Welcome to The Profit Zone 👋

Where thousands of millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on the web.

👉 Will The Stock Market Crash or Soar in the 2nd Half of 2025: Find Out What Investment Banks Are Projecting 📽

👉 Why Birdwatchers Make Great Stock Market Analysts: The Power of Patience and Observation 🔬

👉 Recent Changes To My Portfolio: Inside Access On What I’m Doing With My Stocks 💵

👉 Scale Your Portfolio To New Heights In 2025: Using Covered Calls & Cash Secured Puts 📈

“Buy when everyone else is selling and hold when everyone else is buying. This is not merely a catchy slogan. It is the very essence of successful investments.”

Will The Stock Market Crash or Soar in the 2nd Half of 2025?

The Stock market has been in a state of volatility since Trump announced major changes to trade and fiscal policies, with the market moving into correction territory after the announcement of Tariffs in March.

However, economists are claiming that the “Big, Beautiful Bill” (BBB) signed into law on July 4th will reduce the federal deficit by as much as $11 trillion in the next decade. But that is still up for debate.

With regards to the stock market itself, analysts are constantly changing their projections.

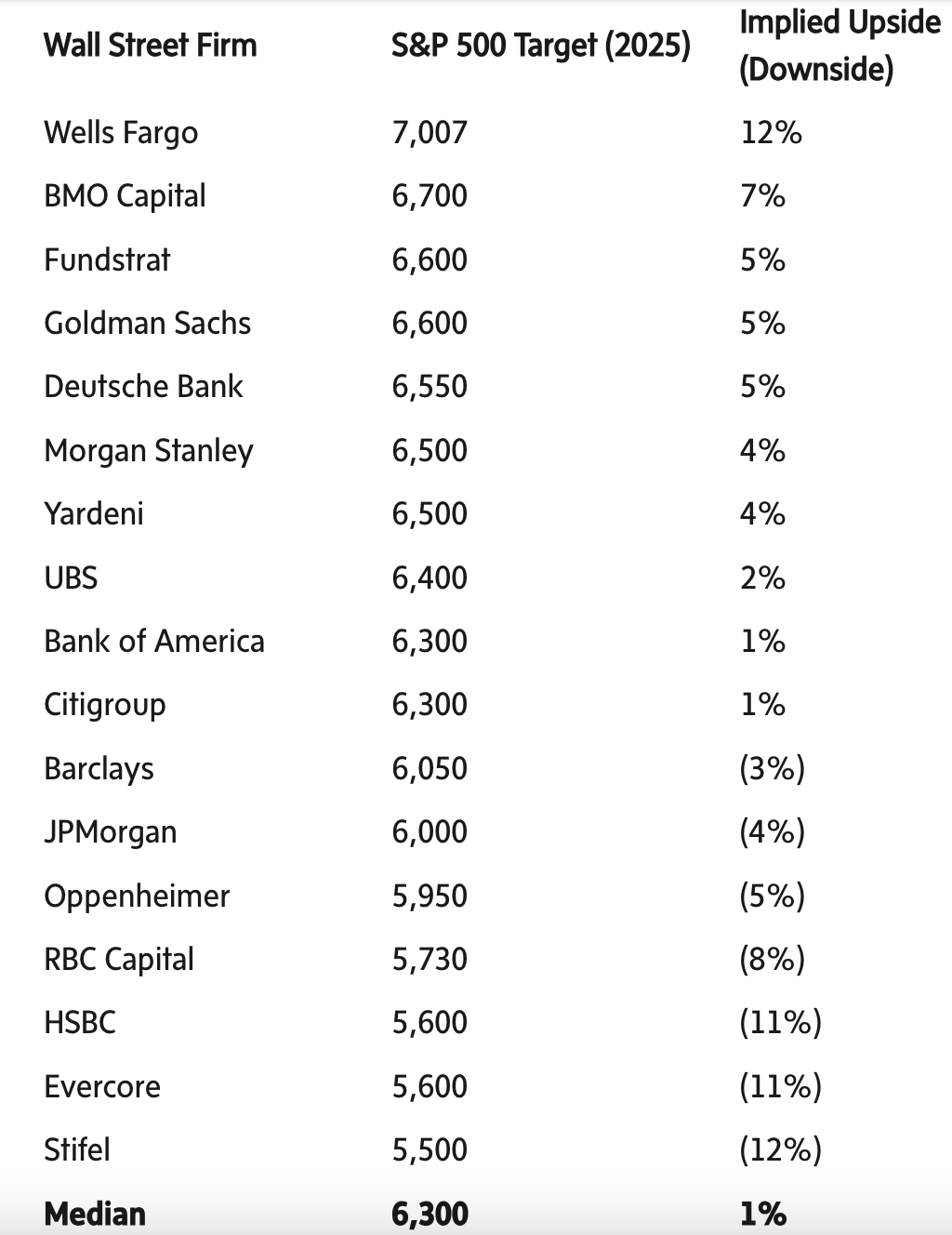

Several Wall Street investment banks have lifted their year-end targets for the S&P 500 including Bank of America and Goldman Sachs, who revised their outlooks upwards in July, among others like Barclay, Citigroup and Deutsche Bank, raising their outlooks in June.

Here are their projections.

The median year target for the S&P 500 is currently 6,300 among 17 Wall Street firms, implying just a 1% upside from its current levels, although this marks a jump from forecasts back in May.

The S&P 500 has averaged an 114% return during the 27 bull markets since 1929, with the current bull market up 75%, which suggests potential for further gains.

However despite all of that, proposed tariffs and deficit spending could limit returns in the near future.

Current tariffs have raised the average U.S. import tax to 18%, marking the highest since 1934, with potential further increases.

These could have a large impact on the economy, given the regions Trump is proposing higher tariffs on are major U.S. trade partners.

Marketing ideas for marketers who hate boring

The best marketing ideas come from marketers who live it.

That’s what this newsletter delivers.

The Marketing Millennials is a look inside what’s working right now for other marketers. No theory. No fluff. Just real insights and ideas you can actually use—from marketers who’ve been there, done that, and are sharing the playbook.

Every newsletter is written by Daniel Murray, a marketer obsessed with what goes into great marketing. Expect fresh takes, hot topics, and the kind of stuff you’ll want to steal for your next campaign.

Because marketing shouldn’t feel like guesswork. And you shouldn’t have to dig for the good stuff.

Why Birdwatchers Make Great Stock Market Analysts – The Power of Patience and Observation

The Power of Patience and Observation

Birdwatching and stock market analysis may seem like two different worlds, but I assure you they aren’t so different.

The skills you develop birdwatching are comparable to the skills you need to have when navigating financial markets.

The patience and observation mirror the discipline and focus required for successful investing.

In todays newsletter, we’re going to be highlighting some real world examples showing you why you should be more like a birdwatcher when it comes to building your wealth and hitting your goals.

Patience: Waiting for the Right Moment

Birdwatchers will spend hours waiting for a rare species to come into sight, much like an investor waiting for the perfect opportunity to buy a stock.

And while I don’t preach waiting for the “perfect moment” to enter the stock market, some companies require more time for the shot to develop.

Warren Buffett, legendary investor from Omaha, embodied this trait more than anyone else. He is famous for holding stocks like Coca-Cola for more than 35 years (1988 to be specific), allowing the compounding effect to do the heavy lifting. But I promise you one thing, Buffett sifted through the financials for a long time before hitting the BUY button.

Similarly, a birdwatchers’ ability to wait quietly for that specific bird develops a mindset of discipline, avoiding impulsive trades that could disrupt long-term gains.

Observation: Spotting Subtle Patterns

One important trait of a birdwatcher is their ability to notice subtle differences in feather patterns or calls, a skill that compares to spotting market trends.

Just as birdwatchers identify species by small details, analysts (like Warren Buffett) scrutinize the financial statements of undervalued companies, picking out patterns and trends that form their analysis.

For example, Buffett’s investment in Apple $AAPL ( ▲ 1.54% ) came after observing a fundamentally changing shift in the company, leading to more profitability.

Similarly, bird watchers focus on environmental cues, like weather shifts that could affect a birds behaviour, which is comparable to an analysts attention to economic indicators.

What This Means For You

Adopting a birdwatcher mentality can be difficult for the average person, but I assure you its not at all complicated.

Think of stocks like birds.

You have a list of birds (stocks) you want to find that fit the criteria of what you’re searching for.

But those birds (stocks) may not be in season, or they might be hiding in the depths of the trees and overlooked.

When you find them, watch them closely.

Analyze their feathers (financial statements), and make the important decision of if it will be something worth taking a picture of (buying).

Recent Changes In My Portfolio

Typically only my premium subscribers get access to new changes I’m making in my portfolio, but for today, I’m going to give you a little taste.

If you didn’t know already, I’m not only a dividend investor. I also buy index funds, growth stocks and a little bit of crypto.

Recently my growth stocks (mainly in AI) have run up significantly, taking my portfolio allocation out of line. This will happen from time to time, and it’s by no means a bad thing. It just means you need to either trim the position or contribute to other positions in your portfolio.

You never want to be overexposed to any one stock, but “diamond hand” investors will 100% disagree with that.

What I’ve been doing recently is selling covered calls on some of the positions that have run up.

For example, I own a stock where I’m up 400% to date, but because of the growth, it’s grown to almost 30% of my total portfolio. No bueno.

I want to trim the position, but I don’t want to just sell out of it because I truly believe in the company long term, however I think the stock price is overextended (P.S. I explain which stock this is and why the valuation is too high inside The Profit Academy).

So here’s what I’m doing instead:

Selling out of the money covered calls 1-2 weeks out.

For example, lets say the stock is Advanced Micro Devices $AMD ( ▼ 1.58% ) and your position is up 400%.

You may consider the $160 Strike Price July 18th call.

At time of writing, this would pay you $26 per contract (100 shares).

Say you have 300 shares of the stock. If you sold a call on all 300 shares, you would collect $78 in premiums, thereby reducing the average cost on your position.

That cash is now yours and you’re free to do what you want with it.

Scenario 1: If the stock price closes above $160 on July 18th, you sell your 300 shares at $160 for a total of $48,000 and keep your $78 premium. You also trim a position that may have outgrown your portfolio allocation.

Scenario 2: If the stock price closes below $160 on July 18th, you don’t sell your 300 shares, but still keep the premium.

The first scenario allows you to sell your shares at a gain, but you’ll miss out on any price action above $160.

The second scenario allows you to keep your shares and keep the premium, and that cash is now yours.

There really isn’t a downside.

I encourage you to use covered calls to your advantage when you own stocks that you think will rise in price over the long term but also want to make some extra money while holding them.

It’s a great way to scale your portfolio.

If you want more information about how to do this yourself, join our Community The Profit Academy by upgrading here.

When you upgrade, you get full access to our discord as well as bi-weekly premium newsletters with all of our 2025 Stock Picks and performance updates.

Our 5 stock portfolio is up 38.47% year to date.

For reference, the S&P 500 is up only 6.67% year to date.

Start building your wealth with The Profit Academy.

Did you enjoy this newsletter?

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Dividend Domination Inc. is a publisher of financial information, not an investment advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

Any projections, market outlooks or estimates herein are forward-looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.