Welcome to The Profit Zone 👋

Where 12,700+ millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on the web.

We’re teaching you what schools forgot in 5 minutes or less.

Happy Monday!

Let’s start the week off strong.

The agenda for today:

👉 A rough week for indexes

👉 Stocks making moves

👉 Why time in the market is so important

“Ultimately, nothing should be more important to investors than the ability to sleep soundly at night.”

- Seth Klarman

Markets YTD

All three major indexes finished the week lower.

The S&P 500 pulled back by 0.26% this week, while the blue-chip Dow and tech-heavy Nasdaq fell 0.93% and 1.17%, respectively.

This past weeks decline marked the worst week for the 30-stock Dow since October.

Some companies making moves:

Headlines Making Noise: Keeping You Informed and Empowered 📝💡

Unlocking the Door to Financial Freedom

“Time in the market beats timing the market”

But why is time in the market so important?

Simple: Compound Interest

Also known as… money making money.

Let’s say you make an initial deposit of $1,000 in an account that returns 10% annually.

By the end of the year, you’ll earn $100 in interest (10% of $100).

In the following year your total is now at $1,100.

Assuming the same rate of return, you’ll earn $110 in interest (10% of $1,100)

The cycle continues.

As you can see, over a long period of time, this starts to add up.

But what about stock market risk?

Starting early allows investors to take on more risk.

Why?

Because you have more time to recover from bad investment decisions without too much impact on your long term wealth.

Lets look at an example:

The Story of John and Jordan:

John starts investing $200 a month at age 20, while Jordan waits until age 30 to invest the same amount.

By the time they both reach age 60, John’s investment has grown substantially more than Jordan’s, despite investing the same total amount.

How much more?

Let’s see below (assumes a 10% annual return)

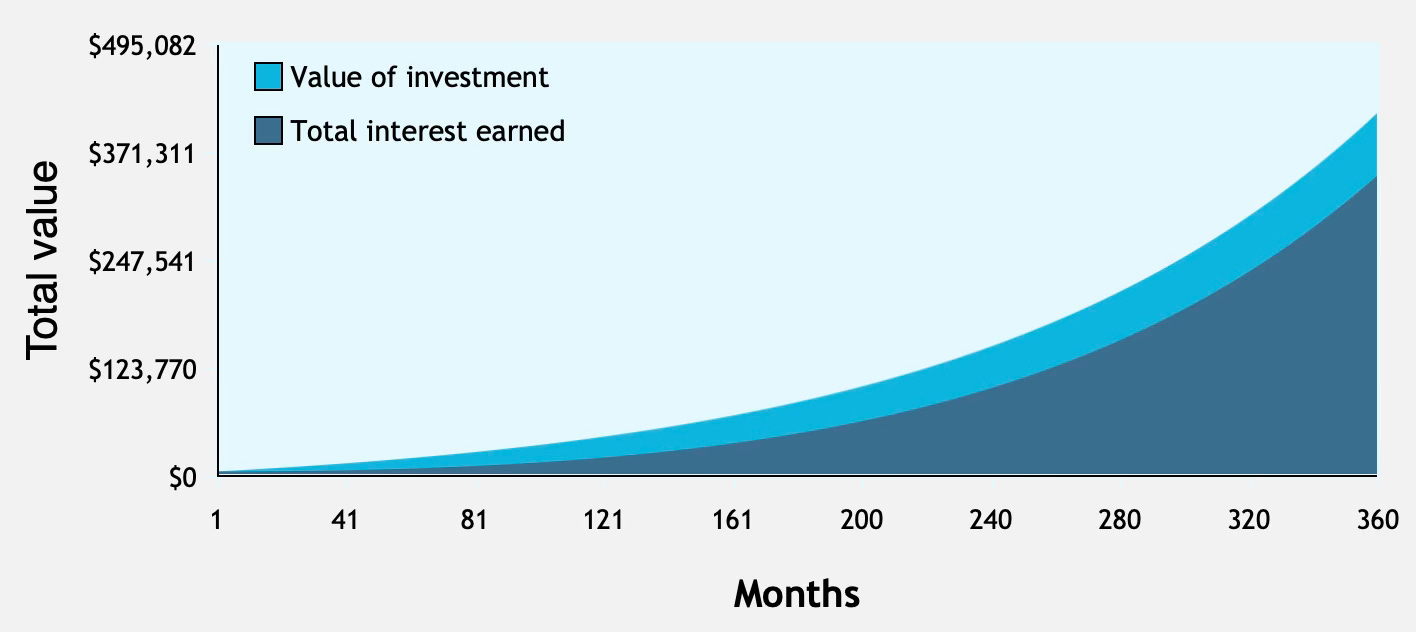

Jordan - Starts at 30 years old with $200/month (30 years of compounding)

Total value: $412,569

Total interest earned: $340,569

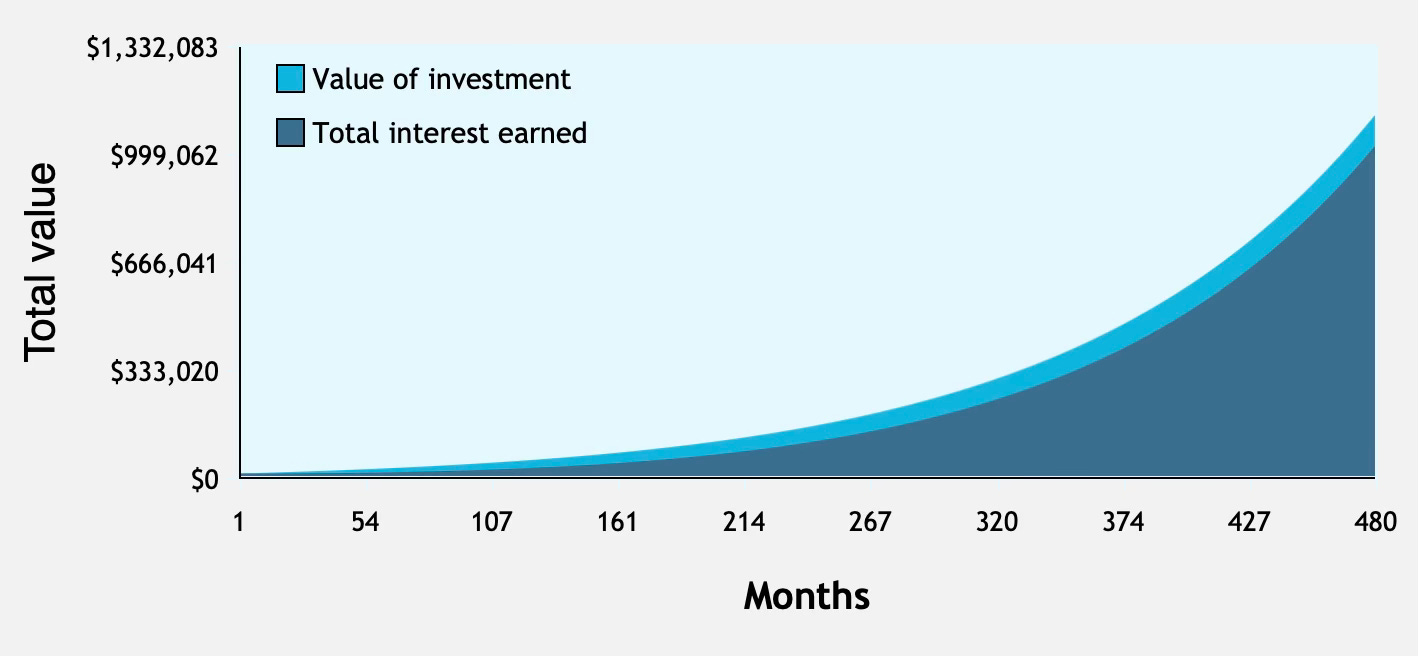

John - Starts at 20 years old with $200/month (40 years of compounding)

Total value: $1,110,070

Total interest earned: $1,014,070

Both invested the same amount at the same return (10%)

The only difference was that John started 10 years earlier.

10 extra years of compounding amounts to…

$697,501 more dollars in retirement.

Some more benefits of starting early:

Less Pressure on Income: Young investors typically have smaller incomes than they otherwise would later on in life. By taking advantage of compounding, they can make up for the difference in income levels.

Risk Tolerance and Learning Opportunity: Investing early allows investors to get comfortable taking on risk. It’s better to make mistakes with $1,000 than it is to make mistakes with $100,000. Trial and error is how you learn, but doing it early is less costly.

Embracing a Saving and Investing Mindset: Investing early builds good financial habits. It allows investors to develop a sense of financial responsibility that can be carried into their later years.

What if you didn’t have the luxury to start investing early?

If you are in your 40s or 50s, you might think it’s too late to start investing.

That couldn’t be further from the truth.

Although the reality is it will be more difficult to make up for lost time.

Your only solution in this case: invest more.

If this is you, you’re now more dependent on your income than if you started earlier.

Find ways to cut costs and widen the gap between what you make and what you spend.

You can play catch up and still win, but it requires a bit more effort.

Final Notes…

The examples above illustrate the undeniable advantage of starting your investment journey early.

Remember, the journey to financial freedom begins with a single step. Whether you're a recent graduate entering the workforce or a seasoned professional planning for retirement, there's no better time than now to start investing in your future.

See you in the next one!

Alex (The Dividend Dominator)

Founder and CEO of Dividend Domination Inc.

Follow me on Twitter, Instagram and LinkedIn

Sponsor The Profit Zone

Want to get more eyes on your products?

Advertise to 12,700+ investors hungry for financial content.

Click below to book with us.

My Website - a one-stop shop for all things dividend investing.

Financial Domination - learn how to set up an effective budget, figure out your investor profile, use stock screeners and rebalance your portfolio without paying someone to do it for you.

My Full Stock Portfolio - get access to all of my positions and get updates every time I buy or sell.

Money Mastermind - the “Money Bible”. Myself and 29 other expert creators teamed up to create the most all-inclusive 280-page finance book on the market. Over 100 topics about money including real estate, crypto, budgeting, dividend stocks, online business, and more.

The Complete Investors Accelerator Pack - everything you need to build a dividend portfolio that grows on itself. Learn more about dividend investing, how to analyze dividend stocks, what to do with your dividends and how to build a stream of passive income through the stock market.

Beehiiv - sign up for Beehiiv and start your own newsletter today.

TweetHunter - let the software do the tweeting for you. The only scheduler you’ll ever need. This tool makes me money in my sleep. Give it a try for free.

Hipster Budget Guide - having trouble saving money? Learning how to budget is your solution. This book will show you ways to save money you never even thought of. Worth every penny.