Welcome to The Profit Zone 👋

Where thousands of millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on the web.

Happy Monday!

Let’s start the week off strong.

The agenda for today:

👉 Google: replaces long-time search and ads boss Prabhakar Raghavan

👉 Cash Flow Statement: How to read one like Warren Buffett

👉 Profit Zone Premium: 2024 Stock Picks continue to beat the market (88% win rate). Upgrade to get all of our picks sent right to your inbox.

“Enjoy the magic of compounding returns. Even modest investments made in one’s early 20s are likely to grow to staggering amounts over the course of an investment lifetime.”

Headlines Making Noise: Keeping You Informed and Empowered 📝💡

Googe has decided to replace long-time search and ads boss Prabhakar Raghavan, with executive Nick Fox.

The move was announced last Thursday, October 17th by Alphabet CEO Sundar Pichai, who said that Prabhakar Raghavan will be moving into the role of Chief Technologist after 12 years of leading teams in the search company.

Google continues to restructure its teams to move quicker in the race of Artificial Intelligence, where it faces increased competition.

Fox has been a Google employee since 2003 and has served as VP of product and design as well as the company’s ads business unit.

Disclosure: the author of this newsletter does not hold a position in Google.

How to Read a Cash Flows Statement Like Warren Buffett

Welcome to one of the most useful posts you will ever read. Are you ready?

Here’s the problem with the investing world… People are lazy.

How do I know that?

Because content online telling others exactly what stocks they should buy get much more engagement than posts showing others how to find quality stocks.

As the saying goes “give a man a fish and he’ll eat for a day. Teach a man to fish and he’ll eat for a lifetime”.

Yet for some reason, investors want to be TOLD what to buy, instead of acquiring the skills to figure it out for themselves.

It’s sad to see the number of investors who refuse to do even a little bit of digging.

Many will invest in a stock just because someone told them to do so.

If this is you, then this post will help you out tremendously.

By the time you’re done reading this, you’ll have a good chunk of the tools you need to make better investment decisions.

The best part is that it doesn’t take long to learn, and once you understand it you can use those skills forever.

The day I learned how to read a cash flow statement was the day I levelled up as an investor.

Remember this as we continue:

Ratios will give you the clues. Statements will give you the answers

If you want to stop guessing with your hard-earned money, keep reading.

But first, a word from our sponsor…

Trade Smarter with these Free, Daily Stock Alerts

It’s never too late to learn how to master the stock market.

You’ll receive daily trade alerts sent directly to your phone and email detailing the hottest stock picks.

The best part? There’s no cost to join!

Expert insights will be at your fingertips instantly.

The Purpose of the Cash Flow Statement (CFS)

The Cash Flow Statement is a tool used to manage a company’s finances by tracking the cash flow in and out of the business. It shows the source of cash and helps monitor cash inflows and outflows.

In other words, it gives you a better idea of how efficiently a company handles its money.

I’m sure you’ve heard the saying “Cash is king”.

If cash is king, then the Cash Flow Statement is the King’s Castle.

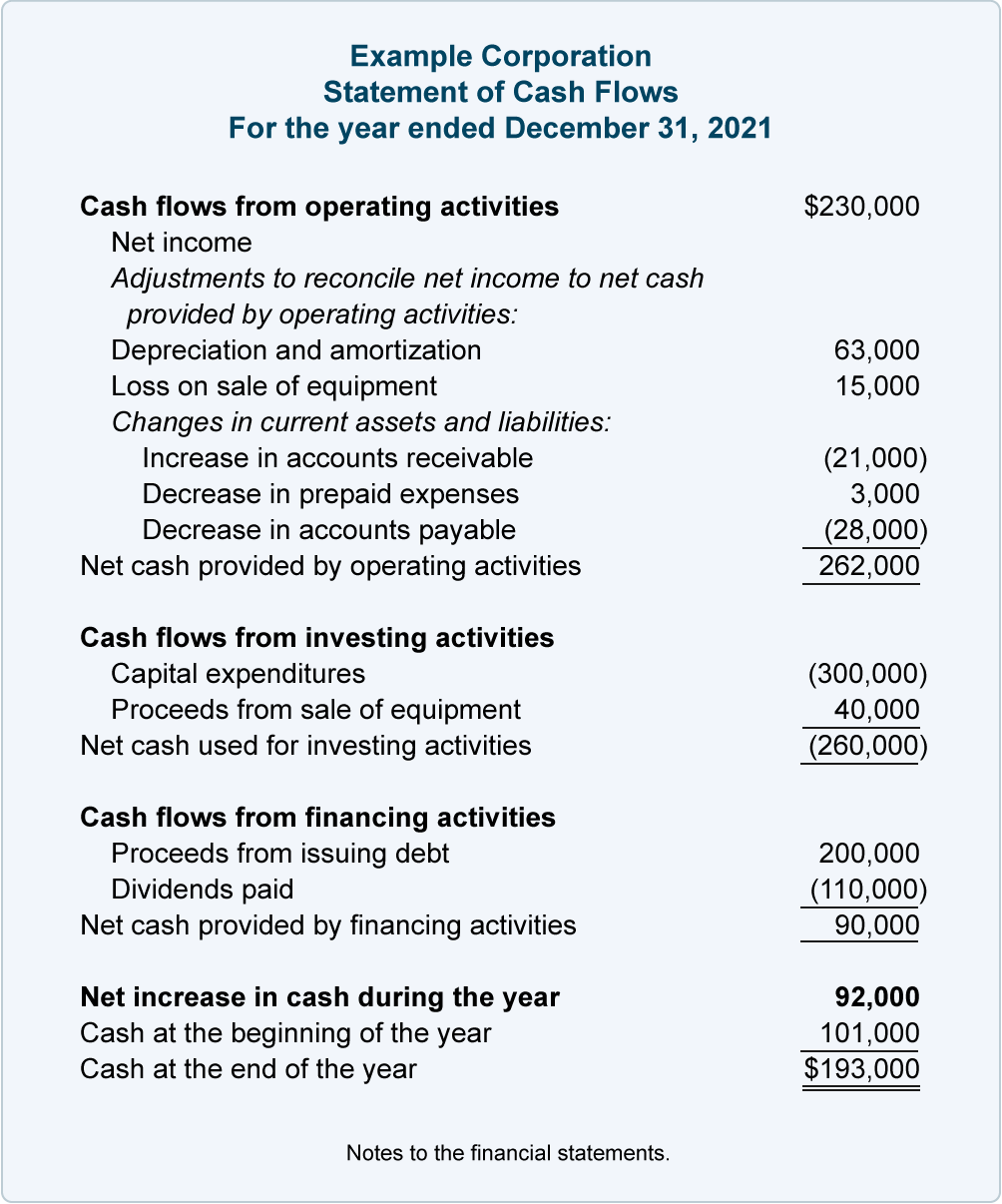

3 Components of The CFS

Operating Activities

Investing Activities

Financing Activities

Let’s break them down.

FYI: At the end of this post you’ll find an example of a cash flow statement. I suggest using the information in this post to try and figure out how the example company handles its cash.

Operating Activities (AKA Cash Flow from Operations - CFO)

By far the most important indicator of a company's cash generation efficiency.

This section measures the cash that the company generates through the sales of its products minus the cash paid to any employees, suppliers or interest on debt and taxes paid to the government.

In other words, it measures a company’s operating profit.

This section is fairly straightforward.

A growing cash flow from operations indicates a growing business and a shrinking cash flow from operations indicates a shrinking business.

Typically we want to stay away from companies who show negative numbers in this section of the CFS, because as investors we don’t want to be investing in companies that are losing money.

Investing Activities (Cash Flow From Investing - CFI)

This section of the CFS includes anything related to the purchase and sale of long-term assets.

Assets such as property, plant, equipment, patents, loans made or received and payments related to mergers & acquisitions.

This section of the CFS is slightly different than operating activities because it is common to see negative numbers in Cash Flow from Investing.

Why?

Because companies are constantly investing in themselves. Recycling earnings back into the business to buy long-term assets will have a negative impact on their cash position.

If you see a negative number in this section, don’t be alarmed. It can be a good thing for long-term growth and expansion.

On the flip side, you will see positive values if the company is receiving cash from its investments or selling off its assets.

Financing Activities (Cash Flow from Financing - CFF)

Last but not least, the financing section of the CFS.

This is where you’ll find how much money the company has raised through share or bond issuances, as well as other forms of debt financing.

If the company decided to take out a loan, you’d see the amount of the loan in this section as a positive value, because it’s money into the business.

You would also find how much they paid in dividends to shareholders like you and me, as well as any principal repayments on their outstanding debts.

A positive cash flow from financing means that the company is raising money, which is a good sign. All great businesses need to raise some sort of cash so that they can continue growing and remain competitive in their respective markets.

Example of a Cash Flow Statement

Final Notes:

An important thing to remember is that all 3 sections of the CFS are dependent on each other. Analyzing only 1 of them would be misleading and wouldn’t give you the full story of how the company manages its money.

One thing to take from this is that Cash is King. And luckily for you, the CFS states exactly how much Free Cash Flow the company has on hand.

I love investing in companies that have enough Free Cash Flow to continue paying (and growing) their dividends while also having enough to invest in the business long-term to facilitate growth.

Happy investing!

See you in the next one!

The Profit Zone Premium 💵

Our 2024 Stock Picks continue to outperform beating the market 88% of the time.

With a ~20% return in just over 3 months, the stocks we’re picking continue to grow building our wealth.

Right now we have a 7 stock portfolio from various sectors of the market that continue to prove why they’re high-quality companies.

If you’re having trouble analyzing stocks or just simply need some more direction on what you should be looking at in this market, subscribe to premium for less than what you’ll spend on lunch today.

We do deep dives, explore valuations, and give you background as to why a company might have a runway for growth.

The best part? You can take what you’ve learned and apply it to finding your own stocks.

Couple that with your newfound knowledge of analyzing Cash Flow Statements and you’ll be unstoppable.

The possibilities are endless.

Click below to upgrade.

Miss last weeks FREE newsletter? Read it below:

Did you enjoy this newsletter?

My Website - a one-stop shop for all things dividend investing.

Financial Domination - learn how to set up an effective budget, figure out your investor profile, use stock screeners and rebalance your portfolio without paying someone to do it for you.

The Complete Investors Accelerator Pack - everything you need to build a dividend portfolio that grows on itself. Learn more about dividend investing, how to analyze dividend stocks, what to do with your dividends and how to build a stream of passive income through the stock market.

Beehiiv - sign up for Beehiiv and start your own newsletter today.

TweetHunter - let the software do the tweeting for you. The only scheduler you’ll ever need. This tool makes me money in my sleep. Give it a try for free.

Snowball Analytics - the number 1 portfolio tracker on the market. Stock screeners, projection tools, public profiles and more. Use code “dividenddomination” for 10% OFF.