Savvy Investors Know Where to Get Their News—Do You?

Here’s the truth: there is no magic formula when it comes to building wealth.

Much of the mainstream financial media is designed to drive traffic, not good decision-making. Whether it’s disingenuous headlines or relentless scare tactics used to generate clicks, modern business news was not built to serve individual investors.

Luckily, we have The Daily Upside. Created by Wall Street insiders and bankers, this fresh, insightful newsletter delivers valuable insights that go beyond the headlines.

And the best part? It’s completely free. Join 1M+ readers and subscribe today.

Welcome to The Profit Zone 👋

Where thousands of millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on the web.

👉 Amazon & Apple: Beating Earnings By No Small Margin 📈

👉 Is Your Portfolio Set Up To Fail? Find Out Below ⬇

👉 Allocations: 4 Types of Portfolios You Can Copy 🔎

👉 Snowball Analytics: The #1 Portfolio Tracker on the Market 💰

The most important quality for an investor is temperament, not intellect

Amazon Beats Earnings 🎉

Here are the numbers:

Earnings: $1.43 vs $1.14 per share expected ✅

Revenue: $158.88 billion vs $157.2 billion expected ✅

Amazon Web Services: $27.4 billion vs. $27.5 billion expected ❌

Advertising: $14.3 billion vs. $14.3 billion expected ✅

Apple Beats Earnings 🎉

Earnings: $1.64 Vs. $1.60 per share expected ✅

Revenue: $94.93 billion vs. $94.58 billion expected ✅

iPhone revenue: $46.22 billion vs. $45.47 billion estimated ✅

Mac revenue: $7.74 billion vs. $7.82 billion estimated ❌

iPad revenue: $6.95 billion vs. $7.09 billion estimated ❌

Other Products revenue: $9.04 billion vs. $9.21 billion estimated ❌

Services revenue: $24.97 billion vs. $25.28 billion estimated ❌

Gross margin: 46.2% vs. 46.0% estimated ✅

Apple beats earnings but misses on revenue beats for its Mac, iPad, other products and services revenue. iPhone revenue, due to the release of the new model, outpaces expectations.

Disclosure: the author of this post has a long position in Amazon and Apple.

Is Your Portfolio Set Up To Fail? Your Optimal Asset Allocation Awaits Below

Ever heard of the saying “Don’t put all of your eggs in one basket?”

In this post, I’m going to be showing you how to spread your eggs into multiple baskets, the correct way.

There are so many ways to diversify. A couple that come to mind includes diversifying by:

Market cap (micro, small, mid, large)

Region (international, domestic)

Market (emerging, developed)

Asset type (bonds, equities, ETFs, Mutual Funds, Hedge Funds)

Real estate (REITs or physical property)

But knowing how many ways you can diversify means nothing if you’re not diversifying according to your goals.

And like a workout plan, every person’s goals are different.

Your optimal allocation is the one that gives you the most realistic return you’re looking for while also allowing you to sleep well at night.

Sorry to burst your bubble, but you can’t expect to have 150% returns every year and also get a good nights sleep. Because unless you get very lucky, to experience that kind of return means you’re carrying high amounts of risk.

On the other hand, you could have peace of mind by investing in a bond-only portfolio, but that may not give you the returns you’re looking for.

Diversification is about finding balance and today, I’m going to take you through a few sample portfolio allocations you can use as a benchmark for your own investing.

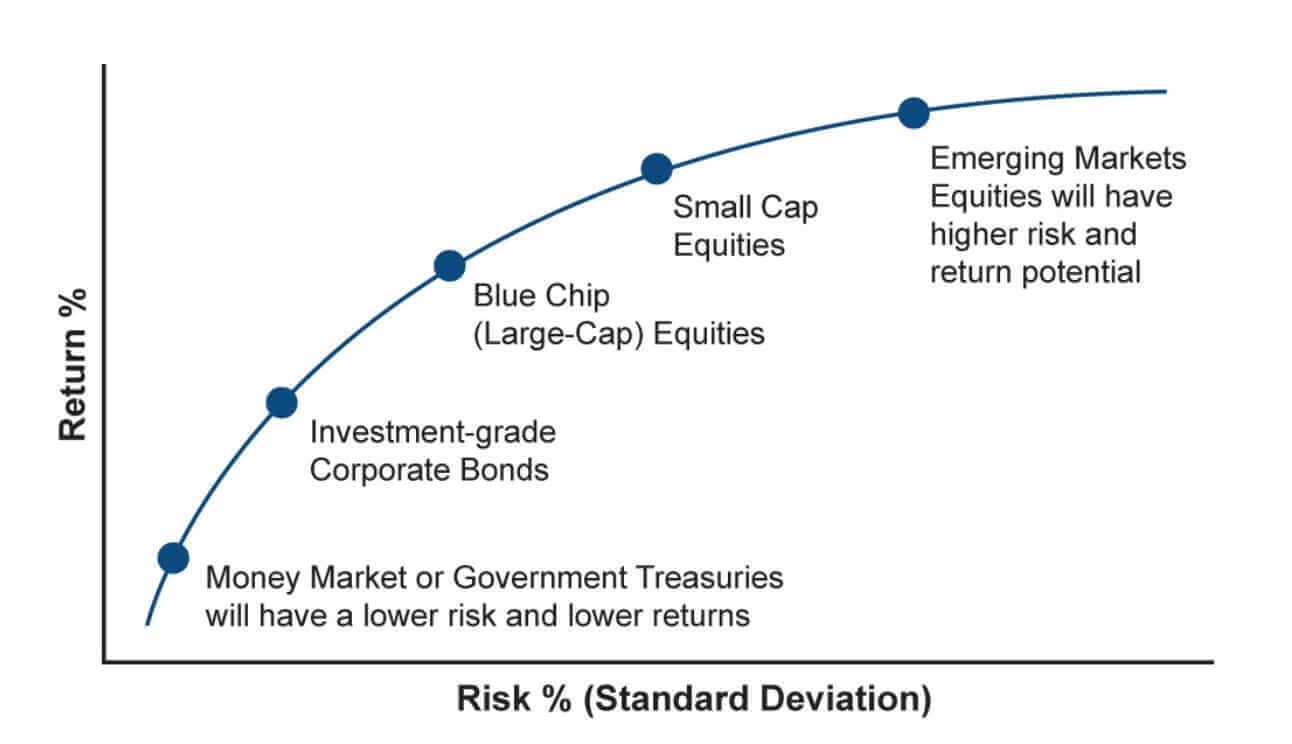

Below is a graph of risk to return so you know where different types of investments stand on the spectrum.

A common rule of thumb is that investors will decrease their exposure to risk as they near retirement in order to retire with the largest sum of money possible. You don’t want the value of your portfolio to fluctuate too much if you plan on living off it.

This is also why people say dividends are only for old people.

Dividend stocks are naturally less volatile than a stock like Tesla for example, but truth be told, dividends are NOT only for old people. Passive income belongs in every portfolio.

So how do you decide what’s right for you?

That’s a question that depends on your time horizon and risk tolerance.

Those with longer time horizons and larger amounts of money can invest in higher-risk stocks with more upside because they have the time (and capital) to make up for any losses.

Those with shorter time horizons and smaller amounts of money may choose to invest in lower-risk stocks because they don’t have as much time (or capital) to make up for a massive loss.

You have to be completely transparent with yourself.

If you only have $5,000, splitting it 50/50 between 2 small cap tech stocks may not be the best idea.

If you have $500,000 and want to take $5,000 and go all in on a small cap tech stock, that’s a smarter financial decision than the one above.

If you’re looking to buy a house in the next 5 years, keeping all of your money in stocks may not be the best call.

Everything is relative and everyone’s situation is different.

Which is why in this next section we’re going to explore 4 different portfolio allocations that you can start implementing today.

#1 - Conservative

Conservative portfolios typically include more fixed income and money market securities, things like bonds and T-Bills/GICs.

These are assets that will pay you a fixed amount of money (often guaranteed) but you won’t find high returns like you otherwise would with stocks.

These types of portfolios are good if you are terrified of losing money and are content with earning a modest positive return year over year.

They are also great if you are nearing retirement.

In fact, as you near retirement, you may even consider increasing the allocation to fixed income securities to as much as 80-90%.

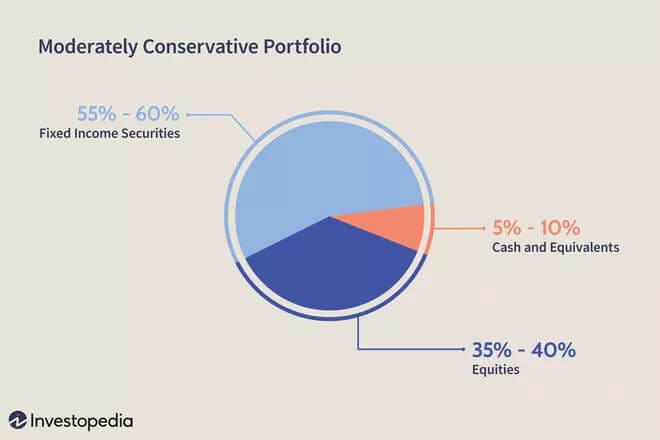

#2 - Moderately Conservative

This type of portfolio is great if you prioritize capital preservation but also want a little bit of exposure to more volatile stocks for potentially higher returns.

Moderately conservative portfolios hold more equities (stocks, REITs, etc) and less fixed income (bonds, GICs, etc).

This type of portfolio is great if you’re nearing retirement but still looking to grow your wealth a bit more.

#3 - Moderately Aggressive

This type of portfolio strikes the best balance between fixed-income securities and equities.

Many moderately aggressive portfolios will often be split 50/50 right down the middle between, giving great exposure to both growth and income.

These portfolios are for younger investors with longer time horizons and more time to recover from mistakes and losses.

#4 - Very Aggressive

The type of portfolio that new investors seem to find the most appealing.

It does give you the most opportunity to make a lot of money, but that doesn’t come without risk.

These portfolios consist mostly of equities, so the value is always fluctuating.

When the market is in a bull run, these portfolios tend to perform the best. But the reverse is also true. You’ll run into a brick wall if this is your allocation when the market starts falling.

Final Notes

Your optimal allocation depends on many things that are personal to you.

How you decide to allocate your money is a decision nobody else can make for you with complete accuracy.

One thing to keep in mind is that your portfolio allocation will change over time.

As you age, raise a family and gain more financial dependents, you may want to decrease your level of risk because at that point your financial decisions are affecting more than just yourself.

Did you enjoy this newsletter?

2023 Dividend Income: $2,952

2024 Dividend Income: $4,019

And that’s without contributing a single dollar more for the rest of the year.

Here’s one thing I did to grow my dividend income by ~36% over the last 12 months ⬇

I started using AI to tell me if a stocks dividend was reliable or not.

Most of us don’t have time to spend hours looking through financial statements.

So instead, we can let AI do the heavy lifting.

Here’s Proctor and Gamble $PG, who received a dividend safety score of 63/100.

I use Snowball Analytics for all of my dividend stock research.

It’s the #1 platform on the market right now and they continue to release features that keep making it better.

Link your portfolio right to Snowball and all of your holdings will be updated in real time.

It’s a one stop shop for hedge fund level analytics about your portfolio.

Sign up here (or click below) and use code “dividenddomination” for a discount.

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Dividend Domination Inc. is a publisher of financial information, not an investment advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

Any projections, market outlooks or estimates herein are forward-looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.