money in my sleep. Give it a try for free.