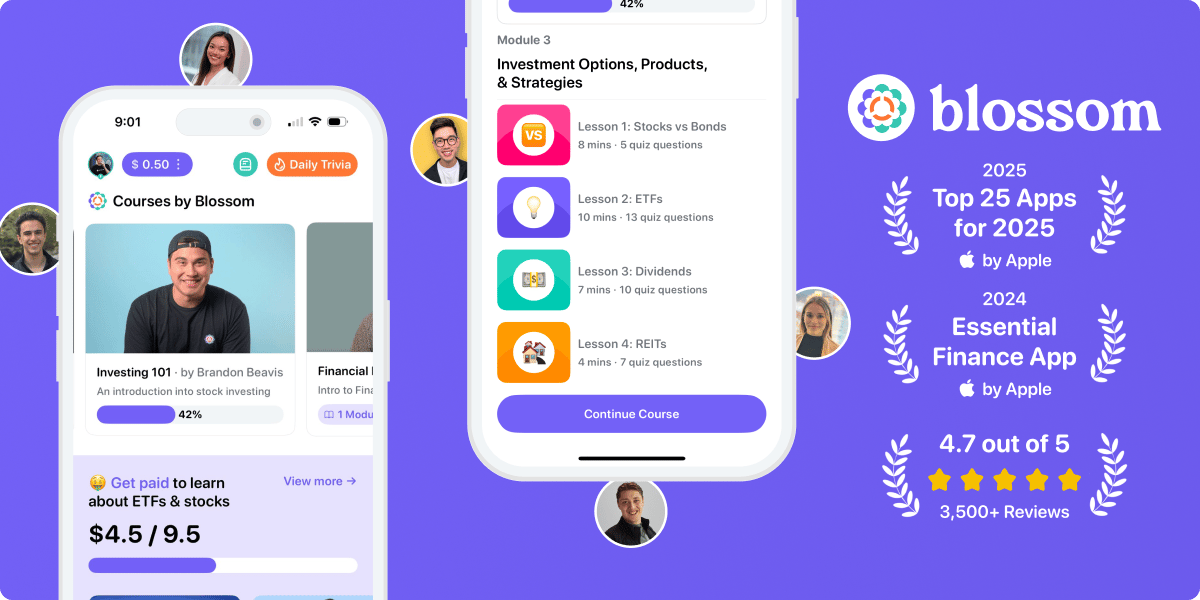

📚 Join the Duolingo for Investing

📈 Want to learn the fundamentals of investing? Check out the app Blossom where you can find over 50 hours of Duolingo-style lessons with videos and quizzes, taught by some of North America’s largest investing content creators. Courses like:

Investing 101

Trading 101

Personal Finance 101

Financial Metrics

and Getting Wealthy with Your 9-5

⭐️ With a 4.7 rating in the App Store and ranked an Essential Finance App of 2024 by Apple, Blossom is loved by over 250,000 members.

🤗 On top of the educational courses, Blossom is also a social network and community for investors where you can learn and get investing ideas from the community - all backed up by what people are actually investing in.

Welcome to The Profit Zone 👋

Where thousands of millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on the web.

👉 Quote of the Week: Brought To You By George Soros 🧔

👉 The Power of Seasonality in Investing: How Seasons Can Affect Your Returns ☀

👉 Price Doubling Tonight: Lock in Your Subscription Now 💰

👉 Reminder: Our Next Premium Issue Coming This Thursday 📰

“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.”

The Power of Seasonality in Investing

It was the middle of winter and my friend, a long time gardener, was standing in his backyard staring at an empty patch of land.

“Give it a few months” he said with a grin on his face.

“Everything changes with the seasons”.

Boy was he right. By spring, the lifeless soil burst into the biggest most beautiful garden you’ve ever seen.

The stock market is similar in many ways.

Just as nature follows a seasonal rhythm, so do stocks, sectors, and broader market trends.

Understanding these cycles can be the difference between riding the wave of growth and being stuck in a financial winter.

1. The Best (and Worst) Months for Stocks

If you’ve ever heard the phrase “Sell in May and go away,” you’re already familiar with one of the most well-known seasonal patterns in investing.

Historically, the stock market tends to perform better from November through April and underperform from May through October.

This pattern isn't random.

It’s driven by a mix of factors, including investor psychology, corporate earnings cycles, and economic activity.

For example, September is often one of the weakest months in the market, while December and January tend to bring rallies as investors reposition their portfolios for the new year.

Knowing these trends can help you manage risk and take advantage of seasonal opportunities.

2. Sector Seasonality – Timing Matters

Just as summer brings beach vacations and winter calls for warm coats and scarfs, different sectors of the stock market thrive at different times of the year.

Lets have a look at what you can be focusing on depending on where you sit on the calendar.

Retail Stocks (Q4 Surge) – The holiday shopping season often boosts retail and e-commerce stocks in Q4, leading to strong gains for companies like Amazon, Target, and Walmart.

Technology Stocks (Early Year Growth) – Tech stocks often get a boost in Q1 and Q2, driven by corporate spending and new product launches.

Energy Stocks (Summer Demand) – Oil and gas stocks tend to rise in the summer months as travel increases and energy consumption spikes.

Healthcare & Utilities (Defensive Plays) – In uncertain economic times, investors move their money into defensive sectors like healthcare and utilities, which tend to perform well regardless of the season.

Understanding these cycles allows investors to rotate into strong-performing sectors and avoid those in seasonal decline.

3. Earnings Seasons – The Market’s Quarterly Pulse

Like the changing of the seasons, corporate earnings cycles follow a predictable pattern.

Companies report earnings four times a year, most commonly in January, April, July, and October.

These periods often bring heightened market volatility, as investors react to earnings releases (both the good and the bad).

Intelligent investors use earnings season as an opportunity.

Strong earnings reports can propel stocks higher, while weak ones create potential buying opportunities for undervalued companies.

Timing your trades around earnings season can give you an extra edge in the market.

But be careful with this. As I mentioned, this brings a period of volatility, especially when picking individual stocks.

Make sure you understand the risks with investing during earnings seasons.

4. Election Cycles and Market Trends

Politics and the stock market go hand in hand.

Historically election years bring volatility, as markets react to policy changes, proposed regulations, and economic uncertainty.

But there’s also a pattern:

The year after a presidential election tends to be strong for the stock market, as uncertainty fades and businesses adjust to the new administration.

Midterm election years tend to be more volatile, but markets usually rally in the months following the election.

Historically, the third year of a presidential term has been the strongest for stock market returns, driven by pro-growth policies and fiscal stimulus.

Keeping an eye on the political calendar can help investors anticipate potential market swings and position themselves properly.

5. How to Use Seasonality to Your Advantage

Knowing that certain months, sectors, and patterns drive stock market performance, how can you apply this knowledge to your investing strategy?

Plan Your Entries and Exits – If you know the market tends to dip in September, you might wait for better entry points. If Q4 retail sales typically surge, you could position yourself ahead of time to take advantage of it. But in any case, I don’t recommend sitting on your hands until you find the “perfect” entry point, because you might miss out on a lot of gains if you don’t pick the right time.

Rotate Sectors Strategically – Shifting your portfolio to sectors that tend to perform well in certain seasons can help maximize returns.

Be Mindful of Macro Events – Earnings reports, elections, and global trends all play a role in market seasonality. Staying ahead of these cycles is key.

The Takeaway

Just like in nature, timing matters in investing.

Understanding the seasonality of the market can help you make smarter decisions, avoid unnecessary risks, and take advantage of predictable trends.

The best investors don’t fight the seasons, they embrace them.

Did you enjoy this newsletter?

🚨 Price Doubling Tonight – Lock in Your Subscription Now! 🚨

The subscription price for The Profit Zone Premium is doubling at midnight tonight.

From $10/month ➡ $20/month.

When you subscribe, you get access to:

✅ Bi-weekly emails featuring our 2025 Stock Picks, which have returned 6x the S&P 500 year to date

✅ Free access to The Profit Academy – a community where I share my real-time buys and sells

✅ Exclusive one-pager deep dives on hot stocks

✅ Earnings breakdowns to help you make informed trades

✅ Live stock valuations so you can see how I value companies using one simple trick

✅ The ability to ask me anything about investing

Lock in your subscription now for less than what you’ll spend on lunch tomorrow.

Subscribe before midnight using the link below.

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Dividend Domination Inc. is a publisher of financial information, not an investment advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

Any projections, market outlooks or estimates herein are forward-looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.